New Gold Electronic Payments System Protect From “National Financial Or Currency Crisis”

Commodities / Gold and Silver 2015 Jun 16, 2015 - 03:38 PM GMTBy: GoldCore

- Texas creates state gold depository – bringing gold home from New York Fed

- Texas creates state gold depository – bringing gold home from New York Fed

- Move to remove gold from Federal Reserve highlights distrust

- Follows repatriation moves by Germany, Netherlands, Austria and others

- Legislation will prevent Federal government from confiscating gold

- Includes provisions that may lead to return to using gold as currency in the U.S.

- New gold electronic payments system protect from “national financial or currency crisis”

- European, UK and Irish governments could learn from prudent monetary move

The state of Texas has just passed legislation to build its own gold bullion depository, to repatriate $1 billion dollars worth of gold currently stored by the Federal Reserve in New York and to create a new gold electronic payments system to protect from “national financial or currency crisis”.

The move is being widely perceived as a vote of no confidence in the privately owned, bank owned central bank and the federal government.

Governor Abbott said that establishing this Depository means Texas will be, “increasing the security and stability of our gold reserves and keeping taxpayer funds from leaving Texas to pay for frees to store gold in facilities outside our state.” (see Governor Abbott Signs Legislation To Establish State Bullion Depository )

The law will go into effect immediately and the new Texas Bullion Depository – soon to be built- will cater to businesses, state agencies and citizens.

Representative Giovanni Capriglione who introduced the bill was reported by the Star-Telegram as saying:

“People have this image of Texas as big and powerful … so for a lot of people, this is exactly where they would want to go with their gold,” leading some commentators to puzzle over whether New York was not “big and powerful”.

Heretofore, it has been Venezuela and European countries that have been repatriating gold – Germany, the Netherlands and Austria have sought to bring their sovereign gold home from New York amid fears that the Fed – whose gold stocks have not been publicly audited since 1953 – may not be in possession of the gold it claims to hold.

It is highly significant therefore that a powerful state from within the U.S., such as Texas, should display such apparent distrust of the Federal Reserve.

Two of Texas’ largest public pension funds from the University of Texas (UoT) and the Teacher Retirement System (TRS) showed similar concerns in 2011 when they took delivery of $1 billion worth of gold bars out of storage with HSBC in New York.

The asset had been held in an ETF but the pension funds were apparently uneasy about not actually owning the physical gold. ETFs track the price of gold and ETF speculators or investors are merely creditors of the ETF and therefore, are very vulnerable to counter-party risk and exposure to the many banks, who are custodians and indeed sub custodians.

The legislation even seeks to protect the state’s gold from confiscation by the Federal government. Section A2116.023 of the bill states: “A purported confiscation, requisition, seizure, or other attempt to control the ownership … is void ab initio and of no force or effect.”

Under the Tenth Amendment the rights of the state trumps any order from the federal government.

Also significant is a provision which may lead to a return to sound money as proposed by Article 1, section 10 the constitution, i.e. gold and silver. In one section the bill states: “depository account holder may transfer any portion of the balance of the holder’s depository account by check, draft, or digital electronic instruction to another depository account holder or [to a person who at the time the transfer is initiated is not a depository account holder.]” [underline]

The man who initially drafted this legislation is Rick Cunningham of the Texas Center for Economics, Law, and Policy. Mr. Cunningham is respected and is the Executive Director of the Center, but he is also a magna ***** laude graduate of Texas A&M with a degree in Economics, as well as a graduate of the University of Chicago Law School, where he served as associate editor of the Law Review journal.

According to Mr. Cunningham

“this proposal consists of two parts – the “depository” part and the “system” part. The “depository” part … provides simply for hedging the state’s investment risk by allocating a recommended portion of state and local investment assets to physical gold and other precious metals, and housing those metals in a state-operated facility…”

“But the truly game-changing aspect of this proposal … lies in the “system” part. This would be an advanced, state-owned and operated system of electronic payments and settlements, denominated in ounces of precious metals, barred from engaging in lending, leasing, speculative or derivative transactions, and always maintaining a 100% ratio of bullion reserves to account balances. At full scale, not only could it sustain state and local government operations, it could potentially sustain large swaths of the Texas economy, even in the face of a national financial or currency crisis.”

