Debunking the Newest Crude Oil Price Myth

Commodities / Crude Oil May 13, 2015 - 04:25 PM GMTBy: ...

MoneyMorning.com  Dr. Kent Moors writes: We've seen massive shifts in crude oil prices in recent weeks.

Dr. Kent Moors writes: We've seen massive shifts in crude oil prices in recent weeks.

Of course, this has brought back some rather specious arguments by talking heads on TV and pundits spinning the next Armageddon scenario.

The latest is about how rising oil prices will prompt more volume to come online from a particular type of well (called DUCs), sending oil into another tailspin.

I'll deal with that in a minute, but first let's address those pundits…

Here's the Tale Being Spun by the "Short" Gang

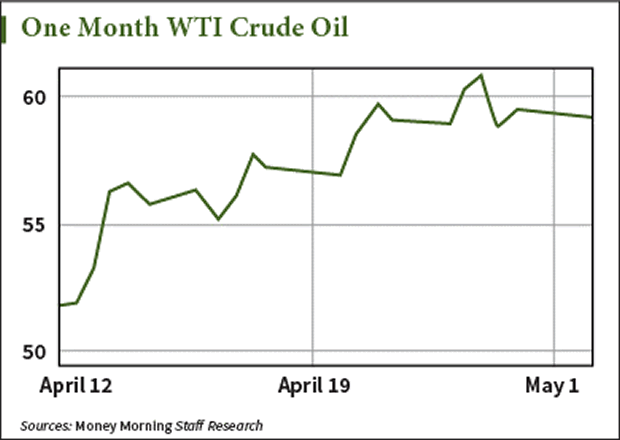

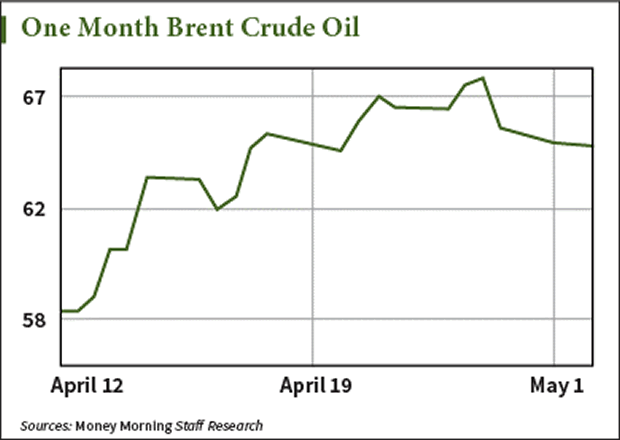

You should take away from recent trading sessions one salient fact. Despite intermittent pauses, we stand today with the pricing floor for oil rising. Both WTI and Brent have been ratcheting upward steadily over the past month.

In mid-afternoon trading yesterday we saw another uptick in both WTI and Brent, moving up – yet again.

I expect some further pullback as traders wrestle with the collision among crude prices, rising interest rates, and the overall strength of the dollar. But one thing is clear. The ratcheting effect I have been talking about – in which oil has an overall trajectory in one direction (in this case up) despite volatility in the other – is taking shape.

But there are analysts who disagree with me, and that's what I want to talk about today.

Let's go. It involves the thousands of wells drilled by U.S. operators which could be quickly turned into completed wells. The reasoning concludes that any protracted rise in oil prices will prompt companies desperate for revenue to complete the wells and drown the market in new volume, thereby sending crude into another tailspin.

Well, I have one word for this bit of creative fiction…

Horsepucky.

Aside from yet another example of why these lost souls need to take a course in Drilling Oil 101… it is simply misinformation masking as analysis.

Companies have always had a program of drilling wells and then completing them later. This type of well is called a DUC (for "Drilled but UnCompleted).

When prices are in excess of $80 a barrel (last summer, for example) and domestic demand is rising, DUCs are of no consequence.

But when concerns emerge about excess production and low pricing levels, when these wells kick in becomes the topic of conversation.

No wonder that the "explain the situation in a 30-second sound bite" crew would latch on to it. Remember, most attempts to persuade you that the price of oil is going down have a sponsored short position just below the surface.

Here's the real two reasons they're wrong.

We're Talking About Just 0.8% of Daily Volume

An analysis of the current state of DUCs indicates those using them to advance a bearish oil outlook may have seriously overstated the problem. Figures tell us the number of U.S. wells drilled over the past three years has averaged about 12,500 a year. At any given time, there are slightly more than 3,500 wells "in preparation."

Yet there are no signals that companies re-drilling more wells with the express purpose of turning them into DUCs are awaiting a further rise in prices. In fact, after surveying some two dozen of the largest American E&P (exploration and production) companies, the analytical team at Bernstein has recently concluded no more than 400 of the wells drilled can be considered DUCs.

Even then, evidence indicates that some of these – perhaps as much as 25% of them – are meant as replacements for already producing but maturing wells. In other words, about 100 of these DUCs are not expected to add a single drop of additional oil to the total production nationwide.

Yet even if there were no replacement wells in the figures, the increase would be marginal at best. Should every one of these wells be completed, comprise new net volume additions, and be put into production at the same time, estimates put the aggregate additional oil coming on the market at no more than 80,000 barrels a day (and that is on the high side of the projections). Such an increase amounts to less than eight-tenths of one percent (0.8%) of total daily American production, easily absorbed by the rising demand.

And even then, all of my industry sources tell me that if their companies had DUCs in their planning cycle, the intention would always be to complete and release the volume slowly through the end of 2016.

Even if there were far more volume available from DUCs, nobody in their right mind would flood the market short term, guaranteeing a decline in profits. That would be the budgetary equivalent of shooting yourself in the foot. Known oil, in place and easily retrievable, is a known (and booked) asset.

But that does not mean it is cheap.

And here is the major reason why DUCs do not pose any significant problem for oil prices.

Well Completion Is a Very Expensive Undertaking

Completing a shale or tight oil well involves running the casing, fracking, moving in the blow out preventer (BOP), and setting up pad wellhead production operations, among other matters.

Click here to read more.

All of that comprises at least 60% of the costs involved in a well. Drilling the hole is the easy (and least expensive) part of the operation. With current horizontal, deep, fracked shale/tight oil wells, the completion part alone runs on average over $3 million in expenses… per DUC.

Average overall expenses for each of these wells now demands a market price of $74 a barrel. That's well above the price likely to exist at least through September. Completing a DUC, unless it is a replacement well (and thereby does not add to the oil in the market), makes no sense. It is expensing a known asset at a loss.

Short of a collapse in the Persian Gulf situation or some similar geopolitical mess, we are not going to see any move to triple-digit oil this year, although the pricing floor will be rising.

The only "ducks" having any impact on oil prices are those found in a "Looney Tunes" view of the world.

Source :http://moneymorning.com/2015/05/13/debunking-the-newest-oil-price-myth/

Money Morning/The Money Map Report

©2015 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.