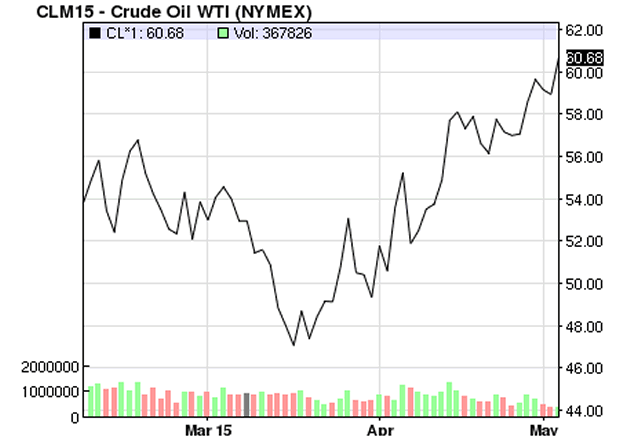

Crude Oil Price Hit 2015 High

Commodities / Crude Oil May 07, 2015 - 10:47 AM GMTBy: EconMatters

Oil hit 2015 high with WTI at $60.40 and Bent at $68.40 end of trading on Tuesday. Crude prices have now risen 50% in just over three months. The overall oil market sentiment is very bullish as CNBC reported hedge funds and money managers raised bets on rising Brent prices to another record, data showed on Monday, pushing net long positions to their highest since official exchange records began in 2011.

Domestic oil inventory has increase almost 21% to 490.90 million barrels as of last week from 406.70 million barrels in January when it hit an 80-year high. The strength in oil is supported mostly by geopolitical news such as:

- Yemen conflict. Reuters reported on Wednesday, witnesses said planes from a Saudi Arabia-led coalition struck Yemeni towns overnight.

- In Libya, protests have stopped crude flow to the eastern port of Zueitina.

- Pentagon announced US Navy warships have begun escorting British commercial cargo vessels through the Strait of Hormuz after Iran seized a Marshall Islands-flagged vessel last week.

The bottom line is the fundamental supply and demand situation has not changed that significantly to warrant a 50% run-up in oil. Our view is that the current price level could be sufficient to incentivize oil frackers to start up production (we highlighted the 4,700 'fracklog' wells in the U.S. below in our earlier post), which could again upset the potential oil market self-balancing already in the works. In addition, we do not expect OPEC to come to the rescue to the U.S. Shale by cutting their output in the June meeting either.

Last night API said overall U.S. stocks fell by 1.5 million barrels while stocks at Cushing, Oklahoma fell by 336,000 barrels. The official inventory report will be released later on Wednesday, which we expect would confirm a similar trend observed in the API survey. We think this only suggests a sign of the starting point to work off the oil inventory buildup, but does not change the short to mid term oil market fundamentals, i.e. over-supply + weak demand. The higher oil bulls drive the prices, the worse another crash would be without the fundamental support.

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2014 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

EconMatters Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.