Gold and Silver Hold Their Own $Over Q1

Commodities / Gold and Silver 2015 Apr 02, 2015 - 05:54 PM GMTBy: GoldMoney

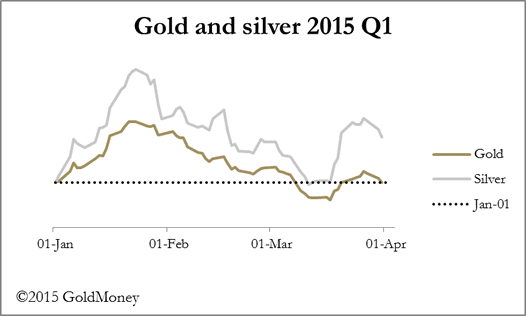

Gold priced in dollars hardly changed over the first quarter of 2015, but silver performed strongly, up 7%. In generally choppy markets across all asset classes silver was bettered only by the Nikkei 225 Index. This compares with the NASDAQ up 3%, the US long bond up 2.6%, and the Standard &Poors up 1%.

Gold priced in dollars hardly changed over the first quarter of 2015, but silver performed strongly, up 7%. In generally choppy markets across all asset classes silver was bettered only by the Nikkei 225 Index. This compares with the NASDAQ up 3%, the US long bond up 2.6%, and the Standard &Poors up 1%.

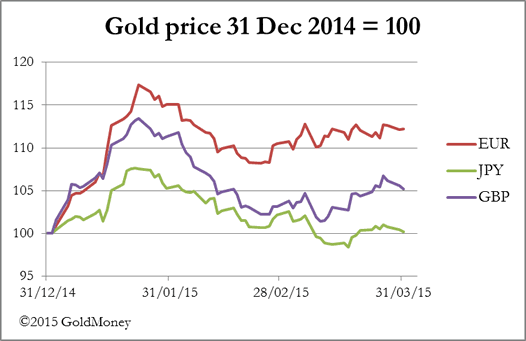

The consensus opinion that the dollar will continue rising is almost total, which is the other side of the gold trade. But while the dollar has risen, gold has not fallen: in other currencies it has gained, the principal exception being priced in yen, which has been consolidating against the dollar after last year's weakness. Gold priced in the other major currencies is shown in the next chart.

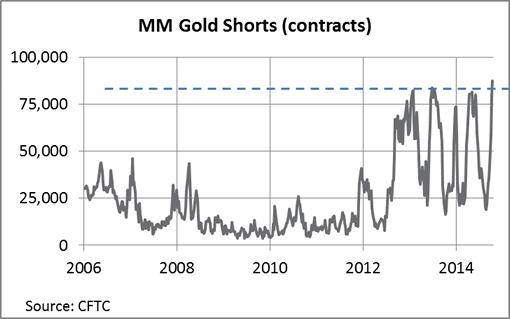

Being unchanged in dollars over the quarter, gold outperformed most other asset classes, with crude oil down 15%, the euro 12.2%, sterling 5.1%, and copper 2.2%. The performance of both gold and silver is against a background of growing pessimism about global deflation relative to the US, with the Managed Money (MM) category for gold on Comex increasing short positions to record levels, shown in the next chart which is updated to Tuesday last week.

Hedge funds selling gold futures are buying the dollar and not necessarily expressing a view about gold, other than something has to be sold to buy the dollar. Therefore, if there is a change in sentiment against the dollar, this could have a dramatic effect on gold and silver prices because it would almost certainly trigger a substantial bear squeeze.

This market condition appeared to drive prices higher in trading on Wednesday, the first day of the new quarter. Up to that point a range of markets appeared weak ahead of quarter-end book-squaring, an influence that has now passed. Gold rose as much as $27, or over 2% on Wednesday before settling at $1204. Silver moved up as much as $0.55, or 3.3%, before settling at $16.95.

Overall, trading is subdued by the Easter break, with many markets closed on both Good Friday and Easter Monday.

Looking forward into the second quarter, the principal concern has to be the unanimity of opinion that the dollar reigns as king over everything else. The certainty with which the overwhelming majority of hedge funds, banks and other investors hold this view is reminiscent of investor psychology in September 1987, when just a few weeks' later equity markets suddenly crashed for no reason other than everyone was fully invested and no one left to buy. If the dollar does have a major correction, it should be reflected in an improved outlook for precious metals starting from a sound base.

Next week

Monday. Japan: Leading Indicator, Eurozone: Sentix Indicator. US: ISM Non-Manufacturing Index.

Tuesday. UK: Halifax House Price index, CIPS/Markit Services PMI. Eurozone: Composite PMI, PPI. US: IBD Consumer Optimism, Consumer Credit. Japan: Current Account

Wednesday. Eurozone: Retail Trade. Japan: BoJ MPC Overnight Rate, Economy Watchers Survey.

Thursday. UK: Trade Balance, BoE MPC Meeting and Rate Decision. US: Initial Claims, Wholesale Inventories. Japan: Bank Lending Data.

Friday. UK: Construction Output, Industrial Production, Manufacturing Production. US: Import Price Index, Budget Deficit.

For more information, and to arrange interviews, please call Gwyn Garfield-Bennett on 01534 715411, or email gwyn@directinput.je

GoldMoney is one of the world's leading providers of physical gold, silver, platinum and palladium for retail and corporate customers. Customers can trade and store precious metal online easily and securely, 24 hours a day.

GoldMoney customers hold almost 21 tons of gold in storage worldwide, and own a combined total of US$1.6 billion in precious metals.

Historically gold has been an excellent way to preserve purchasing power over long periods of time. For example, today it takes almost the same amount of gold to buy a barrel of crude oil as it did 60 years ago which is in stark contrast to the price of oil in terms of national currencies such as the US dollar.

GoldMoney is regulated by the Jersey Financial Services Commission and complies with Jersey's anti-money laundering laws and regulations. GoldMoney has established industry-leading governance policies and procedures to protect customers' assets with independent audit reporting every 3 months by two leading audit firms.

GoldMoney has its headquarters in Jersey and also has offices in London and Hong Kong. It offers its customers storage facilities in Canada, Hong Kong, Singapore, Switzerland and the UK provided by the leading non-bank vault operators Brink's, Via Mat, Malca-Amit, G4S and Rhenus Logistics.

© 2015 Copyright GoldMoney - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.