George Osborne Budget 2015 Election Bribes - Buying Votes with Borrowed Money

ElectionOracle / UK Tax & Budget Mar 18, 2015 - 01:35 PM GMTBy: Nadeem_Walayat

With the election just 50 days away, to imagine that George Osborne would not attempt to bribe the electorate today is delusional and so George Osborne huffed and puffed of how he has managed to find an extra £6-£7 billion behind the sofa to give away to the grateful masses. Those that say that pre-election budgets don't matter, well that may usually be the case but not this time as, as few as a 10 seat swing from Labour to Conservative could make all the difference between which party forms the next government. So THIS pre-election budget definitely DOES matter!

With the election just 50 days away, to imagine that George Osborne would not attempt to bribe the electorate today is delusional and so George Osborne huffed and puffed of how he has managed to find an extra £6-£7 billion behind the sofa to give away to the grateful masses. Those that say that pre-election budgets don't matter, well that may usually be the case but not this time as, as few as a 10 seat swing from Labour to Conservative could make all the difference between which party forms the next government. So THIS pre-election budget definitely DOES matter!

The mainstream press appears to have swallowed Tory propaganda that the Chancellor magically has an extra £6-7 billion a year to play with, this illustrates how inept career mainstream press journalists really are for the simple truth is that all of George's election bribes will be financed through BORROWED money. There is NO spare £6 billion per year instead there is a near £100 billion annual budget black hole.

Furthermore George Osborne is once more repeating that the budget deficit as if by magic will convert into a surplus in 4 years time. Well that is the same conjuring trick that George Osborne has been stating for the past 5 years, as the following excerpt reminds of what George Osborne stated would happen to the budget deficit in his first coalition budget against what has actually transpired, which also illustrates that the OBR is just an economic statistics propaganda mouthpiece of the government of the day -

29th June 2010 - UK ConLib Government to Use INFLATION Stealth Tax to Erode Value of Public Debt

Therefore it is difficult to see how the government will be able to achieve its stated budget reduction target of getting the annual deficit down to just £20 billion by 2015-16. Whilst the government is expected to trend close to target for the next 3 years, however thereafter the governments (OFBR) and my deficit forecasts diverge as the coalition governments primary focus will be towards getting re-elected in May 2015. In all likelihood this means that total debt will be over £100 billion higher than that which the government is forecasting as illustrated by the annual budget deficits forecast graph below-

Whilst the ConLib's deficit reduction targets represent an improvement under the Labour governments target that would have resulted in extra borrowing of £478 billion over the next 4 years if the Labour government managed to stick to its targets. However the ConLib government will still expand total debt by £414 billion over the next 4 years, and £471 billion over the next 6 years to reach £1,242 billion, so hardly an earth shattering improvement.

The following updated graph for UK public sector net debt clearly shows that the Coalition government has hit a deficit cutting road block because instead of the deficit falling to around £37 billion for 2014-15, the government will be lucky if the deficit comes in at under £95 billion. Furthermore the trend for persistently high deficits is expected to continue beyond the May 2015 general election as the Coalition government has ramped up deficit spending to buy votes, the net effect of which would be for a total additional debt of £210 billion beyond the Coalition governments expectations to be added to Britain's debt mountain that looks set to pass £1.6 trillion this financial year.

This illustrates that the only answer / solution that all governments have remains one of stealth default by means of high real inflation hence the Inflation Mega-trend. Inflation is a REQUIREMENT for the Debt Based Economy, this is how governments keep putting off the day of reckoning by attempting to inflate the debt away with printed money and then borrowing more money to service the debt interest which is why virtually all money in an economy is debt money that will NEVER be repaid.

Whenever George Osborne or David Cameron are stating that they are paying down Britain's debt, they are LYING! The same goes for Ed Milliband if he states that he will cut Britain's debt. NO GOVERNMENT DEBT IS BEING REPAID OR WILL EVER BE REPAID! Instead the truth is that the WHOLE of the economic growth (in real terms) since the May 2010 General Election and continuing into the May 2015 General Election will be wholly as a consequence of some £586 billion of additional DEBT. Again this is a very important point to note that virtually ALL of the economic growth of this parliament is DEBT based, ALL of it, including the current election boom, the debt accrued over the 5 year term will equate to total real terms increase in GDP - virtually pound for pound which is why there is a cost of living crisis because printing money (debt) does not increase productivity, all it does is inflate the money supply.

In today's 2015 budget, George Osborne once more forecasts that as if by magic the budget deficit will be slashed and eventually turned into a surplus towards the end of the next parliament.

In today's 2015 budget, George Osborne once more forecasts that as if by magic the budget deficit will be slashed and eventually turned into a surplus towards the end of the next parliament.

- 2014-15 : £90.2bn

- 2015-16 : £75.3bn

- 2016-17 : £39.4bn

- 2017-18 : £12.8bn

- 2018-19 : £5.2bn surplus

- 2019-20 : £7bn surplus

Whilst it is too early for me to forecast what the deficit and debt could be during the next parliament. However given George Osborne's performance in the current parliament it could easily turn out to be more than DOUBLE the amount now being forecast.

