Gold And Silver - When Will Precious Metals Rally? Not In 2015

Commodities / Gold and Silver 2015 Mar 15, 2015 - 07:56 AM GMTBy: Michael_Noonan

If one addresses what is going on between China and the IMF, while keeping an eye on the Federal Reserve's fiat debt instrument, incorrectly called the "dollar," then the likelihood of a significant rally in gold and silver may not develop this year. Those believing the fiat "dollar" is on its currency deathbed and about to implode to its true intrinsic worth, zero, are not paying enough attention to realize that the elite's are still in control while in the process of merely switching horses: to China from the US.

If one addresses what is going on between China and the IMF, while keeping an eye on the Federal Reserve's fiat debt instrument, incorrectly called the "dollar," then the likelihood of a significant rally in gold and silver may not develop this year. Those believing the fiat "dollar" is on its currency deathbed and about to implode to its true intrinsic worth, zero, are not paying enough attention to realize that the elite's are still in control while in the process of merely switching horses: to China from the US.

Call them any number of names but the elites are not stupid, and they are not about to change horses mid-stream, as it were. There are a few developments in the works that need to come to fruition before any significant "reset" in Precious Metals valuation upwards may occur. The most significant is the process China is undertaking to be a part of the International Monetary Fund's [IMF], Special Drawing Rights [SDR], a basket of currencies that will include the Renminbi, [RMB], aka Chinese yuan, in addition to the Federal Reserve's US fiat "dollar."

[We addressed SDRs back in Nov/Dec 2014: Gold-Backed Currency? Not Any Time Soon, But Be Prepared, Dec 14, and For The Elites, All The World's A Stage, Including China And Russia, Nov 14.]

The fiat "dollar" is not about to disappear any time soon. It is the antithesis to gold and silver, therefore, gold and silver's biggest obstacle will continue to be in play, at least in the foreseeable future. Right now, the fiat "dollar" remains king of all worthless fiats, mostly by military might, these days. The Big Four fiats are the "dollar," Yen, Euro, and Pound. It has been the intent of the IMF to replace the fiat "dollar," as the world's reserve currency for settling international trade, with SDRs, a basket of international currencies. The Big Four will now have to make room for China's RMB.

The RMB is currently the 7th most traded currency in the world. Lodged between the Big Four and the RMB are Canada and Switzerland. All seven country's currencies are likely to comprise the new SDR as a reserve for trade between nations. It is highly unlikely that gold will be an official part of the new SDR structure. That means there are no plans for having a global reset based on PMs. [So say the ruling elites.]

There will be an informal IMF board meeting this May to review the SDR basket of currencies. The main issue will be inclusion of the RMB, but that decision will not be formally reviewed until sometime this Fall. No changes can take effect prior to January 2016, based on a required 70 or 85 percent majority vote on the IMF council. With these timing factors, it does not makes sense to expect any major shake-up that would affect the pricing of gold and silver in a major way. No distractions for the status quo.

When we say gold and silver will not rally in 2015, based in large on the above analysis, it does not mean that some kind of rally cannot occur, just not one that would fulfill the expectations of the stacking PMs community. Nothing, however, changes the reason for the ongoing purchase of physical gold and silver.

Gold and silver have no third-party counter risk. Both are debt-free and with a proven history for having an intrinsic value. Those who choose to ignore history and opt for paper fiat, instead, not only run the risk of further erosion in perceived "value," but now have the added risk of bank confiscation of all deposits, which thanks to more Obama and Federal government laws passed, means your deposits are owned by the banks. Once in, it ain't yours any more. That is significant information.

What is of more immediate interest is the fact that the rigging, or as has been called rather appropriately, the London Gold Fix as determined by four participating bank "fixers," is about to come to an end this coming Friday, 20 March 2015. Taking control will be the International Commodity Exchange, and it opens the door to Chinese banks to become participants, at some point.

Will this fix fix the fix that needed to fix the fix prior to this new fix? Time will tell. What we know for certain is that with China's control of physical gold trade on the Shanghai Gold Exchange [SGE], it takes the power to fix the price of gold out of the hands of the elite's corrupt bankers and more in control of communists who exist to serve their central authority. We are not certain this is progress, but it is change.

