Gold Flows East - China, India Import Massive Quantities of Gold from Switzerland

Commodities / Gold and Silver 2015 Apr 27, 2015 - 05:41 PM GMTBy: GoldCore

- Singapore, India and China continue to import staggering volumes of gold from the West

- Singapore, India and China continue to import staggering volumes of gold from the West

- U.K. exports of bullion to Switzerland increase 6 fold to a very large 97 tonnes

- Gold exports from Switzerland to both China and India doubled in March

- Shanghai Gold Exchange (SGE) becoming most important centre for physical gold trade

- LBMA says London gold trade will not move to exchange

- Gold price languishes at all time inflation adjusted lows despite robust demand …

- Gold will protect Asian peasants and western middle classes …

In what future generations will likely see as a major, potentially catastrophic blunder of monetary policy, the West and particularly the City of London continues to hemorrhage huge volumes of gold which is flowing Eastwards to Singapore, India and China from London via Switzerland.

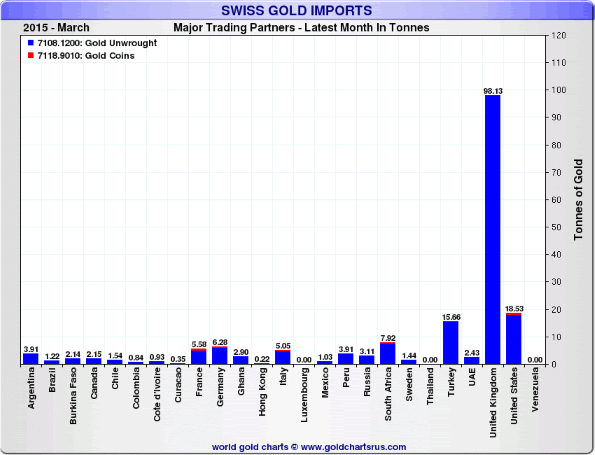

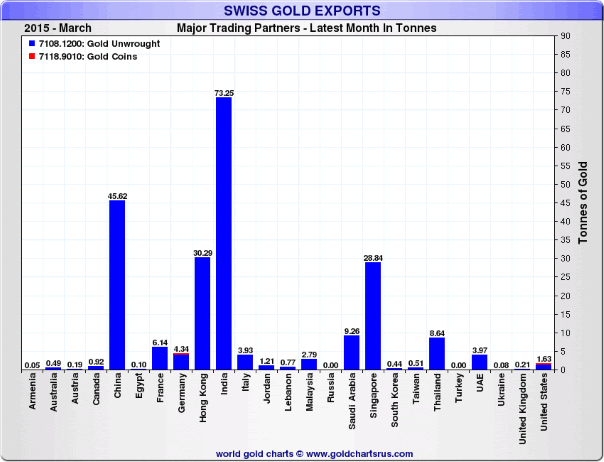

“Gold exports to China from the refining hub of Switzerland almost doubled to 46.4 metric tons in March”, up from 23.6 tonnes in February” according to Bloomberg. India’s gold imports from Switzerland doubled to 72.5 tonnes in the same period.

The increasingly affluent masses in China and India continue to have a voracious appetite for gold as a store of value.

Policy makers in China and Russia have also made gold a cornerstone of their monetary policy.

Bloomberg reported the following:

“Flows to India rose before this month’s Akshaya Tritiya festival, which is considered a traditional day to buy precious metals.”

The Asian demand for Swiss refined gold was met in part by very large gold imports from the U.K. Bloomberg states that Swiss imports from the U.K. rose sixfold in the same period to 97.2 tonnes.

This figure dwarfs Swiss imports from other nations. The U.S. and Turkey exported just over 18 tonnes and 15 tonnes respectively and these figures greatly exceed the amounts coming from all the other countries from whom Switzerland imports gold.

It is likely that London good delivery bars (400 troy ounces) favoured by western institutions including bullion banks and central banks are being imported into Switzerland. They go to the Swiss refineries to be smelted and refined into kilobar format which is increasingly popular in Asia and traded on the Shanghai Gold Exchange (SGE).

