Bitcoin Price to Slump?

Currencies / Bitcoin May 16, 2015 - 02:24 PM GMTBy: Mike_McAra

In short: no speculative positions.

In short: no speculative positions.

A new fund is being launched in the Bitcoin space, we read on CoinDesk:

A new fund has been launched on equity CrowdFunding platform BnkToTheFuture.com that allows investors to benefit from the growth of the Crypto Currency sector.

The new fund, called Bitcoin Capital will be managed by financial journalist, virtual currency inventor, entrepreneur and investor Max Keiser, and Simon Dixon, an ex-investment banker, investor, entrepreneur and co-founder of Bnk To The Future.

Aimed at investors that want to invest small and large sums into the crypto currency sector, Bitcoin Capital is not only a venture capital fund that aims to invest in the highest growth startups in the Blockchain, Crypto and Bitcoin sector, but the fund also offers investors the ability to accumulate daily dividends paid out in Bitcoin.

Traditionally investing in venture capital is a patient game, taking years for companies to mature and be sold or float on a stock market to offer investors a high risk, high return investment. To combat this, Bitcoin Capital is able to pay investors daily dividends by investing one third of all funds raised into a process called Bitcoin mining. Bitcoin mining involves investing in sophisticated hardware that provides security to the Bitcoin network in return for newly created Bitcoins. Because new Bitcoins are created every ten minutes, Bitcoin Capital is using these newly created Bitcoins to pay investors daily dividends while investors wait for the funds in venture capital investments to mature.

This shows that there is still eagerness to start Bitcoin funds even though the currency has been in a downtrend for over a year. As the fund will invest in startups, this might be less of a concern since the returns to venture capital investment in the Bitcoin space don't have to be directly related to the price of Bitcoin.

It will be also interesting to see whether the proceeds from Bitcoin mining will be in fact attractive to investors as a kind of dividend. This is the first Bitcoin-related fund we know of to combine such unique characteristics - investing in Bitcoin startups and reaping short-term gains (hopefully) from Bitcoin mining. It might also be a sign that other kinds of Bitcoin funds, not only those investing directly in the cryptocurrency are going to emerge in the near future.

For now, let's focus on the charts.

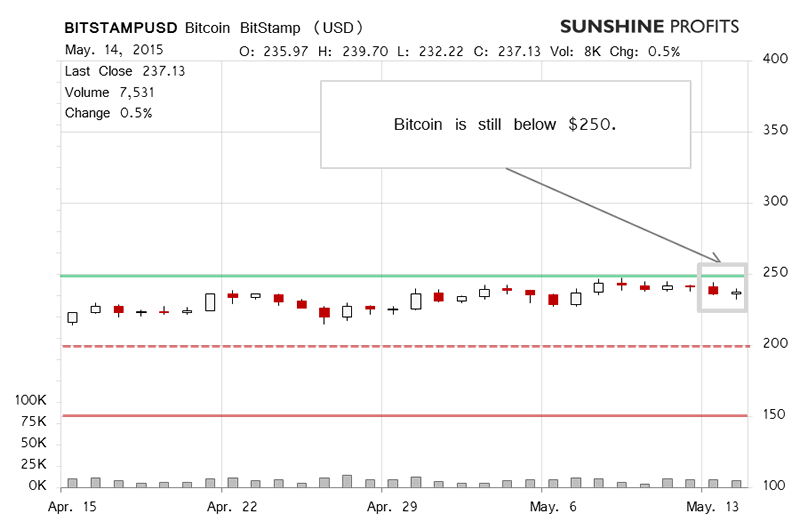

On BitStamp, we didn't see much action yesterday. Bitcoin remained below $250 (green line in the chart), the action was not violent and the volume wasn't really high. Does this mean that Bitcoin has become boring? Not necessarily. Firstly, our comments from yesterday are still up to date:

Even though we saw depreciation yesterday following the publication of our alert, the situation didn't really change much. This was mainly because the price action was not strong enough, in our opinion. Today, we haven't seen very much action (...) and the volume has been relatively weak. Today isn't really supportive of more declines as we haven't really seen a swing to the downside.

Secondly, we haven't really seen much action today (this is written after 11:00 a.m. ET). So, we might expect a downswing but we haven't seen one yet. This makes the situation tense rather than boring.

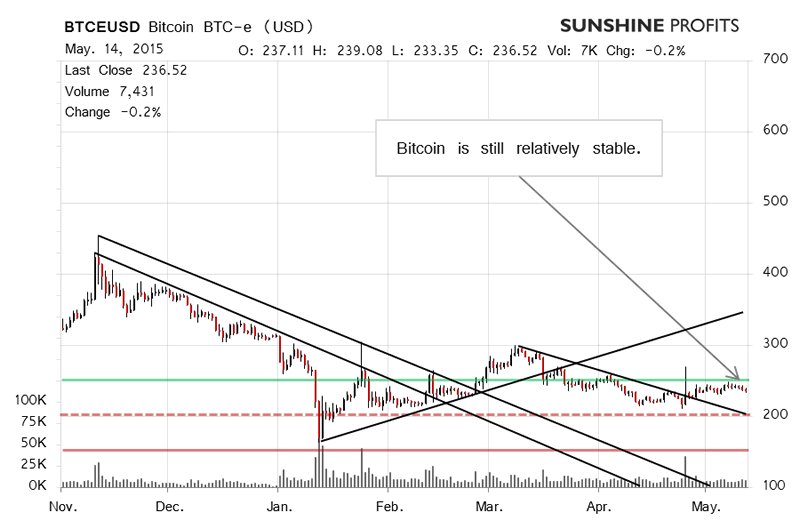

On the long-term BTC-e chart, we see that Bitcoin might be beginning to move down. "Might" is the key word here as we haven't really seen a confirmation of the move being started. Two days ago, we wrote:

(...) We might see a move above $250 and this prevents us from opening hypothetical short positions. The fact that the upside seems limited while the downside looks relatively significant also suggests that long positions might not be the way to go now. In the current environment we would prefer to wait for a move up and a slump or a more decisive sign of depreciation before considering short hypothetical positions.

This is still the case. The short-term outlook is now more bearish than it was yesterday and we are relatively close to a weak confirmation of a move down, but not just there yet. As such, we still are of the opinion that it might be best to wait for an additional confirmation.

Summing up, we don't support any speculative positions at the moment.

Trading position (short-term, our opinion): no positions.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.