Is The Age Of Negative Interest Rates Ending Already?

Interest-Rates / International Bond Market Jun 11, 2015 - 06:16 PM GMTBy: John_Rubino

History teaches that long trends end only when everyone is finally convinced that they’ll keep going.

History teaches that long trends end only when everyone is finally convinced that they’ll keep going.

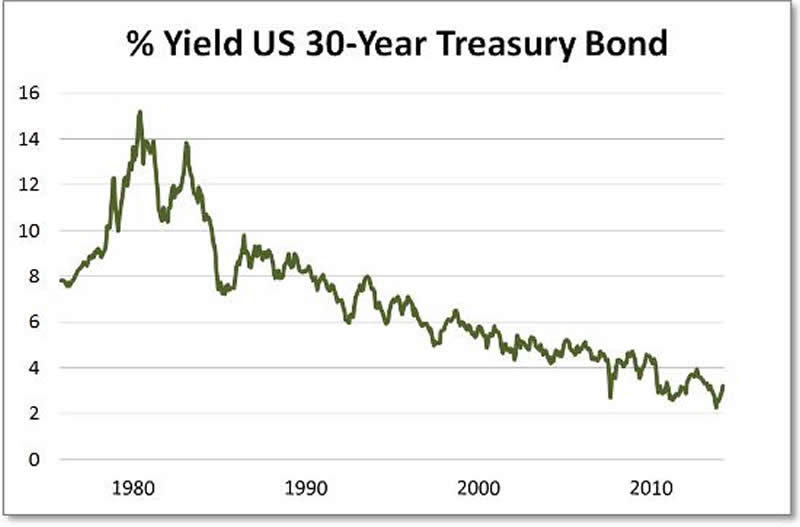

Maybe no trend in modern times has been as convincing as interest rates. The yield on long-term Treasury bonds, for instance, has been falling for as long as most people have been alive:

Same thing for the rest of the developed world. In early 2015 the yield curve for Swiss government bonds was negative out to ten years, and the curves for German and Japanese bonds were nearly as extreme. In other words, investors had to pay for the privilege of lending money to these governments, rather than the other way around.

That’s crazy, but people can adapt to crazy in an amazingly short time. And lately the discussion has shifted from whether rates can stay this low to how governments would force them even lower and whether this would require the abolition of cash itself. See The End Is Near, Part 1: The War On Cash.

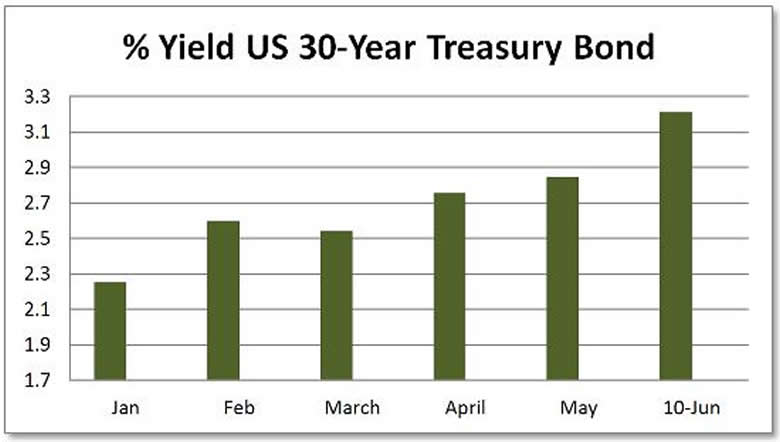

But then, just when we were all finally on board, the interest rate train started heading back up the hill. The yield on 30-year Treasuries so far this year:

Why the sudden reversal? It’s too soon to tell, but the Telegraph’s Ambrose Evans-Pritchard has some provocative thoughts. Here’s an excerpt from a longer, must-read article:

Bond crash across the world as deflation trade goes horribly wrong

Markets ignored clear warnings in Europe and America that the money supply is catching fire, signalling a surge of inflation later this year

M3 growth in the US has been running at an 8pc rate this year, roughly in line with post-war averagesThe global deflation trade is unwinding with a vengeance. Yields on 10-year Bunds blew through 1pc today, spearheading a violent repricing of credit across the world.

The scale is starting to match the ‘taper tantrum’ of mid-2013 when the US Federal Reserve issued its first gentle warning that quantitative easing would not last forever, and that the long-feared inflexion point was nearing in the international monetary cycle.

Paper losses over the last three months have reached $1.2 trillion. Yields have jumped by 175 basis points in Indonesia, 160 in South Africa, 150 in Turkey, 130 in Mexico, and 80 in Australia.

The epicentre is in the eurozone as the “QE” bet goes horribly wrong. Bund yields hit 1.05pc this morning before falling back in wild trading, up 100 basis points since March. French, Italian, and Spanish yields have moved in lockstep.

A parallel drama is unfolding in America where the Pimco Total Return Fund has just revealed that it slashed its holdings of US debt to 8.5pc of total assets in May, from 23.4pc a month earlier. This sort of move in the staid fixed income markets is exceedingly rare.

The 10-year US Treasury yield – still the global benchmark price of money – has jumped 48 points to 2.47pc in eight trading sessions. “It is capitulation out there, and a lot of pain,” said Marc Ostwald from ADM.

The bond crash has been an accident waiting to happen for months. Money supply aggregates have been surging all this year in Europe and the US, setting a trap for a small army of hedge funds and ‘prop desks’ trying to squeeze a few last drops out of a spent deflation trade. “We we’re too dogmatic,” confessed one bond trader at RBS.

As this is written, US rates are down a bit for the day, so it’s possible that the past few months’ spike was only a squiggle in a continuing decline. But if it’s not and rates are finally returning to historically normal levels, get ready for some serious dislocation. Governments that have borrowed trillions of dollars, euro, and yen virtually for free (in some cases better than free) will have to refinance at higher rates, sending their interest costs and therefore their deficits through the roof. Equities that are valued in relation to bonds will see those comparisons get a lot tougher. Houses and cars will be harder to finance, kicking a couple of crucial props from the economy. Volatility, in short, will return with a vengeance.

On the bright side, savers will once again be rewarded for doing the right thing. Morally at least, it’s a good trade.

By John Rubino

Copyright 2015 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.