The end of artificial price manipulation may be coming to an end now that London can no longer fix the fix to their advantage. We could see the beginning of a more realistic price setting for physical gold, but no one has a clue how China will act in assuming a larger influencing control. There is no love lost between East and West, for a number of reasons, so this development may prove to be very interesting. Also, keep in mind, China and Russia are "BFF," [Social media acronym for Best Friends Forever].

We live in interesting times.

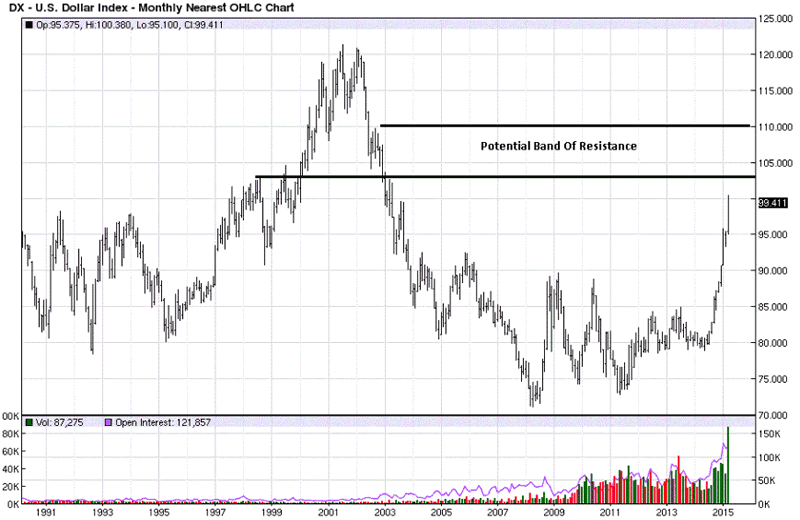

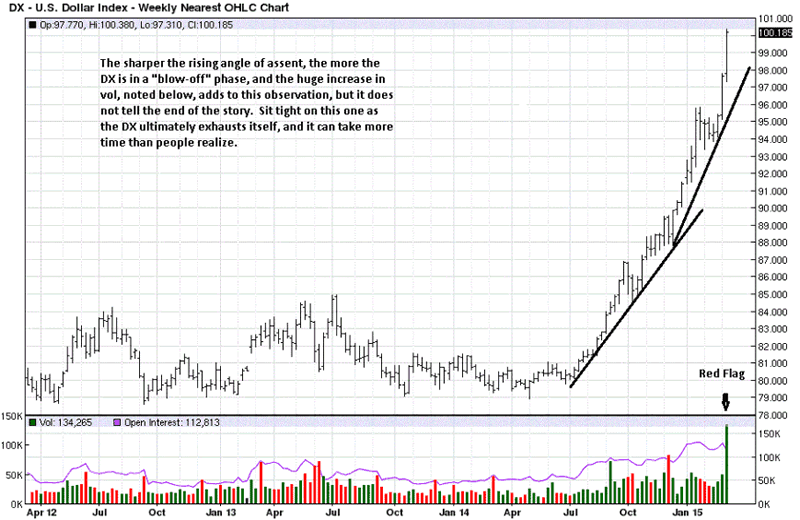

A few charts on the Federal Reserve's worthless fiat "dollar," start our chart line up. We keep referencing the "dollar" as worthless because in truth and reality, it is. Any "value" ascribed to the "dollar" comes from everyone's imagination. It is the ultimate Ponzi best described by "the emperor is wearing no clothes." It reflects the largest propaganda scam by the elites to get people to accept worthless fiat paper as having "value," while maintaining that gold and silver have none. Stackers know otherwise, the majority of others do not, judging by their actions.

We showed a few DX charts at the end of January, Around The FX World In Charts, [Charts 3 & 4]. The advice was not to go against the strong trending "dollar," and that advice applies even more, today. A few potential resistance lines were placed on the monthly, but in a market where military might and economic warfare are backing the fiat "dollar," Anything Can Happen, and obviously every effort is being exerted to keep the fiat as the world's reserve currency, a failing effort acknowledged around the world. In addition to the BRICS nations, led by China and Russia, a growing number of other non-BRICS nations are no longer using the fiat "dollar" for trade exchanges.

The fiat "dollar" is done, but just not on the charts. The end of the London Gold Fix means the end phase of the "dollar," as well. The signs of an end keep mounting.

