Gold And Silver - Thieving Bankers Operate In Open; Public Have Eyes Wide Shut

Commodities / Gold and Silver 2015 May 02, 2015 - 03:07 PM GMTBy: Michael_Noonan

Who are the bankers? There are those known, doing a lot of dirty work, and there are those unknown, operating totally behind the scenes controlling everything, doing even dirtier work. What does that mean, controlling everything? How about the world's money supply, creating it, deciding who gets what and how it is to be spent.

Who are the bankers? There are those known, doing a lot of dirty work, and there are those unknown, operating totally behind the scenes controlling everything, doing even dirtier work. What does that mean, controlling everything? How about the world's money supply, creating it, deciding who gets what and how it is to be spent.

How has a lot of the money been spent? Acquiring politicians, which means controlling governments and the political partied that make up governments. Bankers have paid for and gained control of the entire pharmaceutical industry, the AMA [American Medical Association], all of the huge Agri-business, controlling the like of Monsanto and GMOs. Bankers control the entire media industry, everything you watch on TV, hear on the radio, read in the newspapers and magazines, control over everything they want you to hear and read. The entire educational system is run by the government. Everything is done under the watchful eyes of the bankers. Nothing gets done without their approval.

No where is there any oversight. Nowhere does the rule of law apply, unless you happen to be in traffic court or have committed a crime, but for the bankers, no one in the Obama Administration has been able to uncover any crimes.

What about control of your finances?

Social Security is being postponed to age 67. Corporate pensions are being phased out. All retirement accounts, 401ks, IRAs, etc, are to be targeted by the government in an eventual takeover, for your own good, of course, and your retirement holdings will be placed into worthless government bonds that will off some kind of "guaranteed return" on "investment." But there will be no guarantee your investment will ever be returned with any kind of value.

Retirees are being wiped out with zero interest returns, thanks to a broken banking system that needs zero interest rates because no government can afford to repay the interest. Better to kill off retirees and the pensions and insurance industry that rely upon fixed income returns. Without interest returns, pensions and insurance companies are being forced to acquire junk corporate/government bonds at much higher risk but at least with an empty promise interest rate.

Next in line is a ban on cash. Several European countries have already placed heavy restrictions on the use of cash:

◾Italy made cash transactions over €1,000 illegal;

◾Switzerland has proposed banning cash payments in excess of 100,000 francs;

◾Russia banned cash transactions over $10,000;

◾Spain banned cash transactions over €2,500;

◾Mexico made cash payments of more than 200,000 pesos illegal;

◾Uruguay banned cash transactions over $5,000; and

◾France made cash transactions over €1,000 illegal, down from the previous limit of €3,000.

Why move in this direction? The bankers dislike the privacy of transactions that cash allows. This begs the question nobody is asking, since when is it up to the banking industry to determine who can use cash and how much? Cash is now being equated with terrorism-funded activity, laundering of drug money, etc. Guess which is the biggest terrorist organization that also makes billions from laundering drug money every year?

If you said the US federal government, that would be the number one answer.

Going cashless, one would become dependent upon digital currencies found only in banks.

Banks will be able to monitor how you spend every dime, where it goes, from where it comes. Welcome to my [tax]web said the IRS spiderman. George Orwell was well ahead of his time, and even he underestimated the extent of how pervasive government has become, and it is far from over.

"Knock-knock," on your door. "FBI." "We see you have been buying gold and silver." "Both are now determined to be illegal, and we will take them from you, or you face jail." Of course, this is just a made-up scenario. It could not happen here.[?]

Where is the opposition by the people? When people do oppose, think of Occupy Wall Street [OWS], what happens to those who oppose? Whatever happened to OWS? Oh, yes, the militarized police forces had them forcefully removed, maced, and/or jailed into submission.

Have you noticed how more and more the local police are becoming so heavily armed and militarized, against guess who, the people. The population is being forced to accept martial law environment. Operation Jade Helm 15 is going into effect, this summer. What is Operation Jade Helm? A massive military drill across nine states where armed and ready combat troops will be conducting drills on how to control the population "just in case" civil unrest or revolution arises.

Still thinking about putting off the buying and holding of physical gold and/or silver? Or are you just assuming you will be able to buy it whenever you choose, at some point in the future? In a cashless society, both may become illegal to buy. Is it worth taking the risk? If it were to become illegal to own, there will be early warning signs of what is to come.

For instance? You want to buy gold and silver? Give up your name, address, bank account number. Wait. That is already in place.

What do you mean you paid cash? Can you prove where you got the cash? If not, it may be assumed it comes from some unlawful activity, and you must surrender any remaining cash, along with your silver and gold purchases.

Just a few ideas worth considering, not that any will ever happen in this country.

We are seeing a few headlines where silver is getting ready for a huge bull market. Really? Let's look at the charts, first.

