Gold Price Nearing An Important Pivot Point

Commodities / Gold and Silver 2015 May 11, 2015 - 08:38 AM GMTBy: GoldSilverWorlds

In this article, we show gold’s developing story in 7 amazing charts. As usual, we look at gold from different angles. If anything, it becomes clear that the precious metals market is nearing a pivot point. We cannot be sure in which direction this will resolve, we can only keep on monitoring the developments in the weeks and months ahead until we see a trend. Based on our analysis, we are quite convinced that a new trend in precious metals will arise in the next few months.

In this article, we show gold’s developing story in 7 amazing charts. As usual, we look at gold from different angles. If anything, it becomes clear that the precious metals market is nearing a pivot point. We cannot be sure in which direction this will resolve, we can only keep on monitoring the developments in the weeks and months ahead until we see a trend. Based on our analysis, we are quite convinced that a new trend in precious metals will arise in the next few months.

Chart-wise, gold looks like a cooking pressure, not in terms of price or momentum, but in terms of its chart pattern. The recent sideways action can go on for a while longer, but the descending triangle formation on the chart is reaching its apex. In our own words: we are nearing a make-or-break level.

Besides, the US dollar broke above critical resistance, and is currently in the process of testing it.

The dollar on a higher timeframe (i.e, the monthly chart) puts the recent rally in perspective. The greenback broke through a 30-year trendline, which is being tested again “as we speak.” This has the potential to become truly pivotal for markets around the world, not only for precious metals.

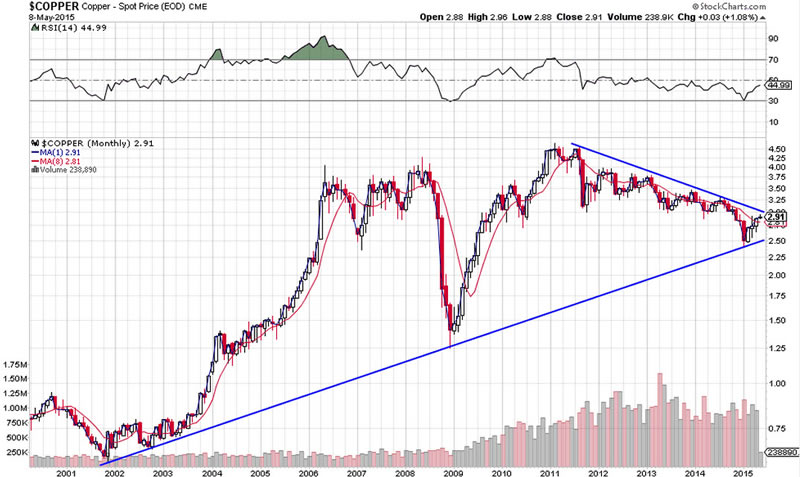

Dr. Copper, the barometer of the world’s economic health, is also about to reach the apex of a mega-triangle that has been developing for more than a decade. Soon we will know more about the true state of the global economy.

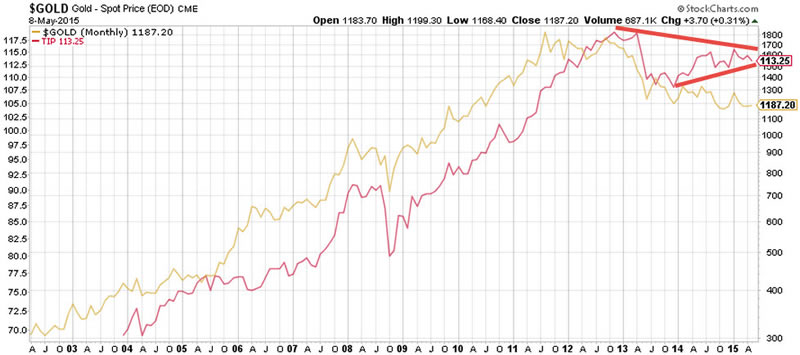

Inflation expectations, the key driver for gold’s price in the last decade, has shown a divergence with the yellow metal for 1.5 year now. Inflation expectations are also nearing a breakout or breakdown point as seen on the chart (red line, red triangle). Note the divergence between gold and inflation expectations on the chart, which is not yet providing a clue about the future direction. The only observation on this chart is a rising level of inflation expectations as evidenced by the higher highs of the red line since 2013.