US Dollar Monthly Chart

What is important to know in blow-off type markets is that the topping process can take several months, or more, so one need not view the end of the "dollar" rally as imminent. The huge volume surge likely means smart money is selling into the end phase of the rally, big time. This does not necessarily mean the top is near. At the end of the current swing rally, the "dollar" can enter a volatile, wide swinging topping phase just prior to what would then be the final high. Even when the final high is registered, the distribution process can be protracted.

Best to let this final phase play itself out and not get caught amongst the elephants moving the market. They take no prisoners.

US Dollar Weekly Chart

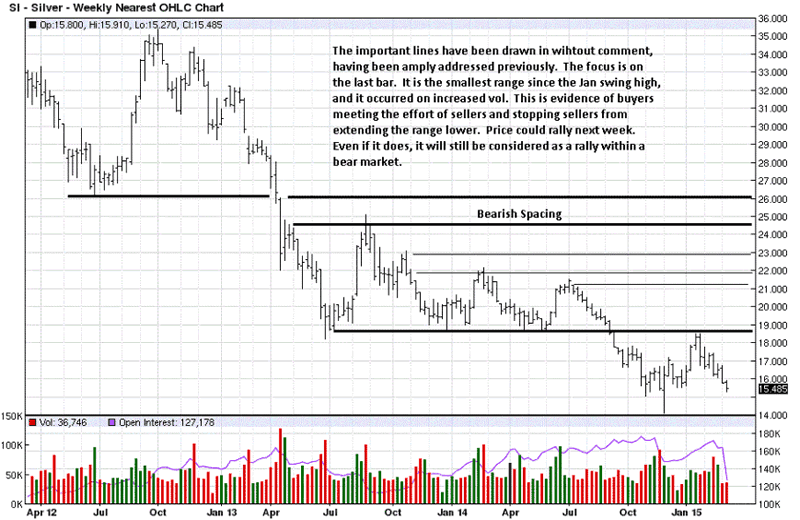

The last bar is the "story" on this chart. Silver is at a support area from November '14. The small range of last week on increased volume takes on increased significance. The odds favor a rally, but it does not mean the down trend has ended. Considerably more evidence is need to make that determination, and silver is far from that, at this point.

Silver Weekly Chart

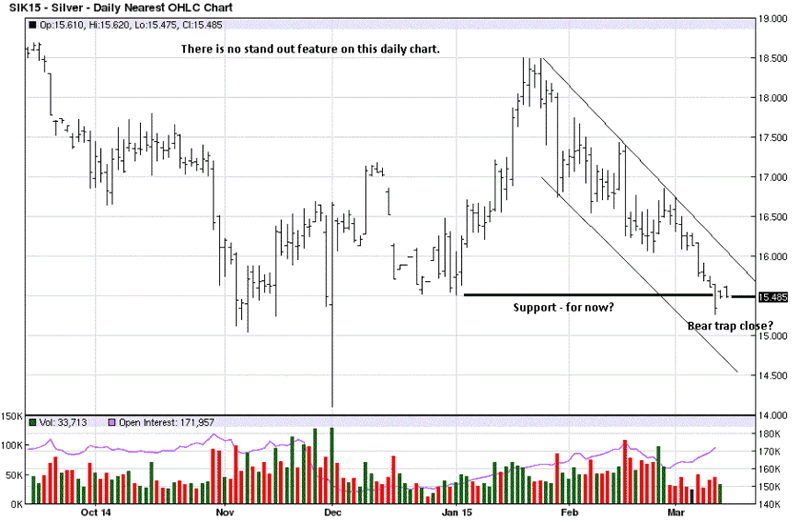

There is little about which one can get excited in this chart. The activity is developing in the middle of a down trend channel. It has a slightly more positive aspect about it, but nothing is clear enough for making a more definitive statement. The weekly chart does that.

