Gold and the New U.S. and UK Recession - ZIRP to Continue

Commodities / Gold and Silver 2015 Apr 30, 2015 - 12:35 PM GMTBy: GoldCore

- U.S. first quarter GDP grew 0.2%, down from 2.2% last quarter

- U.S. first quarter GDP grew 0.2%, down from 2.2% last quarter

- U.K. GDP for first quarter was 0.3%, last than half the previous quarter’s figure

- Large inventory build up in the U.S. may mask deep recession

- Zero percent interest policies (ZIRP) to continue despite suggestions to contrary

- Global economy vulnerable to recession and depression

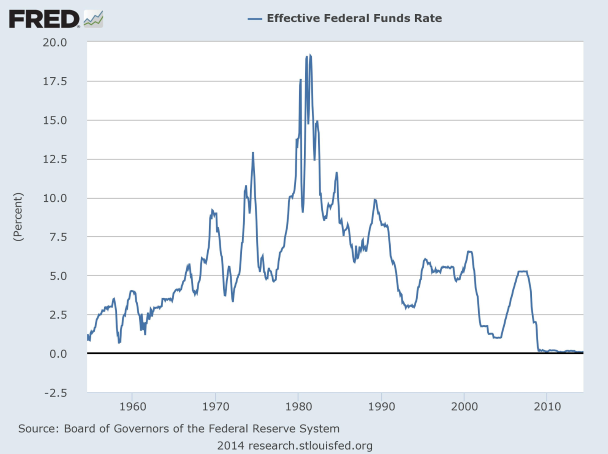

Gold in US Dollars – 5 Years

U.S. and U.K. GDP slowed very sharply in first quarter of 2015. Latest data confirms the rapid slowdown despite stock markets booming in the UK, U.S. and globally.

This highlights the major disconnect between the real economy and a financial sector intoxified by easy money.

U.S. GDP figures fell sharply from last quarter when the economy grew at 2.2%. GDP for the first three months of this year fell to 0.2% with some analysts suggesting the real figure should be in negative territory.

The news of a slowing U.S. economy had a negative impact on sentiment in the export dependent Asian economies and indeed on vulnerable EU economies.

MSCI’s broadest index of Asia-Pacific shares outside Japan fell 1.1 percent with South Korean, Australian, Chinese and Hong Kong shares suffering losses as did European indices.

The abysmal U.S. GDP figure was buoyed by the biggest inventory build in history. GDP grew by $6.3 billion in Q1 2015 whereas unsold inventories increased by a phenomenal $121.9 billion.

The impact of poor weather on Q1 activity has been greatly exaggerated. It appears that the strength of the USD was more important as exports dropped more than 7 percent.

Investment rose 2% driven by inventories and residential investment, the latter up 1.3 percent. Non-residential investment, however, dropped 3.4 percent.

If inventories had remained flat U.S. GDP would have come in at below -2 percent. A massive buildup in private sector inventories added 0.74 percent to the GDP number. Companies kept on stockpiling wares, as the consumption of goods only added 0.05 to GDP. The rest went to inventories, and will eventually have to be sold which is a negative for GDP.

Why does the selling of inventories actually subtract from GDP? The product has already been produced, and if it’s sold, it takes away consumption from products which may have been produced instead. Also, it can only be counted once as a positive, not twice.

Cycles in inventory buildup are normal, but just over the last three years, the United States has racked up $1.1 trillion in inventories, or 6.2 percent of GDP. If the other parts of the economy don’t pick up the slack, the destocking process is likely to be very painful indeed.

However the inventories scenario plays out it is clear that the “recovery” which has not been felt by the “man in the street” and the real economy is now once again on the ropes.

The statement of the Fed’s FOMC meeting which concluded yesterday was notable in that the heretofore panglossian narrative has shifted with acknowledgement that the U.S. labour market is not as robust as previously believed.

Reuter’s quote a Rabobank note to it’s clients,

“All in all, the FOMC statement gave a balanced assessment of the current economic slowdown and the Committee remains very much in a data-dependent mode. However, the balanced and cautious tone in the statement is a far cry from the optimism and (over) confidence that we have seen in previous statements.”

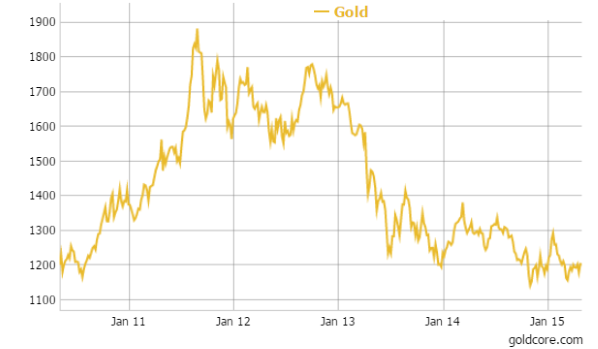

It would appear that the much anticipated hike in interest rates will not occur in June.

As Bloomberg reports,

“Traders have set back bets for when U.S. policy makers will raise borrowing costs as officials such as Atlanta Fed President Dennis Lockhart and Fed Bank of Boston President Eric Rosengren said this month policy should stay accommodative.”

In the same period U.K. GDP fell by almost half to 0.3%. The figures, which some think will impact the Tories coming less than two weeks before the general election.

Chancellor for the Exchequer, George Osborne tried desperately to make the most of the news, stating that it was “good news” that the economy continued to grow adding, “This is a critical moment and a reminder you can’t take recovery for granted.”

Given growing weakness in the U.S., UK and especially Chinese economies, not too mention many very vulnerable EU economies, there is the continuing risk of a major recession on the horizon. Indeed given debt levels are higher today than in 2008 there is the risk of a global depression.

In this environment, it is very likely that ZIRP and NIRP and the ongoing debasement of paper and electronic currencies will continue.

Physical gold will hold up well in such an environment due to its traditional function as a store of value.

Important Guide: 7 Key Gold Storage Must Haves

MARKET UPDATE

Today’s AM LBMA Gold Price was USD 1,204.30, EUR 1,075.99 and GBP 779.73 per ounce.

Yesterday’s AM LBMA Gold Price was USD 1,204.80, EUR 1,095.45 and GBP 783.99 per ounce.

Gold fell 0.68 percent or $8.20 and closed at $1,204.00 an ounce yesterday, while silver slipped 0.48 percent or $0.08 closing at $16.53 an ounce.

Gold in US Dollars – 5 Years

In Asia overnight, Singapore gold prices traded flat at $1,204.20 an ounce near the end of day trading and gold is marginally lower in late morning trading in London.

Gold capped losses from after the Fed statement which did not mention dates for an interest rate hike, but rather stressed the importance of economic data and viewed the recent U.S. economic slowdown as transitory.

The U.S. GDP grew 0.2 percent in the first quarter of this year, well below the expected 1.0 percent and down from 2.2 percent in the fourth quarter of last year. More U.S. employment data is released today.

In late morning trading in Europe gold is off 0.12 percent at $1,203.10 an ounce. Silver is up 0.05 percent at $16.56 an ounce while platinum is down 0.17 percent at $1,148.50 an ounce.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.