Gold Price Next Move

Commodities / Gold and Silver 2015 Apr 18, 2015 - 06:01 AM GMTBy: Submissions

Peter Vogel writes: When determining if a bull move in gold is a probability, a good indicator can be found in the relationship between the junior and senior gold miners etf's. If a bull move is occurring, the junior gold miners etf (GDXJ) should show indications that it will outperform the senior gold miners etf (GDX). This implies investors are willing to take on more risk in anticipation of greater gains by taking positions in the GDXJ verses the GDX.

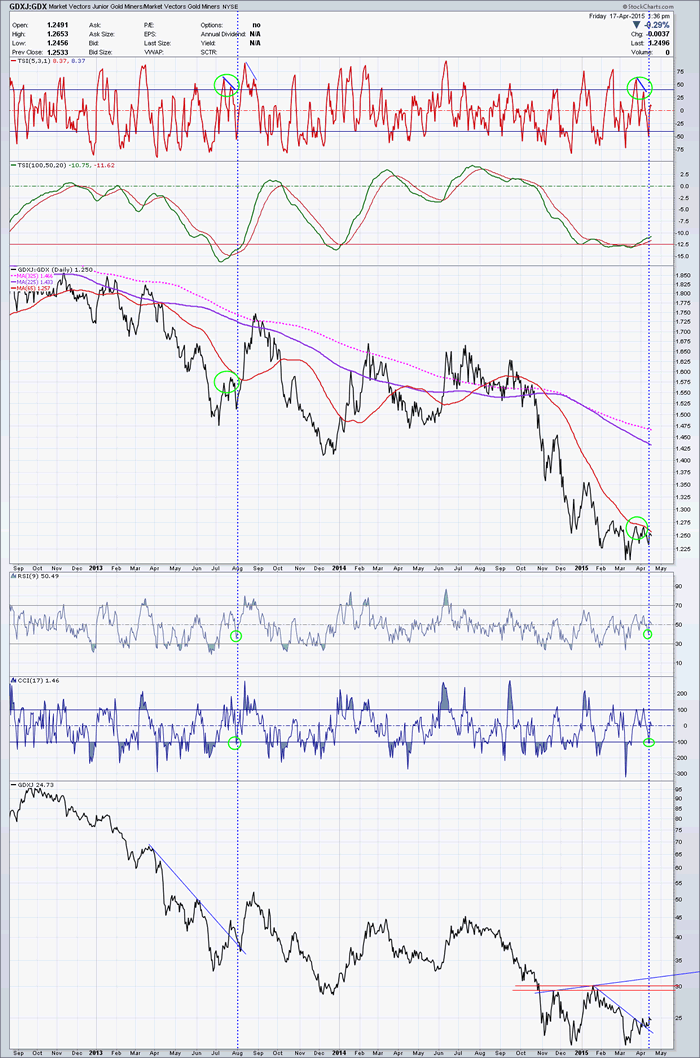

Recently, a pattern became noticeable in the GDXJ/GDX ratio if you take into account its momentum indicators that relates back to a prior short-term bull move during the summer of 2013. The ratio chart below highlights the similarities. The green circles show the similarities in the patterns, starting with the initial negative divergence that occurred in the short-term momentum (1st pane-red line), while the long term momentum (2nd pane-green line) was oversold. The following dip on short-term momentums (pane 1,4,5) into their oversold levels turned out to be the final low before resumption of the next wave up.

The actual GDXJ chart is shown in the bottom pane. Note that the GDXJ/GDX ratio chart (3rd pane) rallied up to the pink and purple moving averages (in 2013) about 1 month later, so that is our expectation for the current situation with a possible 20% return as a target (GDXJ: $29~31) as highlighted by the horizontal double red lines in the GDXJ chart in the bottom pane. We would watch the price action on Monday, April 20 for a break above this week's high for confirmation of this scenario. Alternatively, any move lower next week would be considered to negate any further bullish potential in the near term.

By Peter Vogel

Peter Vogel began his investment career in 1981, first as a Floor Trader and then as an Investment Advisor for a major securities firm. During that time he acquired several securities and options licenses and became registered as a Commodity Trading Advisor (CTA). He also co-founded a venture capital organization that helped finance and commercialize a number of new technologies. Since the beginning of his 33+ years of investing, he developed his own style of technical analysis by focusing on ratio analysis and money management techniques, creating methods that often allow him to buy near precise turning points with confidence.

© 2015 Peter Vogel - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.