Blair Warns On BREXIT - 'Chaos' If UK Leaves EU

ElectionOracle / UK General Election Apr 07, 2015 - 04:33 PM GMTBy: GoldCore

- Ex-Prime Minister warns uncertainty would hit UK economy and cause ‘chaos’

- Ex-Prime Minister warns uncertainty would hit UK economy and cause ‘chaos’

- ‘BREXIT’ would cause the “most intense period of instability” since WW2

- Seeks to portray Tory policy as disingenuous and cynically putting economy at risk

- Uncertainty caused would have negative consequences for British economy and sterling

Tony Blair has entered into the British election campaign debate in support of David Miliband on the issue of what he regards as the Tories reckless attitude to Europe and the potential ‘BREXIT’.

Blair will address his former constituents in County Durham today strongly urging them to support Miliband, who he praised for his “real leadership on the EU” while portraying David Cameron’s EU policy as disingenuous and reckless.

“There is, in my view, a complete under-estimation of the short-term pain of negotiating exit. There would be a raft of different treaties, association agreements and partnerships to be disentangled and re-negotiated. There would be significant business uncertainty in the run-up to a vote but, should the vote go the way of exit, then there would be the most intense period of business anxiety, reconsideration of options and instability since the war”,

Blair will say in the well flagged speech which has been trumpeted in the pro-Labour UK Guardian and of Miliband he will say, “he is own man with his own convictions and determined to follow them, even when they go against the tide”. On the other hand he accuses Cameron of not even believing in a necessity for Britain to exit the EU.

“The oddest thing of all about David Cameron’s position [is the] Prime Minister doesn’t really believe we should leave Europe; not even the Europe as it is today,” he will add, according to London’s Independent.

“This was a concession to party, a manoeuvre to access some of the UKIP vote, a sop to the rampant anti-Europe feeling of parts of the media.”

He makes fair comment on the uncertainty that would stem from a Tory victory and the prospect of a referendum campaign and potential British exit.

“Think of the chaos produced by the possibility, never mind the reality, of Britain quitting Europe,” he will say. “Jobs that are secure suddenly insecure; investment decisions postponed or cancelled; a pall of unpredictability hanging over the British economy.”

He disagrees with Cameron’s contention that he will receive various concessions from Europe prior to the proposed 2017 referendum.

“The rest of Europe will be vigorous in ensuring Britain gets no special treatment. This will be a horrible process. Don’t be in any doubt about that …” he will say, according to the left leaning Guardian.

He will add, “If I was leading a business dependent on access to the single market or, more important, employed in such a business, then the issue of Europe and the risks of this would be a big decider in my vote.”

BREXIT poses risks to free trade and indeed the free movement of people, goods and services. An example of this is the return to borders.

Indeed, a physical border between the Republic of Ireland and Northern Ireland will be re-imposed if the UK decides to leave the EU, a director of the British Irish Chamber of Commerce warned last week.

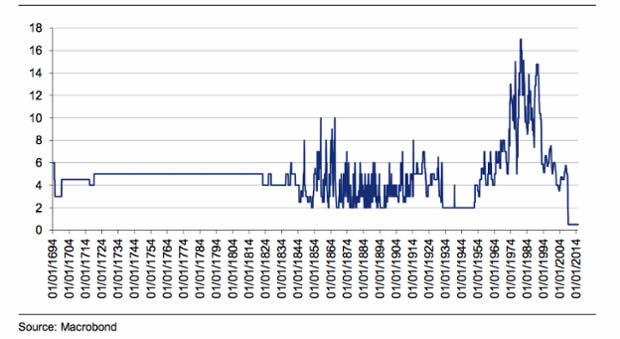

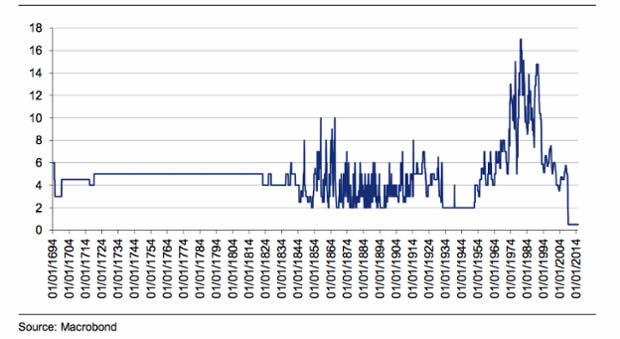

Such uncertainty would not be good for the vulnerable UK economy at this time due to it’s massive and unsustainable levels of total debt. While all the focus is on the government or national debt which is currently 81.58% of GDP, total debt levels including private debt – are much, much higher and have fallen little since the debt crisis in 2008.

