U.S. GDP Economic Growth Flat-Lines, Fed Interest Rate Hike Evaporates

Economics / US Economy Apr 29, 2015 - 09:34 PM GMTBy: John_Rubino

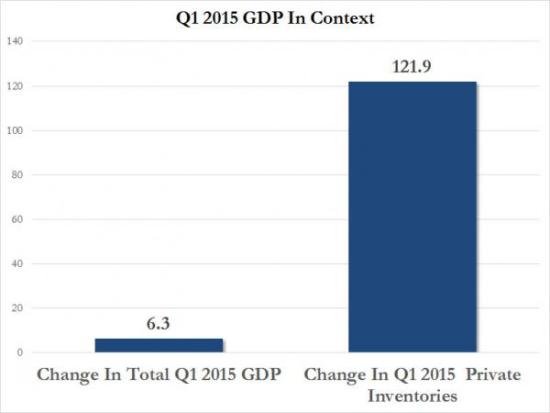

As pretty much everyone is now aware, US Q1 growth was way below expectations. And the only reason it was even marginally positive was because businesses expanded their inventories at a record rate. Here’s a chart from Zero Hedge comparing the economy’s growth with that of inventories:

In other words, if US businesses had just kept inventory levels stable in the first quarter, the economy would have contracted at a 2% rate.

Which once again takes us back to the observation that a strong currency slows down growth by making exports more expensive and therefore harder to sell. Nothing very deep or complicated here, but still apparently beyond the grasp of the economic forecasters who keep expecting an imminent rebound.

Going forward, two things are now virtually certain:

1) That massive inventory build will have to be reversed out in the coming year, which means lower demand for raw materials and, other things being equal, slower growth than would otherwise be the case.

2) The Fed will abandon its (always highly unlikely) promise/threat to raise interest rates in 2015. With growth trending towards zero and national elections coming up, no government in its right mind would tighten monetary policy. So either the dollar falls hard in anticipation (it’s down 1% this morning) or the US takes steps to bring it down.

What to make of all this flailing around? Simply put, the meta-trend towards ever-higher debt and ever less valuable fiat currencies remains in place. Various governments at various times will try to buck this trend, but the results are always and everywhere the same: A rising exchange rate threatens exports, slows growth and forces the errant county back onto the currency war battlefield.

It happened to Switzerland last year and now it’s happening to the US (and via the yuan/dollar peg, China). One more “unexpectedly” weak quarter and we’ll have no choice but to adopt the European negative interest rate, war-on-cash model. American savers will as a result find themselves in an even more uncomfortable spot, either forced to become hedge funds or watch their nest eggs keep shrinking.

By John Rubino

Copyright 2015 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.