The real crisis at the heart of the British economy is that which generates the large annual budget deficit, the welfare state, and so far despite much rhetoric the Tories have only reformed at the margins for it remains a spending black hole that looks destined to swallow the whole productive capacity of the British economy. For instance 9 MILLION adults of working age have near permanently parked their lard asses on benefits for life! So until a government really deals with the 'benefits culture' then Britain cannot recover, but only at best deliver weak below trend growth that most people will barely feel in their pay packets.

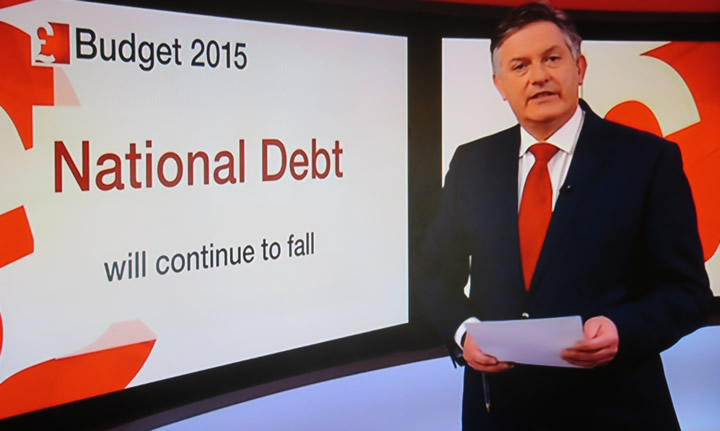

Meanwhile a ridiculous mainstream press as illustrated by the BBC do not even understand the difference between DEBT and DEFICIT, which is why BBC economic reporting amounts to little more than economic propaganda in the interests of whichever party is in government at the time -

National debt will continue to fall ? National debt has been INCREASED from about £1 trillion to £1.5 trillion and according to the Chancellors own fairy tale figures will increase by another £205 billion in the next parliament! BRITAIN'S NATIONAL DEBT HAS RISEN EVERY YEAR !

- Personal allowances raised to £11,000 (£200 per tax payer tax cut), Higher rate to £43,300.

- Help to Buy ISA - Government £50 top up for every £200 saved - boosting house prices.

- First £1k of interest on savings will be tax free. Will make ISA's less appealing.

- September Fuel duty increase scrapped.

- Beer tax cut by 1p.

- Annual tax returns to be scrapped.

- Scaling back of economic austerity.

In terms of the election probabilities, the latest election bribe will undoubtedly bolster the tory vote which as my earlier analysis concluded increases the chance for an outright Conservative electron victory, especially as many more election bribes will be announced in this weeks budget.

15 Mar 2015 - Election Forecast 2015 - Opinion Polls Trending Towards Conservative Outright Win

Hung Parliament is NOT a Certainty!

If the current trend continues then it is possible that the Conservatives could win an outright majority on May 7th as per my long standing analysis of seats vs house prices trend trajectory that painted a picture for a likely probable Conservative general election victory.

16 Dec 2013 - UK General Election Forecast 2015, Who Will Win, Coalition, Conservative or Labour?

The updated election seats trend graph illustrates that the Conservatives are virtually ON TRACK to achieve the forecast outcome for an outright election victory on a majority of about 30 seats which NO ONE, and I mean no serious commentators / analysts has or is currently advocating.

UK General Election Forecast 2015

In terms of what I actually see as the most probable outcome for the general election, I refer to my in-depth analysis that concluded in the following detailed seats per party forecast:

- 28 Feb 2015 - UK General Election 2015 Seats Forecast - Who Will Win?

- 28 Feb 2015 - UK General Election 2015 - Forecasting Seats for SNP, LIb-Dems, UKIP and Others

UK General Election May 2015 Forecast Conclusion

My forecast conclusion is for the Conservatives to win 296 seats at the May 7th general election, Labour 2nd on 262 seats, with the full seats per political party breakdown as follows:

Therefore the most probable outcome is for a continuation of the ConDem Coalition government on 326 seats (296+30) where any shortfall would likely find support from the DUP's 8 seats.

The alternative is for a truly messy Lab-Lib SNP supported chaotic government on 327 seats (262+30+35) which in my opinion would be a truly disastrous outcome for Britain, nearly as bad as if Scotland had voted for independence last September.

Another possibility is that should the Conservatives do better than forecast i.e. secure over 300 seats but still fail to win an overall majority, then they may chose to go it alone with the plan to work towards winning a May 2016 general election.

The bottom line is that the opinion polls do not reflect how people will actually vote on May 7th when they are faced with a stark choice of steady as she goes ConDem government or take a huge gamble on Ed Milliband's Labour party. So in my opinion several millions of voters will chose to play it safe with ConDem which thus is the most probable outcome.

Also available a youtube video version of my forecast:

Ensure you are subscribed to my always free newsletter for in-depth analysis and detailed trend forecast delivered to your email in box.

Source and comments: http://www.marketoracle.co.uk/Article49881.html

By Nadeem Walayat

Copyright © 2005-2015 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.