Why Aren’t These Investors Worried About The Gold Price?

Commodities / Gold and Silver 2015 Mar 20, 2015 - 02:43 PM GMTBy: Jeff_Clark

Have you noticed that some gold investors don’t seem very concerned about the current behavior of gold?

Have you noticed that some gold investors don’t seem very concerned about the current behavior of gold?

While the price remains weak and range-bound, some gold investors don’t seem worried about it at all.

The natural reaction to an asset you own losing a third of its value, with seemingly little motivation to move higher, is cheerless and maybe even depressing. So why aren’t they?

Are they out of touch? Perhaps have nothing at stake? Are they the kind of investors that would go down with the ship?

Or do they know something we don’t?

Gold’s Cycles

The resource markets are well known for moving in cycles, probably more than most other markets. Raging bull market, crippling bear market, repeat. This includes gold and silver.

Yes, catalysts can impact the price along the way—a big discovery, government interventions, and good ol’ supply and demand. But the context that determines how the price ultimately performs in a given period is where we are in the cycle.

Cycles never repeat with the same length or breadth, but they distinctly boom and bust, over and over again. The data doesn’t tell us exactly when gold’s next upcycle will get underway, nor how big it will be, but it does tell us this: another bull cycle is coming.

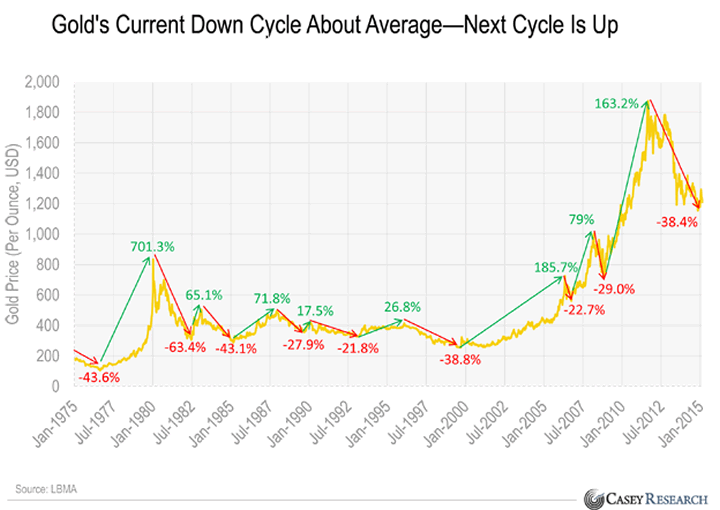

We charted the major cycles for gold and silver from 1975—when gold again became legal to own in the US—to present.

Here are gold’s cycles.

Since 1975, gold has logged eight major price cycles. While no two are identical, our recent downcycle has been one of the longest on record. It’s also been slightly bigger than the average percentage decline.

Regardless of the nominal price, gold has repeatedly cycled between bull markets and bear markets.

Given the prolonged nature of the current bear market, history suggests that the current down cycle is about over. It doesn’t mean the next bull market will start tomorrow, but it does indicate that the next major cycle will be up, regardless of short-term fluctuations.

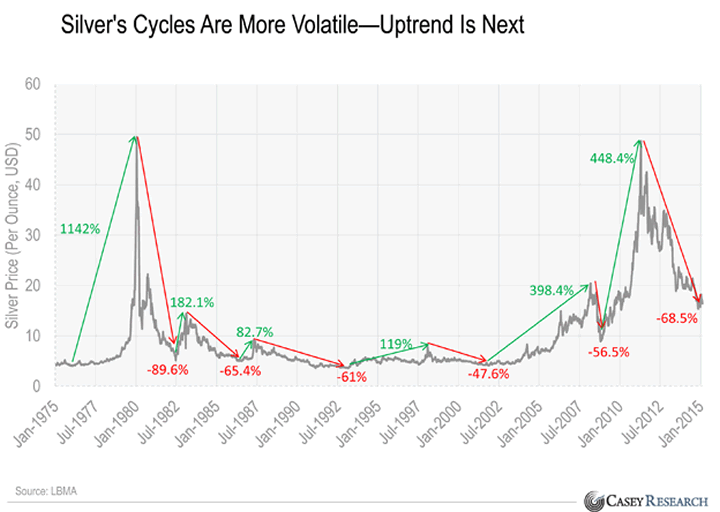

Silver also has prominent cycles.

In terms of percentage decline, silver’s recent downcycle is the second biggest on record. This is a strong indication that silver’s bottom is in.

And like gold, the picture shows that the next big cycle is up.

So what does all this mean to us? Setting the timing aside, history says…

- The current downcycle in the precious metals market has exceeded historical averages.

- Given the extent of the selloff, particularly with silver, the bottom for these markets is likely in.

- The pattern of market cycles means the next major trend for our industry is UP. We don’t know when, but history says it is coming.

In other words, the gains ahead could be tremendous. Preparing now for the next upcycle is key to your future wealth.

Those unworried gold investors are very cognizant of these historical patterns. Not only do they know another bull cycle is coming, but given the extent of the selloff and the monetary malfeasance of governments the world over, they fully expect to become wealthy from it. They’re positioning their portfolios right now in anticipation of a major shift in wealth.

You can hear what they’re doing in our online event Going Vertical. Eight stars of the mining industry and seasoned resource investors discuss the historic opportunity the current market offers and the best ways to prepare your portfolio for a shot at true wealth when the gold market inevitably rallies again. Watch Franco-Nevada’s Pierre Lassonde… Casey Research Chairman Doug Casey… Pretium’s Bob Quartermain… Sprott US Holdings Chairman Rick Rule… Aben Resources’ Ron Netolitzky… US Global Investors CEO Frank Holmes… and Casey Research metals experts Jeff Clark and Louis James. Don’t miss this free special event—watch Going Vertical now!

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.