Americans “Looted” Nazi Gold – Reminder of Gold’s Role in Times of Crisis

Commodities / Gold and Silver 2015 Jun 10, 2015 - 04:04 PM GMTBy: GoldCore

- Documents uncovered in Washington show American’s seized Nazi gold in last days of war

- Documents uncovered in Washington show American’s seized Nazi gold in last days of war

- Himmler stashed emergency fund of gold and currencies in post office of small Eastern town to protect from bombing of Berlin

- Loot quickly shipped to Frankfurt where trail ends

- Story shows strategic importance of gold in times of crisis

In the last days of the Second World War American troops uncovered a large stash of gold, silver and paper currencies at the post office of a small town in eastern Germany called Plauen. Documents show that the stash was directly linked to SS chief Heinrich Himmler.

The Americans seized the town on 16th April 1945. Documents uncovered in Washington by German historian Peter Heintje show that eleven days later a convoy left the town for Frankfurt.

Apparently the post office of the small town was also a secret branch of the Reichsbank. As the bombing raids on Berlin intensified in 1944 Himmler arranged for the stash to be secreted in the quiet eastern town.

Hitler’s Nazis had looted gold throughout Europe. Indeed we featured the frightening but compelling video which details the plundering of Austrian, Czech, Polish and other national gold reserves and the theft of German and European citizens, especially Jewish people’s gold, for the German Reichsbank back in 2008 – see video here.

On 26th April, 1945, a post office employee was interrogated. “He spoke of a safe in the post office building. In it were 900 kilos of gold mainly in the form of coins, 70 kilos of silver and cash found, ” Heintje told German press.

The key to the safe was not available and so US engineers broke into it with explosives. The bullion was stashed in 35 sacks. The hoard also included one million Swiss francs and 151,560 Norwegian kroner and 98,450 Dutch guilders. The fund would be valued at 32 million euros today.

Only one day transpired between the discovery and accessing the safe and its hurried shipment to Frankfurt. This was because Plauen was in the zone which was to come under Russian control at the end of the war as agreed at the Yalta conference.

Apparently the stash remained in Frankfurt for some time but no documents were found that show its final destination. It is believed that it was shipped to the U.S. as war reparations and likely ended up in Fort Knox or the New York Federal Reserve.

The story is a reminder of the extremely important role gold plays in times of crisis and chaos. Himmler’s stash was predominantly made up of gold and silver bullion as opposed to paper currencies.

The U.S. also placed great importance on gold and it was partly due to its enormous gold hoard that it was able to have the dollar placed on an equal footing with gold at the Bretton Woods conference in July 1944.

With so many factors gravitating towards potential global financial stability and potential chaos today it Is prudent for investors and savers to own and have a healthy allocation to physical gold as financial insurance.

Must Read Guide: 7 Key Gold Must Haves

MARKET UPDATE

Today’s AM LBMA Gold Price was USD 1,186.00, EUR 1,049.19 and GBP 767.86 per ounce.

Yesterday’s AM LBMA Gold Price was USD 1,181.00, EUR 1,046.75 and GBP 772.40 per ounce.

Gold climbed $2.50 or 0.21 percent yesterday to $1,176.50 an ounce. Silver slipped $0.04 or 0.25 percent to $15.98 an ounce.

Gold climbed for its second consecutive day as European stock markets dipped, commodities strengthened and the U.S. dollar pulled back.

Gold in Singapore for immediate delivery was up 0.3 percent at $1,176.88 an ounce near the end of the day, while gold in Switzerland was flat.

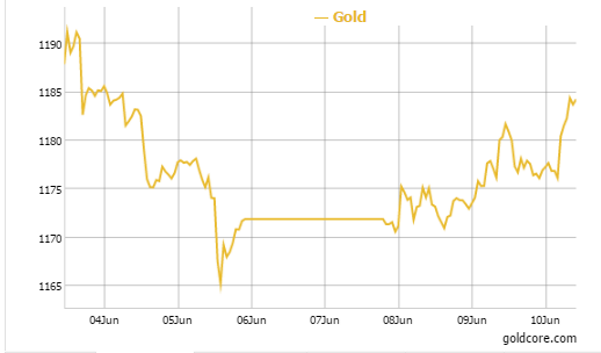

Gold in USD – 1 Week

In Asia, Chinese consumers took advantage of the dip in bullion prices after Friday’s U.S. payrolls report and physical buying grew stronger. Premiums climbed to $2.50 an ounce over the global benchmark on the Shanghai Gold Exchange a jump from premiums of $1.50 to $2 last week.

The Greek Prime Minister Alexis Tsipras is returning to Brussels today for a meeting with the leaders of France and Germany in an attempt to forge a bail-out deal however a stalemate may continue which should support gold.

In late morning European trading gold is up 0.76 percent at $1,186.26 an ounce. Silver is up 1.01 percent at $16.15 an ounce, and platinum is up 0.82 percent at $1,117.14 an ounce.

This update can be found on the GoldCore blog here.

Stephen Flood

Chief Executive Officer

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.