Gold and Silver Mining Stocks Consolidate Before Next Big Move

Commodities / Gold and Silver Stocks 2015 Mar 18, 2015 - 10:21 AM GMTBy: P_Radomski_CFA

Briefly: In our opinion speculative short positions (full) in gold, silver and mining stocks are justified from the risk/reward perspective. We are keeping the stop-loss levels at their current levels, which means that we are effectively keeping some gains locked in and at the same time we're allowing the profits to increase.

Briefly: In our opinion speculative short positions (full) in gold, silver and mining stocks are justified from the risk/reward perspective. We are keeping the stop-loss levels at their current levels, which means that we are effectively keeping some gains locked in and at the same time we're allowing the profits to increase.

Mining stocks have been trading sideway for several days now and the decline seems to have paused. We can infer something from this pause based on an event that accompanied it. Is the decline over or exactly the opposite - is it about to continue?

Before we reply to the above question, we would like to stress that basically nothing changed in the precious metals market yesterday, so all points that we made yesterday remain up-to-date. Consequently, today's alert will be rather short. Let's take a look at what happened in gold (charts courtesy of http://stockcharts.com).

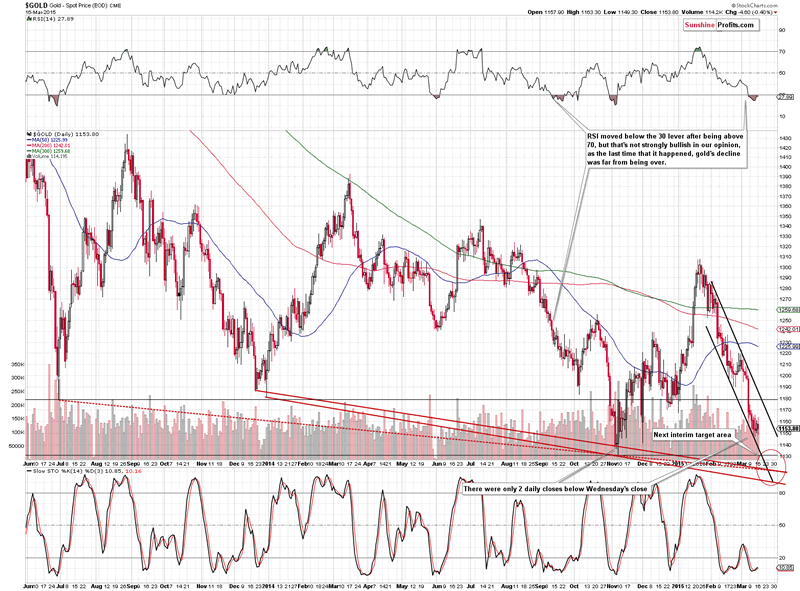

Gold basically did nothing once again, but - this might seem surprising - the implications are actually bearish, not neutral. The reason is that gold remains in a rather tight and quickly declining trend channel. The pause that we saw in the past several days was enough to take gold from the lower border of the trend channel (which provided support) to (almost) its middle.

In other words, thanks to doing nothing recently, gold can now move lower without encountering support immediately. It's still possible that gold will continue to move sideways or even move a bit higher in the following days, but the potential size of the correction is now bigger as the upper border of the declining trend channel is also lower.

The next interim target for gold is at about $1,120 and the final one is at about the $1,000 level.

Once again, nothing changed in the case of silver (and the outlook remains bearish), so let's move on to the situation in mining stocks and to the reply to the previous question about the miners' pause.

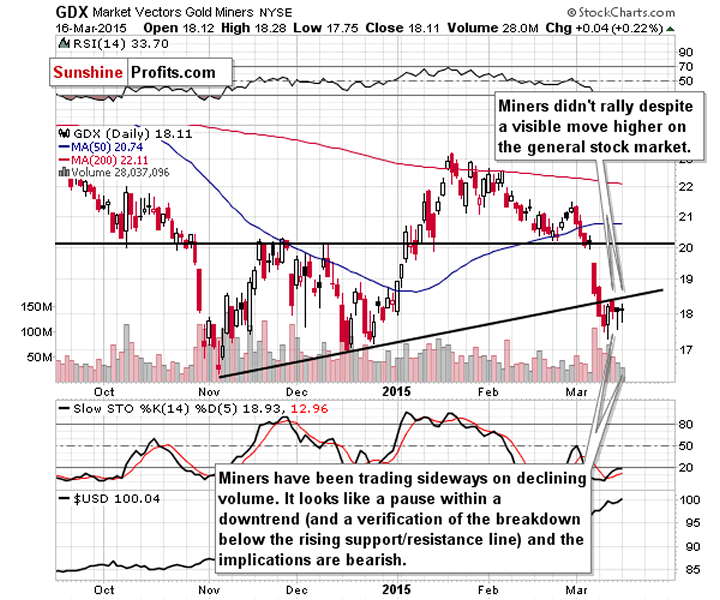

The thing that is very important on the above picture is the volume. It has been declining during miners' recent consolidation, which suggests that the move is indeed a pause within a trend and not a bottom (in the case of the latter, we would expect to see higher volume during daily upswings). The previous move was down, so a move lower is likely to follow.

Please note that mining stocks verified the breakdown below the rising support / resistance line, which is yet another bearish sign.

Summing up, we are likely to see a small corrective upswing sooner or later, but it doesn't seem that we will see a more visible correction until we see gold close to its 2014 (intra-day) low. Gold stocks are now once again underperforming gold, which serves as a confirmation that the correction is over and the decline will now continue.

Even though the size of the profits on the current short position may suggest that's it's worth taking them off the table (we opened the short position on Jan. 23 when gold was at about $1,300), it seems that the risk/reward ratio still favors keeping the position open as it doesn't seem that the decline is over. Even though gold has already fallen significantly, it's still likely to decline even more in the coming weeks and it is this outlook that makes us think that the short position remains justified at this time.

To summarize:

Trading capital (our opinion): Short positions (full) in gold, silver and mining stocks with the following stop-loss orders and initial (!) target prices:

Gold: initial target level: $1,135; stop-loss: $1,234, initial target level for the DGLD ETN: $85.48; stop loss for the DGLD ETN $65.45

Silver: initial target level: $15.10; stop-loss: $17.23, initial target level for the DSLV ETN: $74.05; stop loss for DSLV ETN $48.36

Mining stocks (price levels for the GDX ETN): initial target level: $17.13; stop-loss: $21.17, initial target level for the DUST ETN: $23.49; stop loss for the DUST ETN $11.35

In case one wants to bet on lower junior mining stocks' prices, here are the stop-loss details and initial target prices:

GDXJ: initial target level: $22.13; stop-loss: $27.38

JDST: initial target level: $14.58; stop-loss: $7.10

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep our subscribers updated should our views on the market change. We will continue to send them our Gold & Silver Trading Alerts on each trading day and we will send additional ones whenever appropriate. If you'd like to receive them, please subscribe today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Tools for Effective Gold & Silver Investments - SunshineProfits.com

Tools für Effektives Gold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

Sunshine Profits enables anyone to forecast market changes with a level of accuracy that was once only available to closed-door institutions. It provides free trial access to its best investment tools (including lists of best gold stocks and best silver stocks), proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.