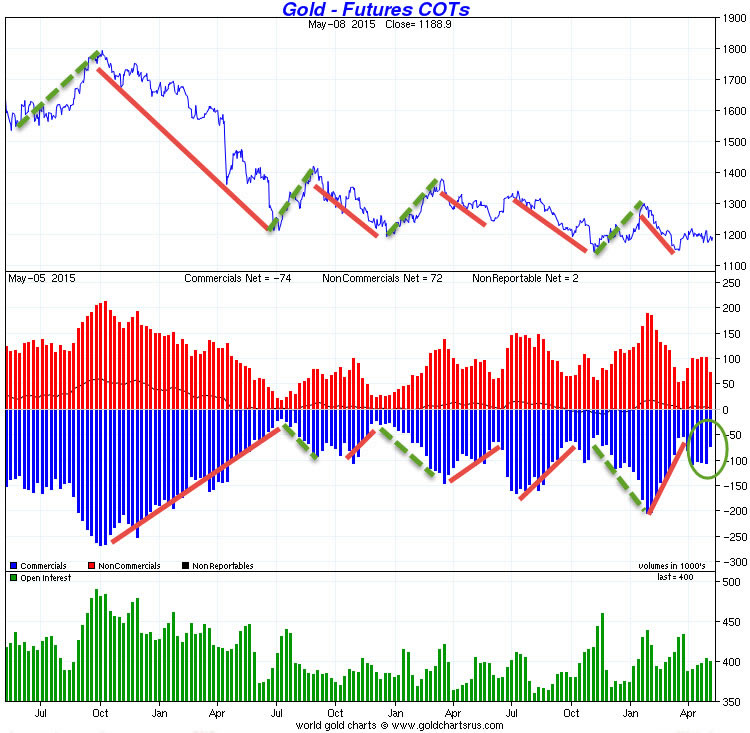

Shorter term, we see a positive development in the COMEX market since last week. The rate of change of short positions of commercials in the COMEX gold/silver market is one of the key indicators we follow. Next to that, extreme futures positions signal a short term trend change. Taking those two indicators together, it appears that gold is very close to another extremely low level of short positions by commercials, which is a bullish situation. The rate of change of those positions will be key to understand the shorter term price movement.

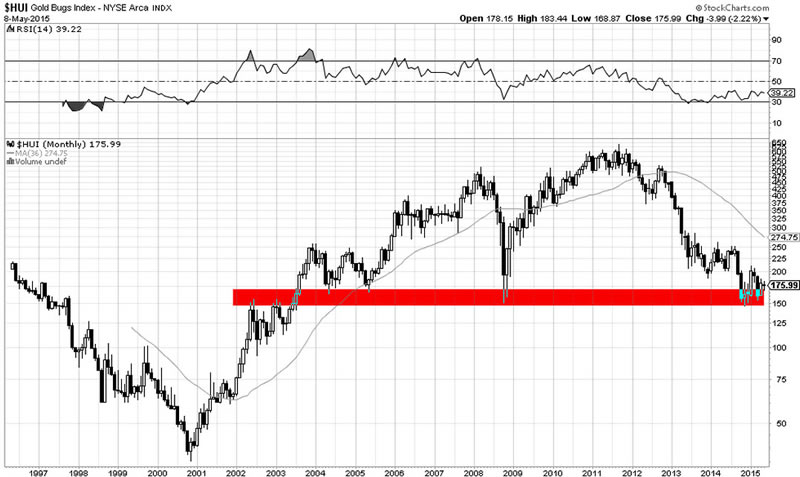

Last but not least, gold and silver miners are consolidating near their structural support level which dates back to 2002. This is another make or break level in the precious metals complex.

Conclusion

It is close to impossible to forecast the coming direction in precious metals. What we do know, however, is that it will only take a couple of months before a new trend will arise. We will continue monitoring our set of charts and indicators for any relevant signal, and update our subscribers accordingly.

Gold bulls should hope for an improving global economy. Although it sounds very counterintuitive that the economy could improve in a world with a global currency war and ultra lose monetary policies, we want to reiterate that gold is performing best in an inflationary environment.

Meantime, while markets are working, it is recommended to prepare your potential positions. In case gold will break out you should be positioned in the gold mining complex. To that end, we suggest consulting our Gold & Silver Report, featuring the best miners with highest risk/reward upside potential!

Source - http://goldsilverworlds.com/

© 2015 Copyright goldsilverworlds - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.