Crude Oil Price Bear Market Is Over

Commodities / Crude Oil May 02, 2015 - 12:44 PM GMTBy: Austin_Galt

I've said it before and I'll say it again. Forget about testing the 2009 lows. It ain't gonna happen. Not as far as I'm concerned anyway. The final low appears to be in place and while I think the downtrend is over I suspect the volatility is not.

I've said it before and I'll say it again. Forget about testing the 2009 lows. It ain't gonna happen. Not as far as I'm concerned anyway. The final low appears to be in place and while I think the downtrend is over I suspect the volatility is not.

Let's check out the technicals beginning with the small picture and then finishing with the big picture outlook.

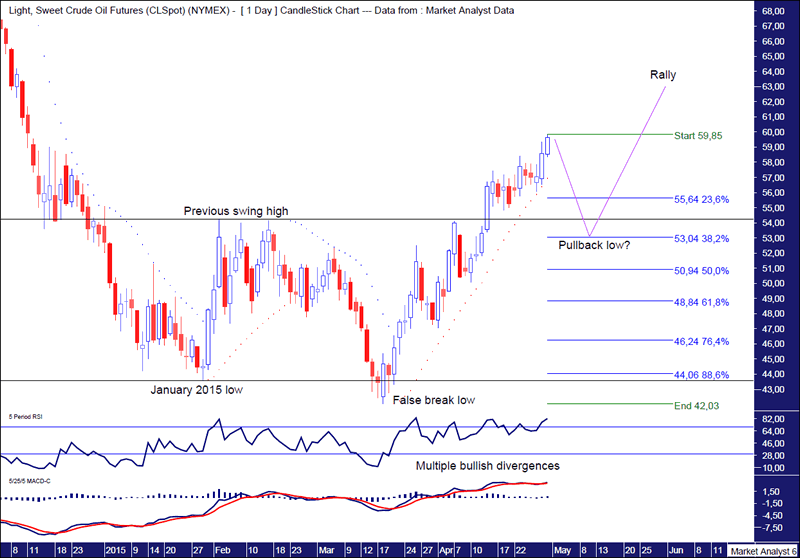

OIL Daily Chart

We can see the recent low at US$42.03 was a false break low of the previous swing low set in January 2015. While this low was lower than originally expected, the low was nonetheless identified the day it took place.

The low was accompanied by multiple bullish divergences in both the RSI and MACD indicators. Nice.

Price has subsequently rallied impulsively from there. The first pullback threw me a bit into thinking another low was on the cards but that was put paid to immediately with price resuming upwards. Price has now busted out above the previous swing high and thus the downtrend has been broken. I favour a move down in early May that finds support around this previous swing high level which stands at US$54.24 and is denoted by the upper horizontal line.

The PSAR is still bullish with the dots underneath price but it is looking long in the tooth and I think a short term pullback is imminent.

I have added Fibonacci retracement levels of the move up from recent low and while price may trade a bit higher I would think it is only marginal and not enough to overly affect this analysis. I expect price to find support around the previous swing high and perhaps push a bit lower as it gives this support level a good test. The 38.2% level at US$53.04 is just below this level and looks like an ideal place for price to turn back up. Price finding support at this level also keeps the uptrend in a strong position and it certainly looks strong to my eye.

Let's now skip to the monthly chart.

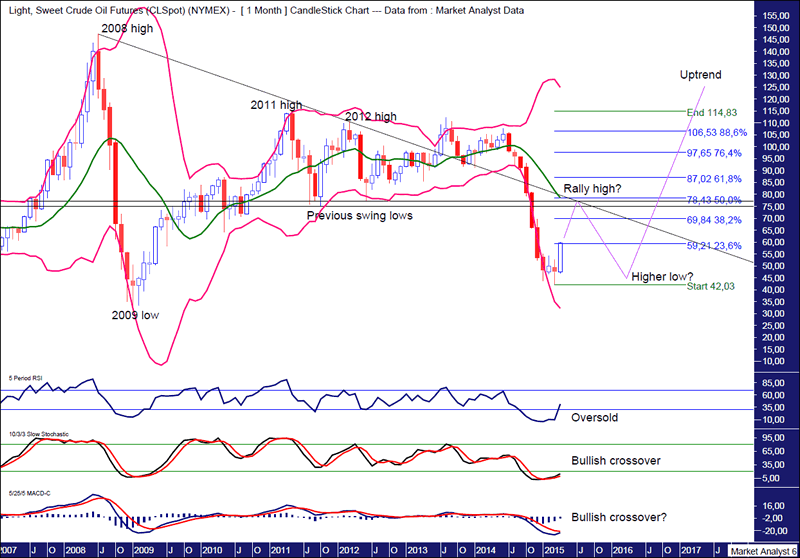

OIL Monthly Chart

The RSI made an extremely low reading of 5.81 at the January low before making a little bullish divergence at the March low. While I generally like to see a more solid bullish divergence, oil makes a habit of price highs and lows being accompanied by outlier readings such as we saw at the 2009 low.

