Gold and Misery, Strange Bedfellows

Commodities / Gold and Silver 2015 Mar 31, 2015 - 04:05 AM GMTBy: Dan_Norcini

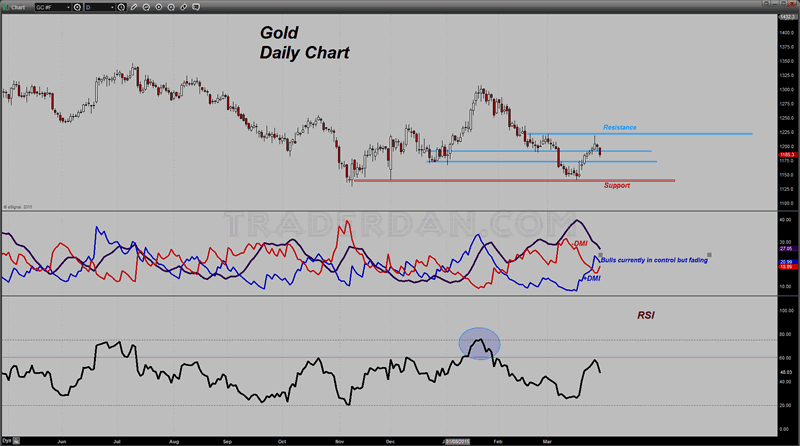

Overhead chart resistance centered between $1225-$1220 has proven to be a bride too far for the gold market. That region has now been confirmed with today’s plunge as a formidable barrier that gold bulls will have to overcome if there is ever going to be anything besides “boring” in the gold market anytime soon.

Overhead chart resistance centered between $1225-$1220 has proven to be a bride too far for the gold market. That region has now been confirmed with today’s plunge as a formidable barrier that gold bulls will have to overcome if there is ever going to be anything besides “boring” in the gold market anytime soon.

Notice on the ADX/DMI, that the short-lived move higher coming off the heels of the FOMC statement has seen the ADX turn down, as well as the +DMI. Also, the RSI has failed at the 60 level, a level which tends to hold bear-market rallies.

I still go back to the fact that gold is moving inversely to the yield on the Ten Year Treasury note. When interest rates rise, as they did today, gold tends to struggle. An offshoot to the higher rates is strength in the US Dollar, which also pressures gold.

It will be interesting to see if the next update on reported holdings of GLD shows yet another decline.

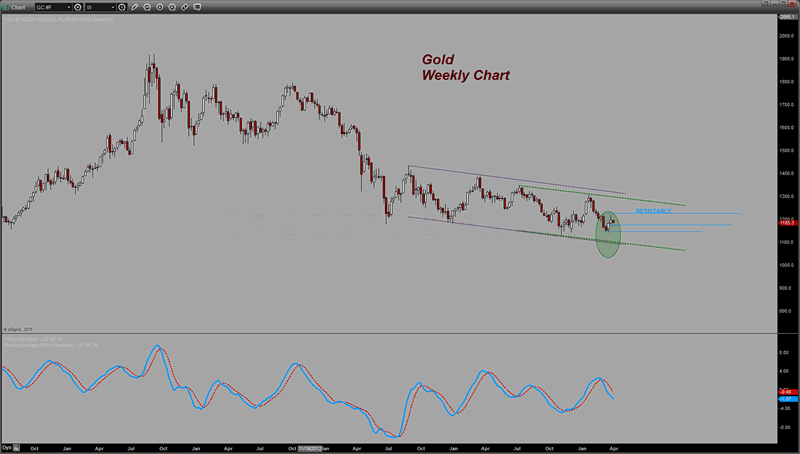

Here is a weekly chart of gold showing that it remains well inside the channel that has held it since the summer of 2013. First level of support remains near $1180. Below that another layer of support emerges near $1150-$1145.

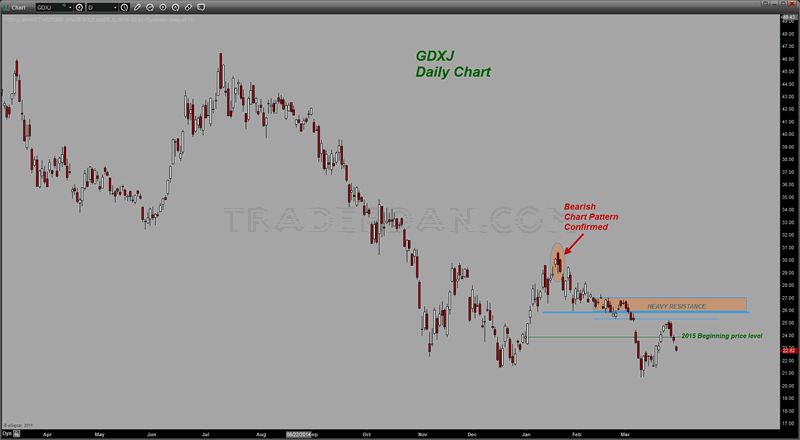

The gold shares remain a giant TRAIN WRECK.

Why anyone would want to own these juniors in particular escapes me. The chart is atrocious as they remain in the red on the year.

