The US Leads All Other Countries In Citizen Defection

Politics / US Politics May 11, 2015 - 05:40 PM GMTBy: Jeff_Berwick

When it comes to extortion, or as they call it, income tax, the places where you want to be a citizen are colored green on the following map. Those countries have no income tax on individuals. The next best countries to be a citizen of, but not live in (as per the Permanent Traveller/Prior Taxpayer - PT Theory) are the ones shaded in blue. Those countries will charge you income tax if you are a citizen of that country AND also residing there... but if you are not residing there they will not charge you income tax.

When it comes to extortion, or as they call it, income tax, the places where you want to be a citizen are colored green on the following map. Those countries have no income tax on individuals. The next best countries to be a citizen of, but not live in (as per the Permanent Traveller/Prior Taxpayer - PT Theory) are the ones shaded in blue. Those countries will charge you income tax if you are a citizen of that country AND also residing there... but if you are not residing there they will not charge you income tax.

There are only two countries on the entire planet that have the gall to charge you income tax if you are citizen, no matter where you may happen to live in the world.

Those two countries are shaded in pink. They are Eritrea and the US.

.png)

There is one big difference between being a citizen of Eritrea or a citizen of the US, however. Eritrea doesn't have a massive Internal Revenue Service (IRS) that can and will track you down anywhere in the world to enforce their tax laws.

So, in that sense, the worst country in the world to be a citizen of, for tax reasons, is the US.

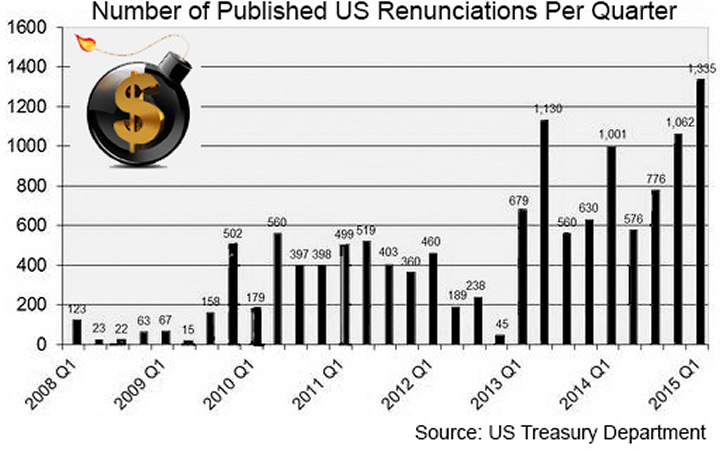

And, for this reason, the US now leads all countries in terms of defections and renunciations of citizenship.

WE'RE NUMBER ONE! WE'RE NUMBER ONE!

A record 1,335 people were listed as renouncing their US citizenship in the latest quarterly disclosure from the Treasury Department, released on Thursday. The new figure puts 2015 on pace to exceed the total of 3,415 renunciations in 2014, which was itself a record. That was up 14% from 2,999 individuals in 2013, the previous record.

That makes the US the #1 country in the world in terms of citizens giving up their citizenship. No other country comes close and certainly not for the same reasons. The closest is Singapore, which averages about 1,200 renunciations per year. But, the grand majority of Singapore renunciations are due to its disallowance of dual-citizenship. So, if a Singaporean citizen wishes to move and become a citizen of another country they have to, by law, renounce their citizenship.

In the US, the grand majority of renunciations aren't because people are forced to renounce by law. Those who renounce in the US are mostly trying to escape the most brutal extortion (taxation) racket in the world.

And, as the US devolves further into becoming a third world fasco-communist police state people are heading for the exit in droves.

The writing has been on the wall for a while as the US government began to realize that people were trying to escape.

In 1996, trying to stem the flow of people fleeing the country, the US changed its immigration law to include a provision to "name and shame" renunciants.

Then, in 2008, Congress enacted the Heroes Earnings Assistance and Relief Act that imposes a penalty—an "exit tax" or expatriation tax—on certain people who give up their US citizenship or long-term permanent residence. Effective June 2008, US citizens who renounce their citizenship are subject under certain circumstances to an expatriation tax, which is meant to extract from the expatriate taxes that would have been paid had they remained a citizen.

Since, all manner of legislation has been considered to stop the bleeding.

In 2012, Congress tried to pass the Ex-PATRIOT Act which was a proposed United States federal law to raise taxes and impose entry bans on certain former citizens and departing permanent residents. The law would automatically classify all people who lost citizenship or permanent residence in the decade prior to the law's passage or any future year as having "tax avoidance intent" if they met certain asset or tax liability thresholds or had failed to file any required federal tax forms within the preceding five years.

People determined to have "tax avoidance intent", referred to in the text of the law as specified expatriates, would be affected in two ways. First, they would have to pay 30% capital gains tax on any US property sold after the law's enactment. Second, they would be barred from re-entry into the US either under immigrant or non-immigrant categories.

Since then, in 2014, the "fee" to renounce US citizenship was raised from $450 to $2,350.

All of these efforts had the intention of slowing the amount of people defecting from the US. As usual, however, they had the opposite effect as people realized just how desperate the US government was getting in trying to stop people from leaving and the number of people renouncing their US citizenship increased dramatically.

GET OUT WHILE YOU CAN

The trajectory is clear. The US government continues to go into more and more debt... and as they grasp for as much of their own citizens assets as possible they will continue to enact more barriers for those trying to escape.

It used to be that people from communist countries like the Soviet Union would defect to the US to escape their oppressive government. That's all changed now as more people defect from the US than any other place in the world as the US federal government seems hell-bent on mixing all the worst parts of fascism and socialism/communism into one.

Our recommendation is just to get out of the US while you still can. That isn't an easy thing to do but it is nowhere near as hard as most people think.

At The Dollar Vigilante (TDV) we have seen this coming for years and have put together an entire resource for those looking to escape the USSA (including ways to internationalize your assets and get foreign citizenship/passports). And, it isn't just the USSA, either. Things are getting worse across the Western world and we have no doubt that much of Europe, Canada, Australia and others will soon enact worldwide taxation systems as well.

Subscribe to TDV for the best information and analysis on how to protect your ass and assets as things continue to devolve. And they will.

Thoughts? Join us at TDV Blog!

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2015 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.