Together, families and non-financial firms’ debt is still over 200 per cent of GDP and is merely back to levels last seen in mid-2007, a time when leverage was already utterly out of control. Current debt levels remain much higher than they were a decade ago (170 per cent of GDP) and even just 15 years ago at the turn of the millennium when they were 128 per cent of GDP.

These massive debt levels are serviceable providing the UK economy continues to grow and interest rates remain near all time record lows at 0%. However, even a slight uptick in interest rates could pressurise the debt laden UK economy. Interest rates are set to rise – the question is when not if.

Unless the next government becomes serious about tackling private and public debt, the next crisis, when it eventually comes, will be devastating and on a scale far worse than the first financial crisis.

Regardless of the long-term rights or wrongs of Cameron’s proposed EU referendum, in the short term it may indeed cause problems for UK businesses – particularly exporters and the financial sector – and debt-mired workers. Potential mortgage defaults would have a knock on effect on the banking system and the property bubble in Southern England.

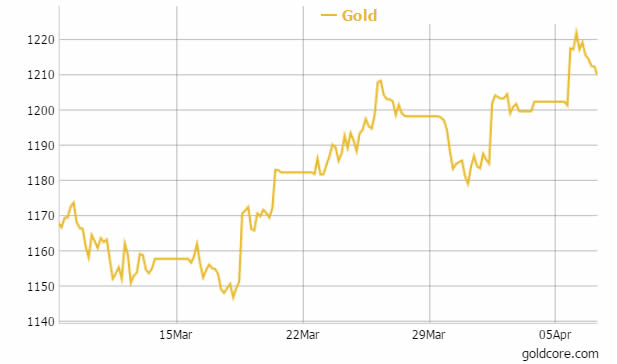

A recession at this time would likely lead to another round of QE – the only policy open to central banks – and a consequent depreciation of the pound. Gold tends to come into its own as financial insurance in an environment of uncertainty and an allocation to physical gold is advisable to offset and hedge the potential risks posed to the UK economy by a ‘BREXIT.’

Click here in order to read GoldCore Insight –

Currency Wars: Bye Bye Petrodollar – Buy, Buy Gold

MARKET UPDATE

Today’s AM LBMA Gold Price was USD 1,201.50, EUR 1,110.91 and GBP 811.11 per ounce.

Yesterday’s AM LBMA Gold Price was USD 1,208.50 , EUR 1,113.82 and GBP 813.63 per ounce.

Gold climbed 1.2 percent or $14.40 and closed at $1,215.70 an ounce yesterday, while silver gained 1.55 percent or $0.26 closing at $17.00 an ounce.

Gold in Singapore was mostly unchanged at $1,213.11 an ounce near the end of day trading. Yesterday, the yellow metal reached a high of $1,224.10 per ounce its highest since February 17th.

The gold price in Europe in late morning trading was $1,208.33 off 0.52 percent. Silver was $16.78 or down 1.06 percent and platinum was $1,165.88 or down 0.31 percent.

The U.S. non farm payrolls figure on Friday rose by only 126,000 jobs in March well below the forecast of 247,000. This downward surprise sent the U.S. dollar falling and saw safe haven flows into gold and silver.

Gold in GBP – 6 Months (Thomson Reuters)

Negative economic data out of the U.S. raises the likelihood the U.S. Federal Reserve may not be able to raise rates this year. As we have warned for some time, the U.S. economic recovery is weak at best. Rising interest rates will lead to a new recession and hence the Fed’s growing Catch 22.

New York Fed President William Dudley said over the weekend that the timing of the U.S. rate hike, which would be the first in nearly a decade, is unclear and policymakers must watch that the U.S. economy’s surprising recent weakness does not signal a more substantial slowdown. It does and it will.

Shanghai Gold Exchange (SGE) premiums are just under one dollar per ounce over the global benchmarks. This suggests demand in China has fallen from the very high levels seen in the first weeks of 2015 and over Chinese New Year.

However, the SGE gold withdrawals show very high levels of demand. In week 12 (for the period from March 23 to March 27) they were a robust 46 tonnes. Total withdrawals so far in 2015 are at 607 tonnes, up more than 8 per cent from 2014 and up 32 per cent from 2013.

The world’s largest gold ETF, SPDR Gold Shares, saw its first outflows of the month on Monday, of 1.8 tonnes. Its holdings are currently 735.447 tonnes, up around 25 tonnes from the start of the year.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.