Why Oil’s Price Is Baffling Analysts (but Not Us)

Commodities / Crude Oil Jun 02, 2015 - 05:14 PM GMTBy: ...

MoneyMorning.com  Dr. Kent Moors writes: It sure has been amusing to watch the oil instant experts trying to shove “square peg” explanations into “round hole” price moves this week.

Dr. Kent Moors writes: It sure has been amusing to watch the oil instant experts trying to shove “square peg” explanations into “round hole” price moves this week.

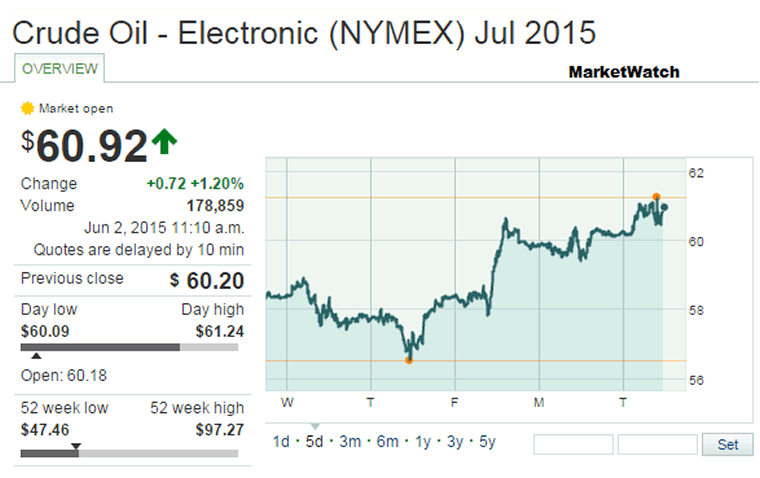

For most of yesterday’s trading session, West Texas Intermediate (WTI) crude oil prices were declining about 1% after a huge 4.5% rise on Friday. Once again, the “experts” had instant prognostications, once again they signaled a familiar refrain – a strong dollar, oversupply – and once again they missed the boat.

When the price rebounded toward the end of the session yesterday to close down only 10 cents a barrel (after rising over $2.60 on Friday), the pundits were true to form. They said nothing.

So why do these analysts keep getting it so wrong?

Well, some of these folks are fronting for short plays now overextended. If they can convince you the sky is falling, then they make money. There is no objectivity from them (whereas I just want you to be well-prepared to make money from any move).

But beyond those with vested interests in oil falling, something else is afoot…

The oil market has actually stabilized.

The Same Old Arguments Are Falling Short

The traditional way the oil market has been analyzed doesn’t seem to be working very well these days. While this must continue to be a supply-and-demand-based view, the normal factors aren’t telling us what they used to.

The “instant read” yesterday had nothing new; rather the continuing mantra singing angst about the value of the dollar and concerns over supply. In other words, same old, same old.

Is there any merit to these arguments? Sure. But it’s limited.

1) A stronger dollar does put some upward restraint on price acceleration because it makes purchases with foreign currency more expensive. Since a barrel of oil is traded in dollars, an increase in the foreign exchange rate for the greenback requires more euros or pounds or yuan to effect a purchase. That effectively moves demand down, all other matters being equal.

The dollar argument has been gaining traction among pundits lately. The speculation today surrounds the likely Greek debt default, a Fed move to raise interest rates at some point later this year, and unexpectedly strong U.S. construction spending. All of these, it is argued, have strengthened the dollar.

Of course, all three of those factors were there last Friday when oil surged.

2) And then there is the speculation surrounding supply. Much of this is hardly new either, but we are now into a “news cycle” focusing on the OPEC meeting next week. Analysts widely expect that there will be no change in production levels at the meeting.

The cartel continues to over produce – well above target and above current anticipated demand – in a move to maintain market share at the expense of non-OPEC producers (read U.S. shale/tight oil operators and Russia here). On both the supply and the demand side the moves are very different from that OPEC has traditionally done in the past.

But once again the OPEC dual move has been part of the oil landscape for almost two months, with a continuation (at least short-term) virtually guaranteed for some time now. Hardly high drama moving into the cartel’s meeting next week.

3) And then there is the “explanation” attempted for what happened Friday. A significant price hike in both New York and London was written off as a reaction to a decline of 13 rigs in U.S. oil and gas production fields.

Thirteen.

There are still 646 in operation, but somehow a reduction of 13 (after one the previous week and declining rig counts for the past seven months) spurred the largest percentage increase of oil prices on both sides of the Atlantic (4.5% in New York, 4.9% for dated Brent, the benchmark set in London)… since the beginning of April for WTI and April 16 for Brent.

Now I am not saying we are breaking out on the up side for some quick move north of $80 a barrel or that volatility in the oil patch is over.

Here’s what I am saying.

This Oil Market Has Stabilized

In the 41 trading sessions between April 1 and close yesterday, WTI has risen 23 times and declined 18. But it has also posted an average daily increase of 30 cents, with 12 sessions posting a rise of over $1 against four posting a decline of over $1. All of this is happening despite the huge recoverable resources available in the U.S. and OPEC producing at levels not seen in years.

This market has stabilized.

It’s not an indicator of a massive upward pressure brewing, but of a solidifying floor and stabilization. We are establishing a base, and that foundation will provide a better overall view of actual demand levels.

There, global demand is once again rising and faster than either OPEC in Vienna or the International Energy Agency (IEA) in Paris had forecasted. But this trend goes unnoticed by commentators still fixated on the situation in the U.S. or Western Europe. The action for some time has been elsewhere.

A Clearer Global Demand Picture Means Upward Pricing Pressure

My current projections point toward a huge push into developing markets and out of the established industrialized nations – which is already underway. It will intensify through at least 2030. This has led to a rising belief among some of my more knowledgeable international colleagues that the current model for determining global demand is increasingly underestimating major demand curves in several regions of the world.

This is likely to provide more accentuated upward short-term pulses in oil prices as the broader market rebalances paper barrels (futures contracts) against wet barrels (actual oil delivered). I have for several years criticized the IEA on this score. But that is a subject for another time.

All of this occurs each day without any genuine ability to handicap geopolitical impacts on oil price. Most of these will put additional pressure on oil to rise, although a breakthrough in the negotiations with Iran or a resolution in the Libyan civil war may prompt concern over new supply entering the market and depress prices.

Nonetheless, we have a slow but tangible upward move underway.

Is there any way this upward move will be overridden?

Sure, U.S. shale producers may decide to commit suicide and turn on the spigots full out, drive down the price of their own oil, drive themselves into insolvency, and turn the oil market back to the Saudis.

But is that likely?

…About as likely – now that a lesson about balancing American production has been learned the hard way – as a 30-second TV sound bite explaining it correctly.

Kent

Source :http://oilandenergyinvestor.com/2015/06/why-oils-price-is-baffling-analysts-but-not-us/

Money Morning/The Money Map Report

©2015 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.