Silver Daily Chart

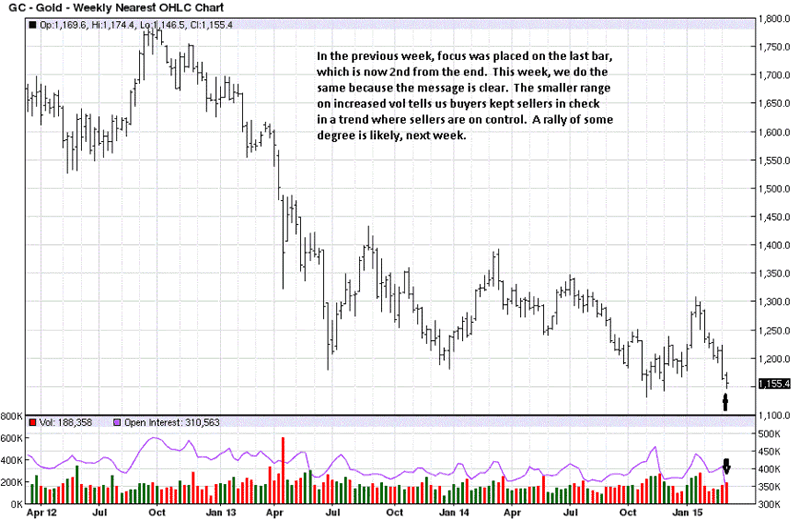

As with weekly silver, weekly gold's smaller range on obviously much higher volume is a clearer indication for a rally of some degree, next week. To what extent cannot be known, but it will be within the context of a bottoming process. That process has yet to make clear if a final bottom is in.

Gold Weekly Chart

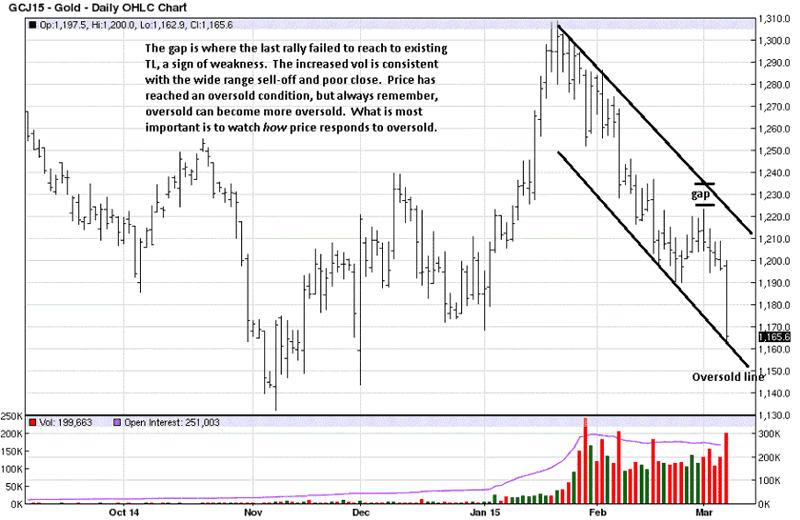

This chart is from last week's article. It is included to illustrate how developing market activity does send a message, some clearer than others. The next chart, updated, shows the how factor mentioned on this chart.

Gold Daily Chart

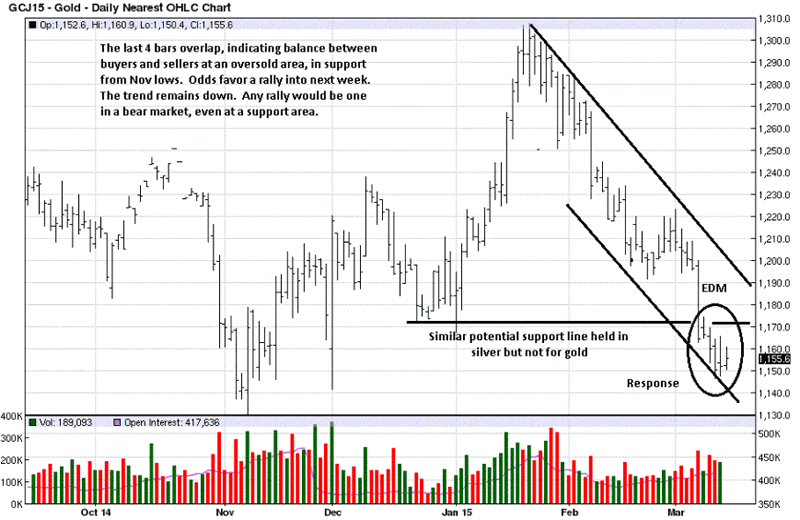

Interestingly, where the weekly gold chart was more definitive than silver, the daily silver chart held its support area where gold did not. Still, the response after last week's EDM bar [Ease of Downward Movement], was muted by a lack of further downside movement. As with silver, gold is likely to have some kind of rally, next week.

Gold Daily Chart 2

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2015 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.