U.S. Crude Oil Production Sets New Modern Record

Commodities /

Crude Oil

May 30, 2015 - 06:21 AM GMT

By: EconMatters

EIA Report

EIA Report

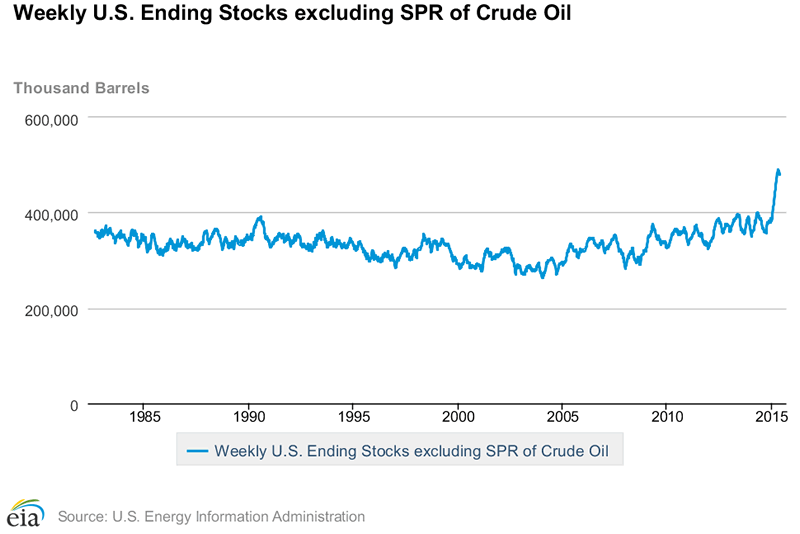

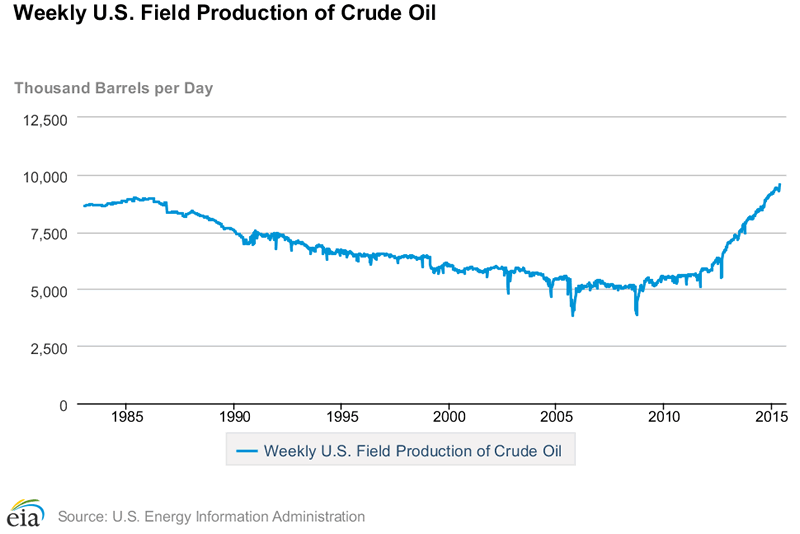

I looked over the weekly Petroleum Inventory Report put out by the EIA today, and the biggest takeaway by far was that U.S. oil production set a new modern era high at 9.566 Million Barrels per day. The last high in U.S. production occurred in March, and it appeared that the U.S. production numbers were getting slightly weaker, and maybe the top in U.S. production was in. But this past week Production really ramped back up with a blowout number, and if it wasn`t for a week in which imports were unusually low for the week, there would have been another huge build in Oil Inventories for the week.

