Is Bitcoin Price in Bullish Territory?

Currencies / Bitcoin May 08, 2015 - 04:50 PM GMTBy: Mike_McAra

In short: no speculative positions.

In short: no speculative positions.

The first Bitcoin has become the first U.S. entity to be regulated by banking laws, we read on CNBC:

A New York City-based bitcoin exchange itBit has become the first to receive a charter under New York banking laws. (…)

ItBit is a commercial exchange that trades the virtual currency. Thursday's announcement makes it the first company to receive a charter from the New York State Department of Financial Services (NYDFS).

(…)

ItBit CEO, Chad Cascarilla said in an interview with CNBC's "Squawk Alley" on Thursday, that the charter will allow the company to operate in all 50 states as a regulated entity.

"It moves us to a standard of care and allows us to operate with customers that's totally different from where anyone is currently," he said.

The company also announced the itBit Trust Co. that will provide full asset protection and FDIC insurance.

This is important news. Maybe not news that will propel Bitcoin into mass adoption, but this definitely is a sign that Bitcoin exchanges are making the move to become regulated. The effect will not be token since regulated entities offer customers advantages, one of which is the most discussed deposit insurance. The basic idea here is that the deposits taken by regulated exchanges would be effectively guaranteed by the government, at least to some extent. This is in sharp contrast with deposits at unregulated entities. Just think “Mt. Gox” and all that may happen with not insured funds.

The flipside will be the transaction costs – it remains to be seen what kind of cost levels regulated entities will have. On the one hand, costs of running a regulated exchange might be higher than for not regulated ones. On the other, customers might be willing to pay more for the increased security. We will see what kind of level of costs crystalizes once more regulated Bitcoin exchanges enter the space.

For now, let’s focus on the charts.

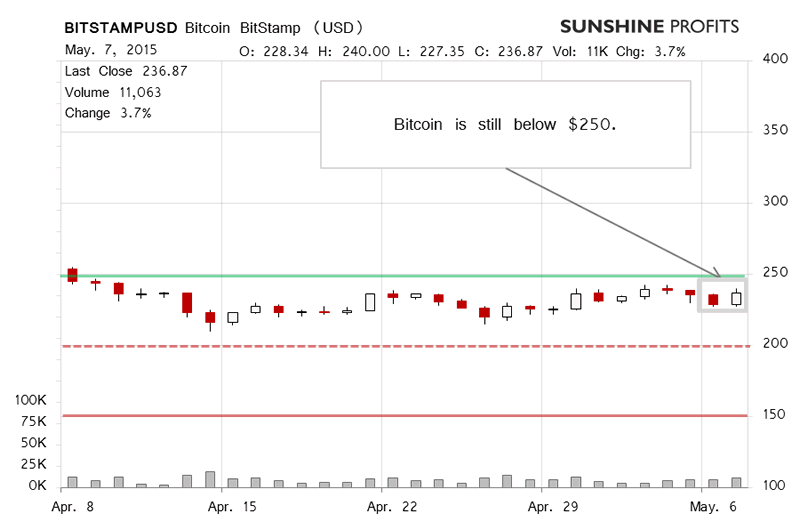

On BitStamp, we saw a relatively violent rebound to the upside yesterday. It erased the Wednesday’s depreciation. The volume was also elevated, albeit not really huge. While yesterday’s move was visible, it didn’t really bring Bitcoin above $250 (green line in the chart). Did the move change anything in the short-term outlook?

We think it didn’t. Yes, the situation is slightly more bullish now but only on the surface. The volume accompanying the move was not particularly significant, the appreciation didn’t at any time go above $250, and Bitcoin didn’t seem to start a next big move. Consequently, the remarks we made yesterday are still up to date:

(…) Yes, we’ve seen appreciation today, and yes, the volume might be higher at the end of the day than it was yesterday but we have to remember that yesterday’s and today’s moves are not really strong fluctuations. It looks more like a storm in a teacup but does this action suggest that there’s more volatility to come? It might but it doesn’t seem like the move has started just now.

Since yesterday’s action was not really volatile like a strong swing, we don’t view yesterday’s action as the beginning of a new big move.

Today we have seen a move potentially confirming the points made above (this is written around 10:30 a.m. ET, so the day is not over yet, mind). Bitcoin has remained largely flat and the volume has been lower than yesterday. This might be an indication that the buying power is drying up and that Bitcoin might start moving in line with its general trend which is down.

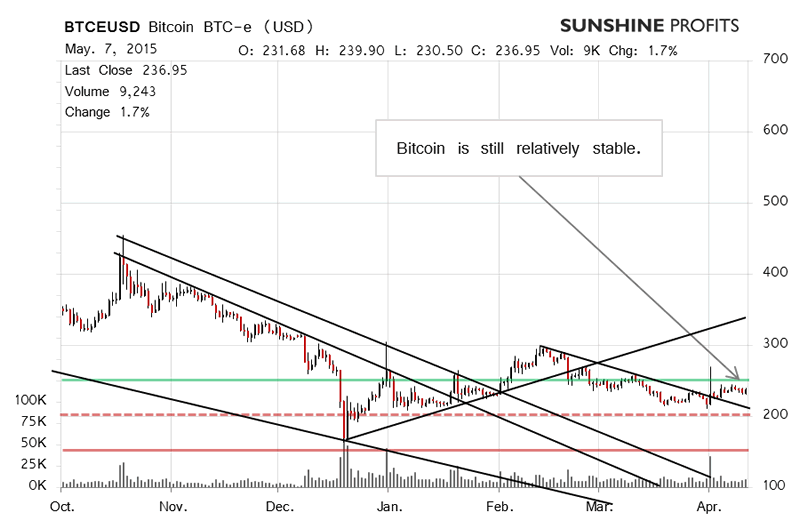

On the long-term BTC-e chart, Bitcoin is still above a possible recent declining trend line but below $250. At first sight, a possible breakout above the declining line might look like an indication of more action to the upside but bear in mind that $250 is not far away and it might stop any move up. Right now, it seems that we might still see some appreciation but it might run its course pretty soon. In this sense, our yesterday’s comments are still valid:

(…) While we can’t actually rule out a possibility of a move up, the current environment looks more bearish than it might seem at first sight. Our best bet now would be on Bitcoin returning to the possible declining trend line rather than launching yet another move up. The fact that the currency has stayed above the line so far makes us cautious, however, and this is why we’d rather wait for additional confirmation before opening hypothetical short positions.

Consequently, we are of the opinion that we might see a selling opportunity in the coming days/weeks but this is not the case just now.

Summing up, we don’t support any speculative positions at the moment.

Trading position (short-term, our opinion): no positions.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Mike McAra Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.