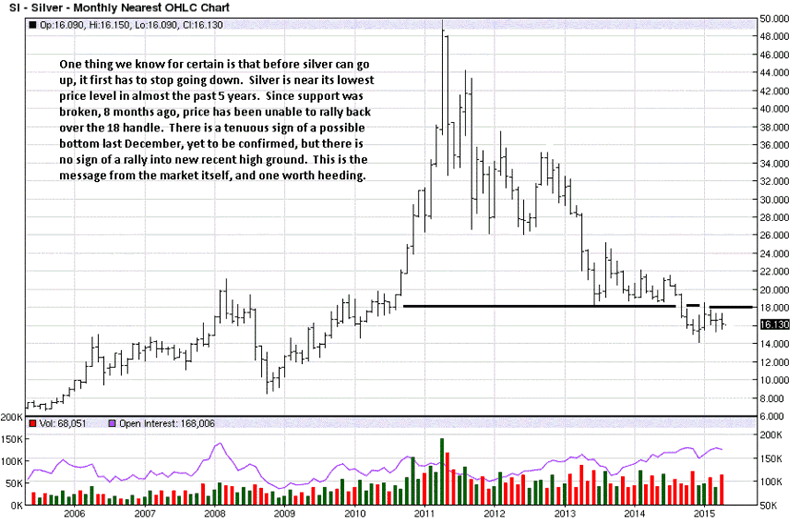

Silver is trading at a loose support level in that it has not moved under the December low. That low is where the last low occurred in February 2010 before the unabated rally up to the 50 level. April's close was about where the middle of the TR is, so little can be gleaned more than the fact that the trend remains down.

Silver Monthly Chart

The Axis Line at the 18.40 level, previous support now resistance, is the first most important hurdle that could signal a change in trend. For now, it remains a waiting game to see how much longer the bankers can control the suppression of price.

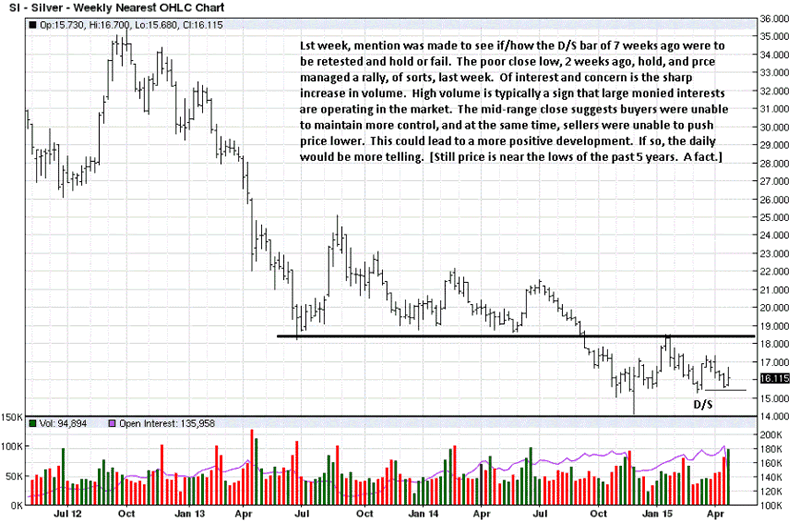

Silver Weekly Chart

Given Thursday's assault to push price lower, silver responded well, under the circumstances. The fact that price rallied off the low shows buyers offering some degree of support. Friday made no further upside progress, but the close was near the high of the range, indicating buyers were relatively more active than sellers.

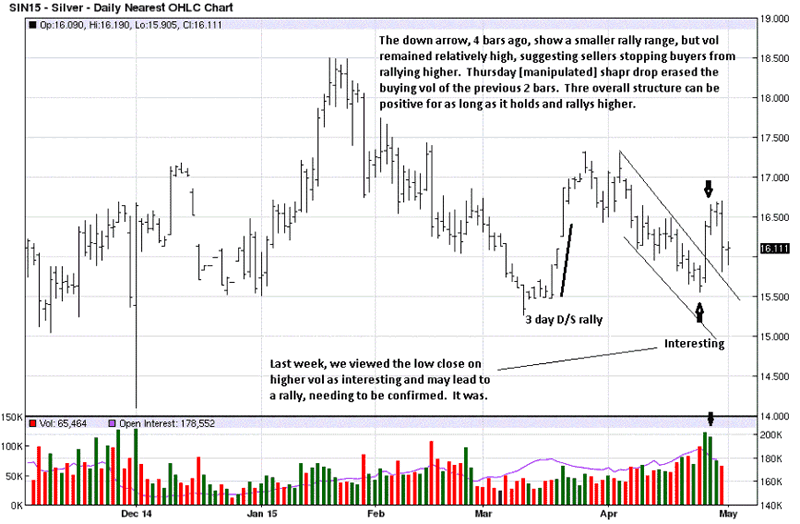

Silver Daily Chart

Price continues to move farther along the RHS of the TR [Right Hand Side]. which is where a final resolve will occur. So far, there are no signs it is ready to move higher.