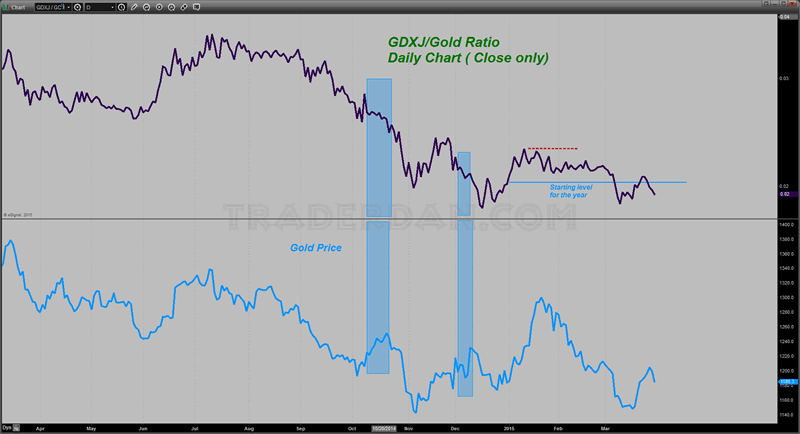

Lastly along this line, the GDXJ/Gold ratio continues to head in its favorite direction, namely lower.

By the way, a few random thoughts about gold and its proponents. Most of you know by now, that I regard gold as INSURANCE; nothing more and nothing less. It is simply another asset class. Sometimes it is in favor and does well; sometimes it is out of favor and does not do well.

Many gold bugs seem to forget that gold can go long, long periods doing absolutely nothing to improve ones portfolio. Think about the 20 long years from 1980 to 2000-2001 when gold went nowhere but down. For twenty long years, those who had pinned their investment hopes exclusively on gold, missed huge opportunities to grow their wealth by diversifying. Yet, many of them who remained bullish for those twenty years, believed that they were rewarded for keeping the faith. They cite the fact that gold rallied from near $250 to slightly over $1900 in 2011 as proof that it pays to own gold.

That would be true but that assumes that one who bought gold actually SOLD IT and captured the profits. The problem with gold bugs is that one never or at least rarely, hears them talking about doing just that. For them, it is always onward and upwards to the next new high, even if it takes 20 years to get there. That most did not sell and capture the gain, means that they have lost nearly half of any paper gains that they might have made back in 2011.

I do not know about the rest of you, but watching any investment lose 50% of its value is a sure-fire method of short-circuiting any chance of making serious progress in one’s long term investment strategy.

I guess what I am saying here is that for some reason, gold tends to feed the pessimistic streak in all of us. Think about it – for one to be bullish gold, it means that one must also be negative towards the entire financial system or at the very least, the US Dollar. That translates into what I believe is an unhealthy OBSESSION with bad news.

Driving in my truck today, I heard yet another one of those “quick – head for the hills because the Dollar is going to crash”, annoying ads that **** Capital seems to love to unleash upon us. This time it is all about “Alan Greenspan’s warning of financial instability”, so hurry up and load the boat with more gold. After enough of these, one soon gets a feeling of nausea and disgust that it is the same thing, time after time, year after year, with these people. “The entire world is going to end tomorrow so make sure you spend lots of your money buying gold from us.”

This is also why some of you who are on the mailing lists of these many gold cult members who infest the internet, will almost daily find your email inbox filled with one story after another about how bad this is, or how bad that is, or how soon this will collapse or how soon that will collapse. Each piece of economic news that seems to indicate slowing growth is therefore heralded as if it is some precursor of what is a guaranteed soon-to-be financial Armageddon.

This is to be expected for the reason I noted above – in order for one to be bullish gold, one must, by necessity, be hoping for bad news. That strikes me as a particularly depressing way of going through life.

Please do not misunderstand what I am saying here – one can hold the yellow metal as a form of insurance without having this perversely depressing morbid outlook on life that seems to infect so many gold bugs. After all, most of us have insurance on the homes we own or against catastrophic health issues, or our cars, or life insurance. But here is the difference – those who are MENTALLY stable NEVER, NEVER, NEVER actually HOPE to collect on it. We buy it hoping the exact opposite, namely, that we will NEVER NEED it.

What would our lives consist of if we transferred the mental state that marks the average rabid gold bug to our home, auto, life or health insurance? That means I would be cheering that the fire in my next door neighbor’s home would spread to mine. It means that I would be anxious to get the same horrible disease that some friend or acquaintance was unfortunate enough to be smitten with. It means that I would be anxious for the car wreck, all so that I could collect on my auto insurance coverage. It I think you see my point. Foolish it is not? Seriously, what would you think of any such person with those sorts of HOPES who would fill your email box with stories about fires in his neighborhood and sounded actually excited about the prospect???

Serious-minded investors/traders must avoid falling into this sort of mentality. Remain objective, level-headed and above all, watch out for the sensationalism that pervades the world of the gold bugs. Buy some gold, hold it for insurance, and then get on with your investing life! You’ll be a lot happier an and a lot more fun for family and friends to be around.

Dan Norcini

Dan Norcini is a professional off-the-floor commodities trader bringing more than 25 years experience in the markets to provide a trader's insight and commentary on the day's price action. His editorial contributions and supporting technical analysis charts cover a broad range of tradable entities including the precious metals and foreign exchange markets as well as the broader commodity world including the grain and livestock markets. He is a frequent contributor to both Reuters and Dow Jones as a market analyst for the livestock sector and can be on occasion be found as a source in the Wall Street Journal's commodities section. Trader Dan has also been a regular contributor in the past at Jim Sinclair's JS Mineset and King News World as well as may other Precious Metals oriented websites.

Copyright © 2015 Dan Norcini - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

Dan Norcini Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.