The Stochastic indicator has just made a bullish crossover while the MACD indicator looks to be threatening one.

The Bollinger Bands show price has left the lower band and now looks headed to the middle band. I favour price finding resistance at this middle band and heading back down to test the low.

I have drawn two horizontal lines denoting previous swing lows and I expect the rally to find resistance around these levels and then head back down to test the low. These levels stand at US$74.95 and US$77.28.

I have drawn a downtrend line connecting the 2008 and 2012 highs and I favour price finding resistance the first time it hits this trend line. This downtrend line looks to intersect the previous swing low levels around July this year.

Also, I have added Fibonacci retracement levels of the move down from 2011 high to recent low and I favour the rally high to be around the 50% level at US$78.43. Perhaps price will fall just short of there. Let's see.

Once the rally high is in place I expect a move back down to test the recent low which holds and hence puts in a higher low. From there a big uptrend should ensue.

Let's wrap it up Voodoo style with the yearly chart.

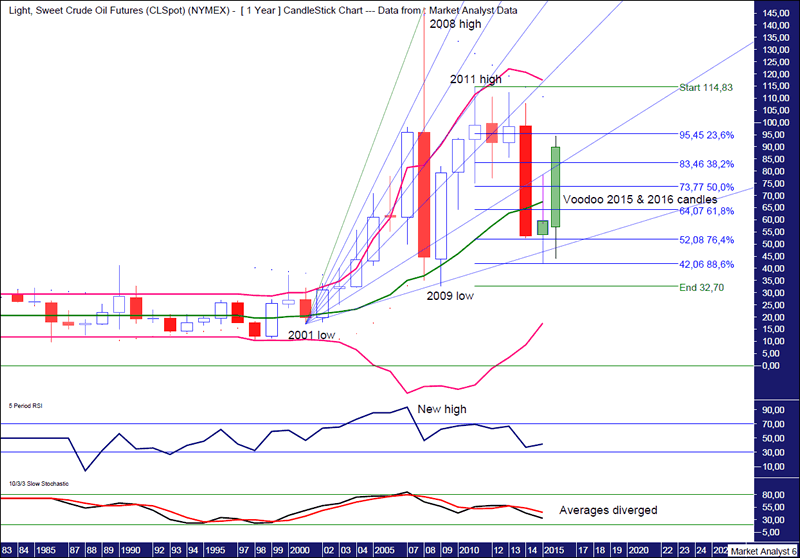

OIL Yearly Chart

The RSI showed a new high reading at the 2008 high which leads me to believe price will eventually make new all time highs in the future that are likely accompanied by weaker RSI readings signifying bearish divergences.

The Stochastic indicator still has a bearish bias but the averages have diverged quite a bit so price turning back up here would be of no surprise.

The Bollinger Bands show price giving the support from the middle band a thorough workout. Price has dipped quite a bit under the middle band and any lower would likely see price go forth to the lower band which would mean price taking out the 2009 low. It is my firm belief that won't happen.

The PSAR indicator has a bearish bias but I expect price to rally over the next few years and bust that resistance.

I have added Fibonacci retracement levels of the move up from 2009 low to 2011 high and the recent low at US$42.03 was right at the 88.6% level. Price often likes to take things to the limit and this is certainly the case here.

I have also drawn a Fibonacci Fan from the 2001 low to 2008 high which has shown some nice symmetry with price. The 2009 low was at support from the 88.6% angle, the 2011 high was at resistance from the 50% angle while the recent low was once again at support from the 88.6% angle.

I have drawn Voodoo style the candles for 2015 and 2016 as I expect to see them. The 2015 candle shows price trading up further this year to a high around the 76.4% Fibonacci Fan angle and just above the 50% Fibonacci retracement level at US$73.77. Then price comes back down and closes the year marginally positive and leaving a big wick in place. The 2016 candle shows price testing the 2015 low before heading back up impulsively as the new bull trend starts to kick into gear.

So while we can forget about testing the 2009 low at US$32.70, we can expect a test of this year's low next year. That's how I see it anyway!

By Austin Galt

Austin Galt is The Voodoo Analyst. I have studied charts for over 20 years and am currently a private trader. Several years ago I worked as a licensed advisor with a well known Australian stock broker. While there was an abundance of fundamental analysts, there seemed to be a dearth of technical analysts. My aim here is to provide my view of technical analysis that is both intriguing and misunderstood by many. I like to refer to it as the black magic of stock market analysis.

Email - info@thevoodooanalyst.com

© 2015 Copyright The Voodoo Analyst - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Austin Galt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.