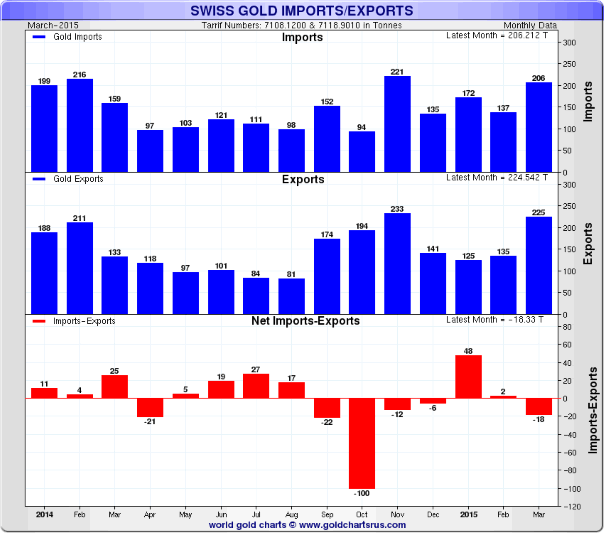

Bloomberg also reports that “Global sales from gold-backed funds totaled 55.7 tons in March.” This would indicate that the gold making its way to Asia is coming from official holdings and or liquidation of gold ETFs. Some of those selling the ETFs are opting to acquire physical, allocated bullion and storing in vaults in Zurich, Hong Kong and of course Singapore.

Singapore is fast becoming an important gold hub and a favourite location for allocated bullion storage among risk conscious bullion buyers. Hong Kong saw a decline in its share of the market as Chinese investors increasingly opt to use the Shanghai Gold Exchange (SGE) for buying and trading in general.

Bloomberg reports that “Shipments to Hong Kong fell 26 percent to 30 tons”, whereas “Trading volume for bullion … jumped about 60 percent from the previous month to a record in March, Shanghai Gold Exchange data show.”

The SGE deals solely in physical gold bars and not paper contracts or unallocated bullion bank accounts which can be used to divert and reduce actual demand for physical gold and cap gold prices.

Between them China and India and Singapore – who imported almost 29 tonnes from Switzerland – imported almost 150 tonnes of the 223.3 tonne total of gold exported from Switzerland in March which Bloomberg said are “the highest since at least 2013”.

While sentiment towards gold in the West is abysmal – even as gold languishes at record lows when adjusted for inflation – Asian demand remains insatiable.

It would be wise for investors to inform themselves as to why this should be so. Demand for gold in Asia is often written off by Westerners as an irrational impulse of uneducated Asian peasant farmers and workers.

This is unfair to gold buyers in Asia – many of whom have experience of currency devaluation and therefore opt to own gold as a savings mechanism and a superior store of value.

However irrational holding gold may appear, the alternative – holding paper currencies which are continually being devalued through QE and inflation in various sectors of the economy – is even more irrational.

The fact that it is a matter of Chinese state policy to continuously accumulate vast volumes of gold and that the Chinese government has encouraged its citizens to own gold shows that bullion is not the fringe asset of irrational ‘gold bugs’ as it is often suggested in some western media.

The fact that Western central banks continue to hold, consolidate and repatriate gold shows the strategic importance placed on gold by the very entities who issue the currencies we use.

People need to protect themselves from potential economic and monetary crises where existing currencies may be devalued. In the event of serious problems or even the collapse of the unsustainable debt-based international monetary system, an allocation to gold will protect wealth. Both the savings of peasants in India and those of the middle classes and high net worths in the western world.

Separately, this morning the LBMA have said that gold bullion trading in London isn’t likely to move to an exchange because it would increase costs and reduce liquidity, the LBMA told Bloomberg.

The London Bullion Market Association on Monday said it has commissioned Ernst & Young LLP to conduct a study and prepare recommendations on how to develop the market. In the future, there may be more regular transaction reporting and a return of publishing gold forward offered rates and the forward curve, said Ruth Crowell, the association’s chief executive.

The World Gold Council began gathering views from banks and traders, including potentially moving over-the-counter trading to an exchange, three people with knowledge of the matter said in February. Contracts change hands through an exchange in New York, Singapore and Shanghai, while London relies on banks and other companies to manage counterparty risks.

