Gold Stocks: This Bear Sleeps at least for now

Commodities / Gold and Silver Stocks 2015 Apr 09, 2015 - 10:35 AM GMTBy: Bob_Kirtley

Background

Background

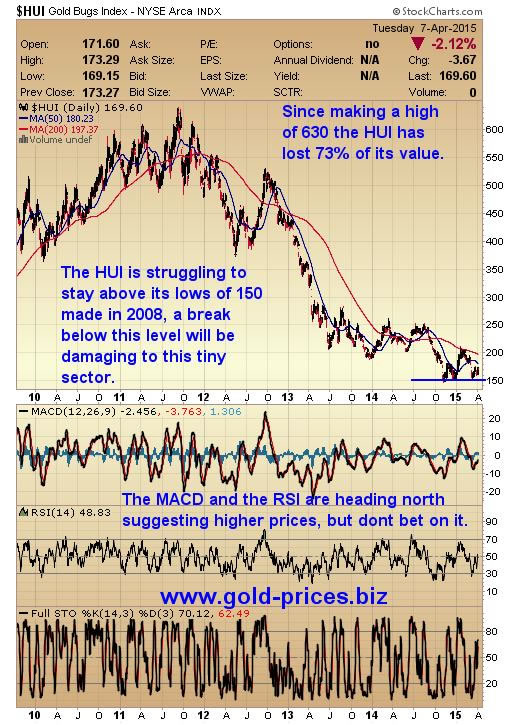

2015 has started brightly with gold, silver and the miners all rallying to higher ground as evidenced by the Gold Bugs Index, the HUI, gaining 50 points or approximately 30%. This sort of behavior in any sector brings out the bulls in full cry that the bottom is in and we should all hit the acquisitions trail. Alas this rally didn’t last and the miners soon started to give back the gains almost as quickly as they were made. This pattern of falling stock prices punctuated by sudden price hikes has characterized the precious metals sector for the last three years or so. Unfortunately the bounce is rarely of the same magnitude of the preceding falls in prices and so we have witnessed the HUI fall from a high of 630 to a close today of 167, recording a drop of some 73% in the value of these stocks.

Gold Mining Stocks

The time to buy is when ‘blood is the streets’ as they say, but we haven’t quite reached that stage yet. One of the tell-tale signs is that the perma-bulls keep trumpeting the reasons and various metrics to buy this sector now; regardless of just how poorly it is performing. If you were of the opinion that the stocks were a buy when the HUI was standing at 630 then for every 100 points it has dropped it must have become a screaming buy and today a golden opportunity for investors. Then perma-bulls that have bought this sector all the way down are almost all-in so their effect on future prices is negligible as they don’t have the cash to follow through with actual acquisitions.

The sign of a true bottom is when it goes eerily quiet and no-one wants to buy any of these stocks, volumes are miniscule and sentiment is in the basement. Is that the situation today, well its ‘close but still no cigar.’ Don’t despair; that time is coming and will be well worth the wait for those who have put aside some opportunity cash. For those who have sat through this decline most of the damage is behind you although there is more pain to come in the short term. This is the time when investors finally give up the ghost and sell their stocks and vow never to touch another gold or silver mining share ever again. When this happens we will see a sudden spike down in prices which will be the final capitulation that this sector has not experienced so far. We are all aware that when a bull market reaches maturity there is a final blow-off in prices with the charts going exponential. The same goes for the final stages of a bear market with the charts heading for the basement with considerable rapidity.

Taking a quick look at the chart we can see that the HUI is struggling to stay above the ‘150’ level which is an important support level last seen in 2008. This level has been tested 3 times recently which is not a good sign for a sector which is supposed to have bottomed.

A chart of the unhedged gold miners.

Conclusion

Gold has been doing well in most currencies other than the US dollar which is an argument for holding gold in those countries. However, it is still second best to the dollar so why settle for second place when you could be in the best performer; the US dollar.

In terms of what to do at this stage of the cycle we are sticking with our strategy which is as follows;

Keep the lion’s share of your investment funds in cash for now. Wait for a final capitulation before investing, unless you are very nimble and can trade in the short term, long or short.

Wait for the data to confirm that the economy is either going well or heading lower, recent non-farm payroll numbers were very low and this may or may not be indicative of the future direction of employment.

Watch the Fed for what they say and do and remember that they are ‘data driven’ so we have no clarity regarding the future of interest rates or even if QE is about to make a comeback.

Do not buy the producers because they are cheaper than they have been cheaper does not necessarily mean cheap.

This recent bounce in prices is already looking like another false dawn and there have been plenty of those over the last three years to at least make you a tad skeptical about this market.

At the moment we have 70% of our funds in dollars and are happy to be in dollars as they have strengthened considerably; giving us more spending power for when the bargains present themselves.

Stay flexible and don’t be afraid to short this market if a rally looks to be overbought and go long when the stocks have been flattened. These trades are not long term investments and should be considered on a hit and run approach, taking small profits quickly and hopefully minimizing the risks. Finally, only deploy small amounts of capital until the new bull is confirmed, we all need to live to fight another day.

Got a comment, then please fire it in whether you agree with us or not, as the more diverse comments we get the more balance we will have in this debate and hopefully our trading decisions will be better informed and more profitable.

Go gently.

Bob Kirtley

Email:bob@gold-prices.biz

URL: www.silver-prices.net

URL: www.skoptionstrading.com

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. Winners of the GoldDrivers Stock Picking Competition 200

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.