Let's Make Silver Shine Even Brighter Than Gold

Commodities / Gold and Silver 2015 May 04, 2015 - 03:29 PM GMTBy: Money_Morning

Tom Gentile writes: In the world of precious metals, silver is considered the "Poor Man's Gold."

Tom Gentile writes: In the world of precious metals, silver is considered the "Poor Man's Gold."

Anyone who believes this nonsense will stay away from investing in silver for all the wrong reasons.

With the S&P 500 pushing resistance once again at 2,100, perhaps it's time to visit the land of the contrarian trader, for as the saying goes, as the stock market falls, the precious metals markets rise.

And I am interested in the "Poor Man's Gold" not only because it's priced far less than gold. I'm in it for the type of returns no man, poor or otherwise, can resist…

Novice Traders Mistake Price for Value

Silver and gold are both in the precious metals group, both are used for industrial and cosmetic products, and both have suffered from a drop in price over the last year. For virtually time immemorial, gold has been more expensive than silver. Anyone can tell you this, and most people when asked the question "How can you compare the two?" would answer with "by looking at the difference in price."

Okay, that makes sense. Looking at the chart below, here are recent cash prices of both gold and silver near the end of April:

Spot gold closed near $1,200 an ounce

Spot silver closed near $16.35 an ounce

The difference in value between the two is clear: $1,183.65 per ounce. Now we can track the difference this way every day, but the problem is that it's always going to look like a high number. The bigger problem is that it's how the novice trader looks at the difference between both metals.

Most novice traders would simply look at a chart of silver and/or gold and make a determination based on price only whether or not it might be time to buy. Based on the chart, both commodities are not only technically cheap, but seem to be hitting support levels for the year.

But which one might have the least downside risk? Is there a way outside of conventional thinking to come to an answer to this question?

Indeed, there is, and I want to get to a trade opportunity based on my way of viewing the data…

Here's How We'll Find Silver's "Golden" Payout

Let's take a different approach. Since we already know gold is much more valuable than silver, let's look at how many ounces of silver it takes to equal an ounce of gold.

The calculation goes like this: $1,200 (price of 1 ounce of gold) / $16.35 (price of 1 ounce of silver) = $73.39. That's the number of ounces of silver needed to equal 1 ounce of gold. We call this the Gold/Silver Ratio.

What's so special about this calculation?

Well, by looking at history, we can see the fluctuations of how many ounces of silver it takes to equal an ounce of gold, thereby giving us an idea of how cheap or expensive the two are when comparing them to each other.

The chart you see now reflects this ratio for the last 10 years.

Back in 2008, the ratio spiked to 80, showing that you needed 80 ounces of silver for each ounce of gold. In 2011 however, that ratio dropped to near 30.

With the markets rising, and both metals falling, silver has taken a beating, falling at much greater percentages than gold, thereby increasing the ratio to near 10-year highs. What does this tell me?

Well, if I am bullish on metals for the long term, I want to give silver more interest. If the ratio between gold and silver were to narrow, it could only be caused by gold dropping in percentage terms more than silver, or if silver were to rise faster in percentage terms than gold.

If I am bullish silver, then I should suspect either of these to happen, giving me a better reward to risk trading opportunity than by being long gold at this time.

With this in mind, here's what we are going to do…

SLV: A Silver Lining to Profit

When looking for an alternative to buying the physical asset, traders turn to gold and silver exchange-traded funds (ETFs). They represent the physical asset, but in share format.

The problem with ETFs is that the management fees and contango (a market phenomenon that eats away at value over time) can decay their value slowly. If there were only a way of being able to take a long-term position on silver, getting it below cost at these historical lows…

There is: iShares Silver Trust (ETF) (NYSE: SLV).

Selling Puts… Safely

Now, I am not a fan of naked puts – those are options where you don't own the underlying stock already, and they can lead to big losses. I have seen too many people get wild-eyed selling puts on stocks, only to see the stock drop hard, and their money follow. Selling a put obligates the seller to purchase the underlying asset at the agreed upon price. For that, the seller receives a premium – essentially, a fee. Put sellers essentially provide a form of insurance to put buyers against declines in their stock.

Most of the time I avoid these like the plague, but there are exceptions… and ETFs on commodities are my exception.

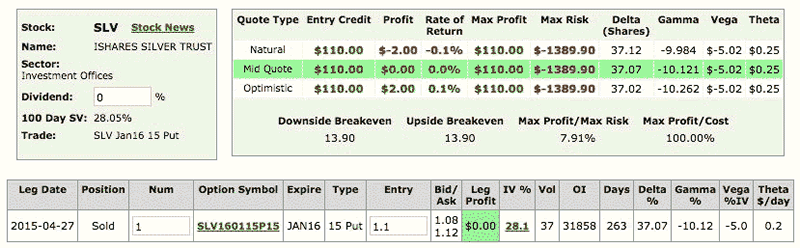

Let's take a look at a case study involving a long-term SLV put sale, and the risks and rewards around it.

First things first – do not take this type of strategy UNLESS you want to own the underlying stock at the strike price, because there is a possibility that could happen.

That being said, look at the above graphic. The buyer of the put we sold has the right to sell SLV at 15 should he or she decide to exercise that right. Now in this case, why am I smiling?

Honestly, this is where I want to buy it… why? It's historically low, that's why! And by selling puts at this level, I am standing in line to buy at 15… and getting paid to do so.

Remember, the buyer pays me a premium, in this case $1.10 or a nearly 8% premium that I collect if SLV doesn't go back to 15. What if it does? That's fine, my cost is actually $13.90 when you factor in what I am getting paid!

Once again, not a strategy I employ often, but if you're bullish on silver, this could be a golden opportunity…

Good Trading,

Tom

Source :http://moneymorning.com/2015/05/04/lets-make-silver-shine-even-brighter-than-gold/

Money Morning/The Money Map Report

©2015 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.