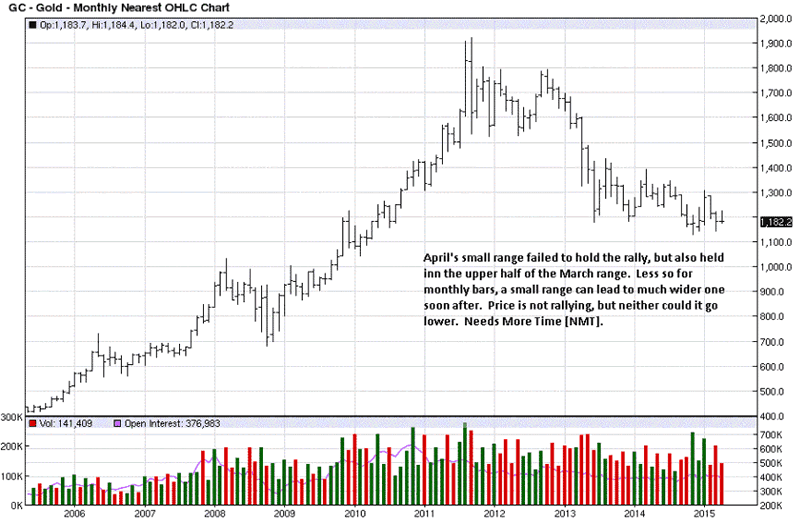

Gold Monthly Chart

Since the March swing low, gold has moved sideways in overlapping bars, a sign of balance between buyers and sellers. The past two weeks were low range closing bars, but no downside follow-through. In a weak market, the onus is always on buyers, [still absent].

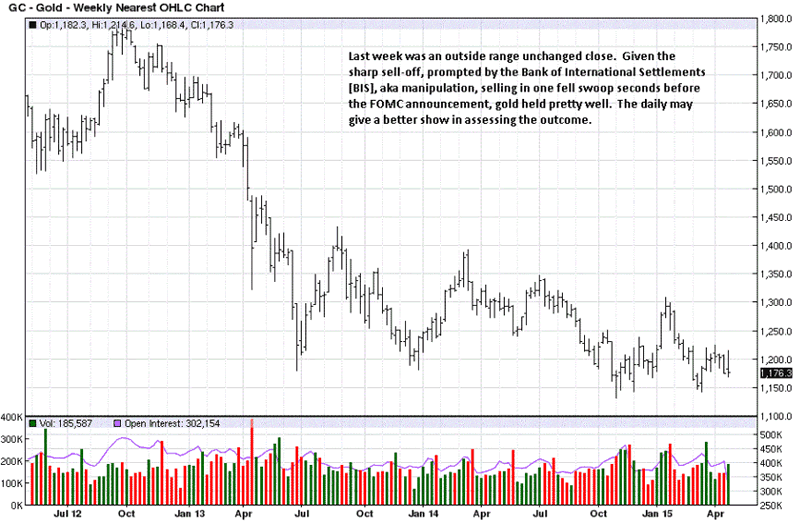

Gold Weekly Chart

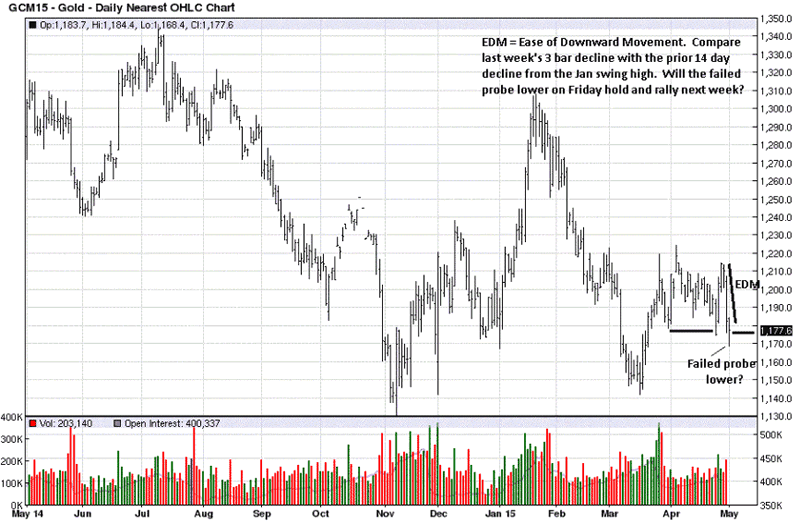

Ostensibly, the three day EDM [Ease of Downward Movement] looks like price may continue lower, next week. Friday's probe lower did not attract additional selling, and that could start to offset the EDM decline. Not much else going on.

Gold Daily Chart

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2015 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.