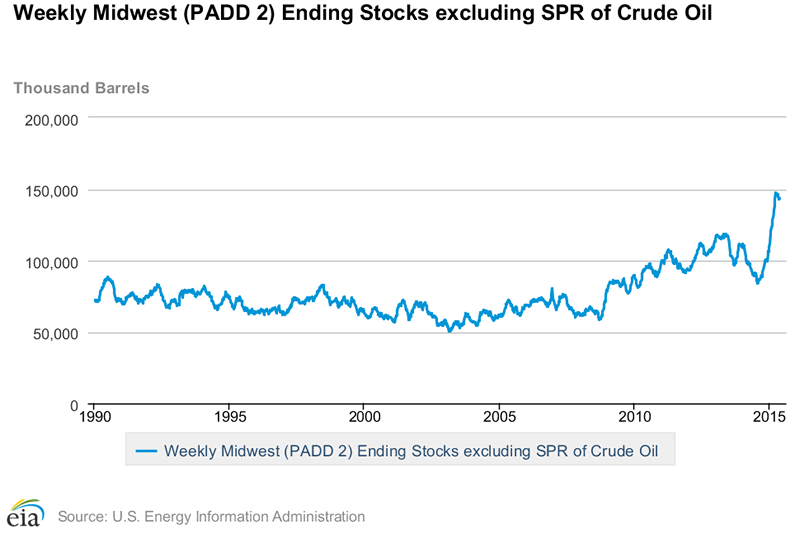

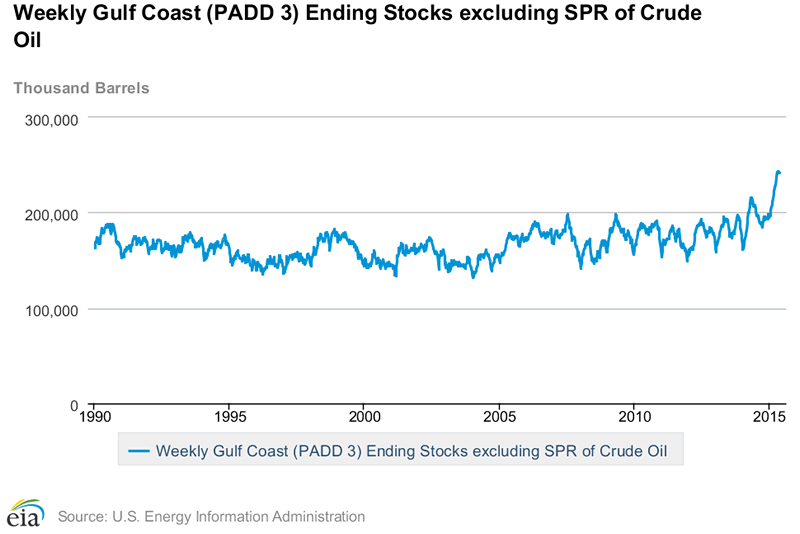

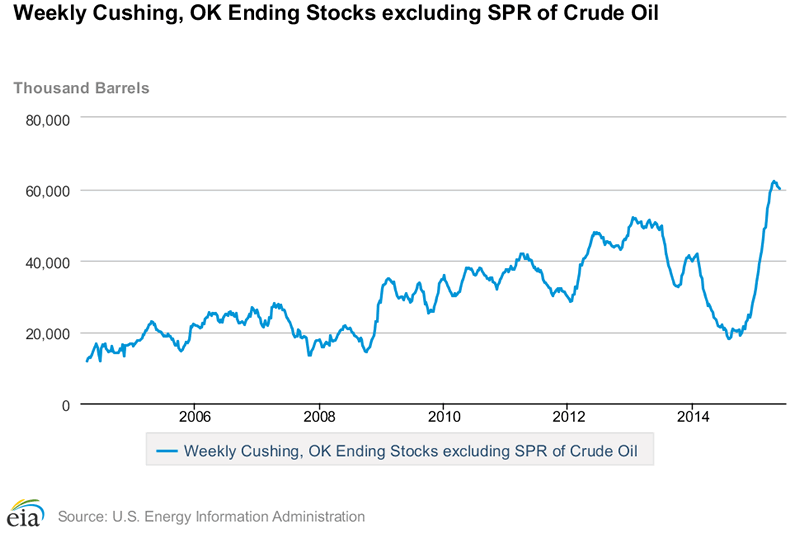

Energy Storage Hubs

Refineries were operating near full capacity on the week cranking out a utilization rate just shy of 94%, which also helped avoid another weekly inventory build in oil supplies. However, Cushing Oklahoma and the Gulf Coast Region barely budged in reducing the oil inventory surplus at those two crucial storage hubs. Cushing Oklahoma still has 60 Million Barrels stuck in storage facilities, while the Gulf Coast has 242 Million Barrels awaiting refinery for end use.

Shale Industry

However, the noteworthy takeaway is that despite a large reduction in drilling rigs, and the lower prices of the last year, U.S. oil production is still going up, and not tapering off at all! So much for the Saudi and OPEC strategy of putting a dent in U.S. oil production by not cutting production and hoping to gain market share for their oil by putting the Shale Industry out of business.

Annual Comparison

For example, a year ago U.S, oil production was 8.472 Million Barrels per day, and now after a market share price war between OPEC and the U.S. producers, the U.S. is producing a record level of Production, a new modern era record since the EIA began tracking this data in 1983 at 9.566 Million Barrels per day. This is an increase of over 1 Million Barrels per day in U.S. oil production in a year`s time, and considering the decline in drilling rigs, this speaks volumes about the increased efficiencies taking place in a lower price and cost environment.

Market Reaction

The oil keeps coming out of the ground at record levels, and throw in OPEC`s record output, and it doesn`t bode well for oil prices the second half of the year once the summer driving season ends and we start the building season all over again in oil inventories! We really are at risk of both the Cushing and Gulf Coast storage hubs reaching their storage limits over the next year, and it will be interesting how the oil market deals with this reality.

By EconMatters

http://www.econmatters.com/

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2014 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

EIA Report

EIA Report