Debt Bomb - Big Volatility Shakes Bond Market Investors

Interest-Rates / US Bonds May 13, 2015 - 03:33 PM GMTBy: EWI

Is the debt bomb about to go off?

Is the debt bomb about to go off?

Editor's note: You'll find the text version of the story below the video.

The yields on U.S. Treasuries and European sovereign debt have risen sharply in a relative short time.

Bond prices trend inversely to yields -- which means debt portfolios have suffered substantial losses.

From mid-April through May 6, yield on German 10-year bunds spiked 47 basis points. Yields on 10-year U.S. Treasuries jumped 29 basis points in just the past week.

Volatility in the bond market continued on May 7. In just a few hours, the yield on the 10-year bund jumped 21 basis points before pulling back. Bear in mind that sovereign bond yields rarely move more than a fraction of one percent in a day.

Long-term bonds have been hit particularly hard. The yield on 30-year U.S. Treasuries topped 3% for the first time this year.

"We've been hurt," said [an] investment manager at Aberdeen Asset Management. "The movements of recent days have been extremely unusual ... ." (Financial Times, May 7)

German government debt is regarded as a benchmark for European assets.

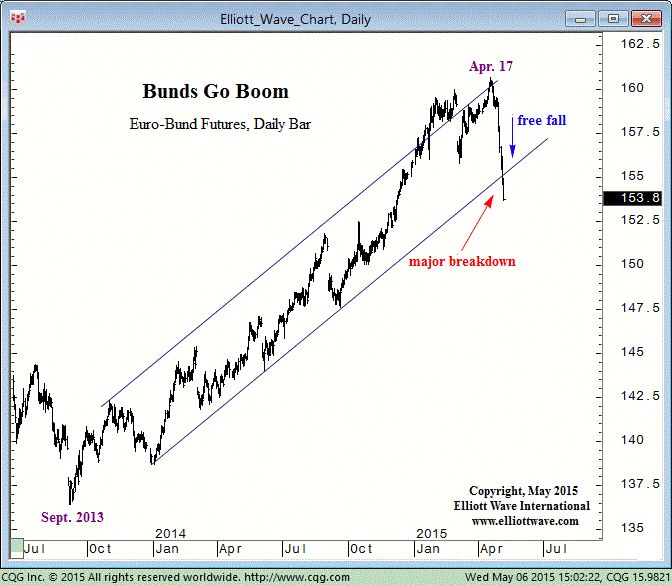

Take a look at this chart of Euro-Bund futures from our May 6 Financial Forecast Short Term Update:

Similar to the credit crisis in 2007-2009, the rout is starting in the bond market, where the pace of evaporating liquidity is quickening. Bids are pulled, prices crack, yields rise and it leaks out toward other asset classes. The turn in bonds in the U.S. and Europe is a sign that the "debt bomb" ... is about to go boom.

The April Elliott Wave Financial Forecast warned subscribers about the insanity that pervades the world's bond markets. Take a look at this chart and commentary:

Many bonds that are perceived to be the safest credit risks guarantee investors a loss. To our knowledge this has never occurred on such a widespread basis in the history of finance. Yields on nearly a third of the euro area's $6 trillion of government bonds are below zero, which means that bond buyers are guaranteed to lose money if they buy these bonds and hold them to maturity.

The risk of widespread defaults also lurks in the world's credit markets.

Here's what well-known hedge fund manager Stanley Drunkenmiller recently said:

Back in 2006/2007, 28% of debt being issued was B-rated. Today 71% of the debt that's been issued in the last two years is B-rated. So, not only have we issued a lot more debt, we're doing so with much [lower standards].

All told, the world's credit markets are on very unstable ground. Expect that ground to get even shakier in the months ahead.

Credit Insanity: The Biggest Debt Bomb in History and the Fuse is LitCreated for paying subscribers and now accessible to the public for the first time, this eye-opening new report reveals the precarious consumer, corporate and government debt situation around the world. Read this three-part report now and hear directly from the top analyst at the world's largest financial forecasting firm about key research, statistics and concerns about U.S. and global debt, as well as its imminent threats to investors. |

This article was syndicated by Elliott Wave International and was originally published under the headline Big Volatility Shakes Bond Investors. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.