Bitcoin “Total Crypto Breakdown” Highlights Risks To Digital Assets

Currencies / Bitcoin Jun 04, 2015 - 02:11 PM GMTBy: GoldCore

- Bitcoin wallet app Blockchain suffers major security blunder

- Bitcoin wallet app Blockchain suffers major security blunder

– Poor tech sees multiple accounts being created using same address

– Security lapses in electronic and digital currencies not uncommon

– Bitcoin and cryptocurrencies in infancy but are useful tools

– Physical gold offers most secure form of wealth preservation

Blockchain.com, which claims to be the maker of the most popular Bitcoin wallet, suffered at the weekend what the Guardian describes as a “total crypto breakdown”, highlighting once again the vulnerability of electronic and digital currencies to human and technological errors and hacking.

Multiple accounts were created using the same bitcoin address which meant that many users apparently had access to the same pool of funds which led to losses for a few.

The newspaper reports that a “series of bad development choices” in the software “all failed in the worst way possible”. It was operating in the typical “belt and braces” mode where if one line of defence failed another should still be operational.

“Bitcoin wallets are typically created by randomly generating a public address and a related private key. As a result, it is important for address and key to be truly random, or else it may be possible to guess the private key by looking at the public address.”

In the case of Blockchain.com, the random code was generated from two different sources which were then combined. The first was the random number generator on the device on which the app was being installed.

However, some Android phones failed to deliver the code to the blockchain app which meant its random code was generated entirely from the second source. The second source was an online service called random.org.

“But on 4 January, Random.org strengthened the security of its website, requiring all visits to be made over an encrypted connection. The blockchain app, however, continued to access the site through an unencrypted connection. So rather than getting a random number, as expected, it got an error code telling it that the site had moved.”

Blockchain then unwittingly used the same error code in creating the address for multiple users, the devices of whom had failed to produce the first line of random code.

“The magnitude of the error sparked shocked reactions from information security professionals.”

Security lapses in software for managing digital and electronic currencies are by no means uncommon. The constant march forward of technology often means that less attention can be paid to older systems which have not yet become obsolete.

Early last year banking giant JP Morgan was hacked. It had its system hacked and details of 76 million customers were stolen (Cyber Attacks Growing In Frequency – Entire Western Financial System Is Vulnerable). JP Morgan use the “belt and braces” approach of two-factor authentication but in one older overlooked system they were still using a less sophisticated single password system.

In February, we covered the story where Russian cybersecurity firm Kaspersky lab uncovered an international hacking group who had managed to tamper with customers accounts in order to steal possibly up to $1 billion from over 100 banks globally (International Hacking Group Steals $300 Million – Global Digital Banking System Not Secure).

There have been numerous incidences in recent months where strategically vital monetary, financial and infrastructural computer systems have been seen to be very vulnerable to human error and malintent.

We can see the benefits of Bitcoin and cryptocurrencies in the coming years. We are particularly excited about the potential of the Blockchain itself (Blockchain Promises To Be As Disruptive A Technology As The Internet)

Cryptocurrencies are a useful tool which could provide a vital degree of short-term liquidity and means of exchange in the event of capital controls and or a banking or currency collapse.

However, given their non-tangible nature and other risks posed to them, we do not view them as a store of value or a safe haven asset akin to physical gold bullion in your possession or stored in the safest vaults in the world in the safest jurisdictions in the world.

Must Read Guides:

Essential Guide To Storing Gold In Singapore

Essential Guide To Gold Storage In Switzerland

MARKET UPDATE

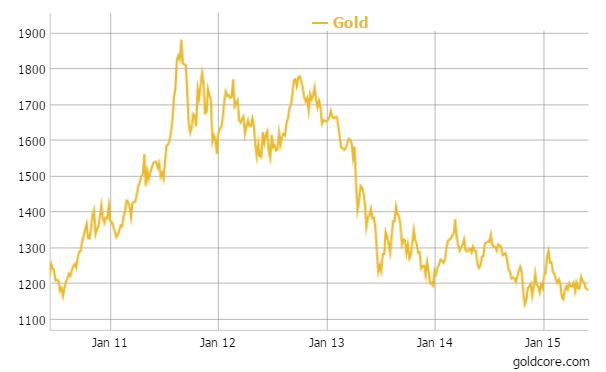

Yesterday’s AM LBMA Gold Price was USD 1,186.60, EUR 1,067.23 and GBP 777.60 per ounce.Today’s AM LBMA Gold Price was USD 1,182.45, EUR 1,041.76 and GBP 766.55 per ounce.

Gold fell $8.10 or 0.68 percent yesterday to $1,185.30 an ounce. Silver slipped $0.25 or 1.49 percent to $16.55 an ounce.

Gold in USD – 5 Years

Gold in Singapore for immediate delivery fell 0.2 percent to $1,182.80 an ounce near the end of the day, while gold in Switzerland edged marginally higher.

Gold stumbled to its lowest in three weeks today despite very mixed U.S. economic data – there is a perception amongst some market participants that the U.S. economy is recovering and a U.S. rate hike will be occur … timing undetermined.

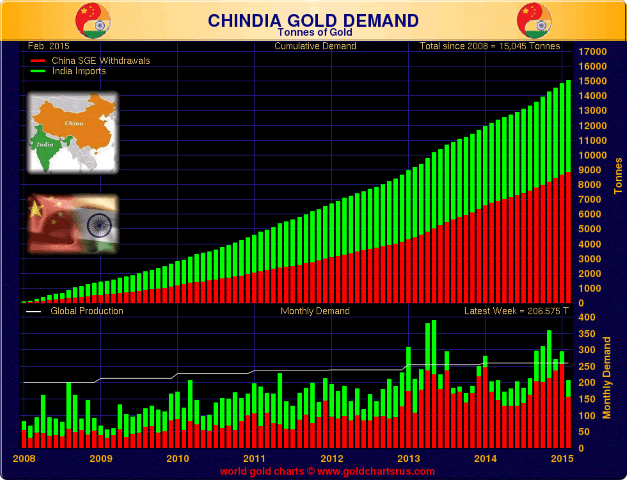

Physical gold demand remains robust in China and India and this is supporting gold near the $1,200 level.

The chart below shows the cumulative gold buying in “Chindia” since 2008. As can be seen gold demand has been and continues to be voracious. Monthly global gold production is shown in the bottom section highlighting the rampant gold demand of Chindia.

U.S. weekly jobless claims are at 12:30 GMT and tomorrow’s nonfarm payrolls figure will be watched.

Gold is moving into the quiet summer months. Demand from Asia remains robust with premiums in China at $1.50-$2 over the global benchmark and SGE withdrawals robust.

Greek Prime Minister Alexis Tsipras said a deal with creditors was “within sight” after he stepped out of talks with senior EU officials in Brussels. Tsipras said that they would make the IMF payment on Friday.

This has taken some of the safe haven appeal out of gold bullion and moved money into other assets as market participants see a Grexit as less of a threat. Although stock markets today are sharply lower suggesting jitters on bond markets are spreading to equities.

In late European trading gold is down 0.27 percent at $1,182.40 an ounce. Silver is off 0.17 percent at $16.47 an ounce, while platinum is up 0.17 percent at $1,105.55 an ounce.

This update can be found on the GoldCore blog here.

Stephen Flood

Chief Executive Officer

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.