“It is unlikely that the Ernst & Young review will recommend moving the existing business from OTC to an exchange, given a move would increase costs for OTC clients and diminish liquidity,” Crowell said by phone on Monday. “We have also had a lot of changes happening in the market. Recently, the market has needed a lot more from the LBMA …”.

Important guides to storage in Singapore and Switzerland:

Essential Guide to Storing Gold In Singapore

Essential Guide to Storing Gold In Switzerland

MARKET UPDATE

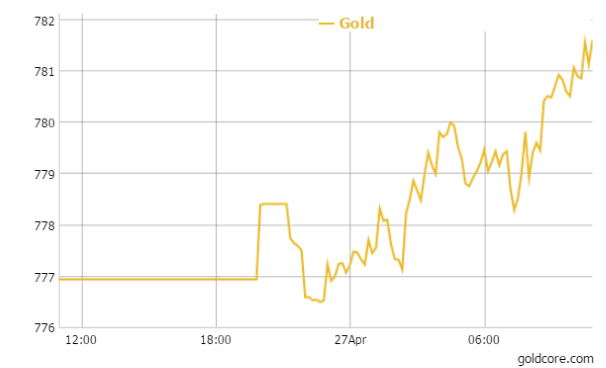

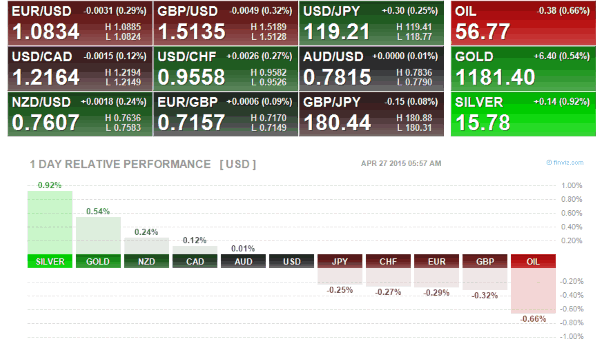

Today’s AM LBMA Gold Price was USD 1,182.75, EUR 1,090.52 and GBP 780.85 per ounce.

Friday’s AM LBMA Gold Price was USD 1,192.15, EUR 1,097.49 and GBP 788.04 per ounce.

Gold fell 1.35 percent or $16.10 and closed at $1,178.60 an ounce Friday, while silver slipped 1.07 percent or $0.17 closing at $15.72 an ounce. Gold and silver both fell for the week – down 2.15 percent and 3.32 percent respectively.

Spot gold in Singapore was up 0.1 percent to $1,180 an ounce by end of day trading and gold continued to eke out meager gains in dollars in London trading – and had better gains in euros and particularly sterling due to UK election jitters.

Gold in GBP – 24 Hours

Investors will be cautious due to the Greek default risk and the U.S. FOMC meeting that begins tomorrow. This has impacted European stock markets this morning which are seeing losses.

Greek bond yields edged higher today as investors reacted to fruitless debt relief talks between eurozone finance ministers on Friday which only served to highlight the gulf between Greece and its creditors.

No deal was reached between the Eurozone finance ministers and Greece after meetings on Friday. On Saturday, Wolfgang Schaeuble hinted that Berlin was preparing for a possible Greek default.

This week local Greek governments are scouring for cash in order to help pay out its pensioners and employees, while households and businesses withdrew 1.3 billion in another run on Greek banks last week.

Germany’s Bild newspaper reported today that Tsipras asked Merkel to convene an emergency European Union leaders’ summit. Yesterday, Bloomberg reported that Greek Prime Minister Alexis Tsipras held a call with German Chancellor Angela Merkel and Eurogroup President Jeroen Dijsselbloem to discuss progress in negotiations, said a government source from Athens.

Greece is still hanging onto its membership in the Eurozone by its fingertips but we are nearing the end of the saga.

Gold in late morning European trading is up 0.30% or $1,183.78 an ounce. Silver is up 0.69 percent at $15.83 an ounce and platinum is also up 0.02 percent at $1,120.00 an ounce.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.