If gold and silver were to become widely circulating currencies in Texas, the Federal Reserve issued and continuously devaluing dollar may slowly fall out of favour. Not maintaining a currency monopoly could ultimately lead to a return to using gold and silver as currency in the U.S.

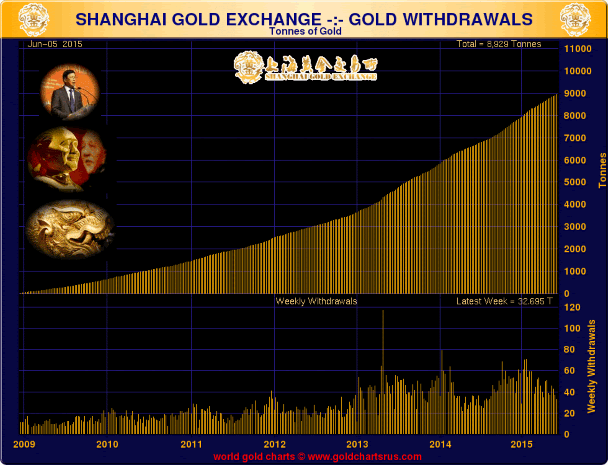

In the coming months and years it is likely that the Federal Reserve and the Federal government of the U.S. will come under increasing pressure from Russia and China to back the dollar with something of intrinsic value rather than simply increasingly empty promises.

If either of those two countries chose to back their currencies with gold bullion, of which they have been accumulating vast volumes in recent years, the U.S. would be forced to follow suit in order to prevent sharp falls in the value of the dollar and in an attempt to preserve reserve currency status.

Now, it would seem, the Federal Reserve note – the dollar bill as issued by a private central bank in defiance of the Constitution – may face pressure from within the U.S. as ‘Lone Star’ state Texas begins to bring gold back into the monetary system.

The days of paper and electronic currencies – backed by little more than faith in governments that the public increasingly do not trust – are numbered. Texas is preparing for this as are European nations such as Germany, Austria and the Netherlands.

Gold’s historic, symbolic, financial and monetary value is slowly being appreciated anew.

European governments including the UK government should take a leaf from the move by the state of Texas and explore setting up their own state national depositories in order to protect citizens, businesses and the nation itself from dislocations caused by “a national financial or currency crisis.”

It is not too late to undo the financial and monetary damage that Gordon Brown inflicted on an unsuspecting UK public when he sold the UK’s gold bullion reserves.

Preserve your wealth by acquiring an allocation to history’s only enduring money – gold.

Must Read Guide: 7 Key Gold Must Haves

MARKET UPDATE

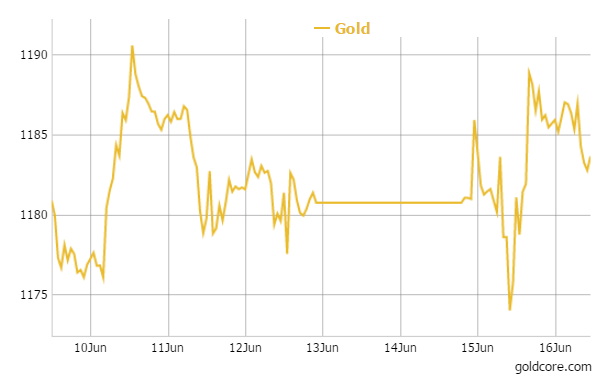

Today’s AM LBMA Gold Price was USD 1,182.10, EUR 1,050.06 and GBP 759.36 per ounce.

Yesterday’s AM LBMA Gold Price was USD 1,178.25, EUR 1,049.57 and GBP 760.01 per ounce.

Gold climbed $5.20 or 0.44 percent yesterday to $1,186.20 an ounce. Silver rose $0.17 or 1.07 percent to $16.11 an ounce.

Gold in USD – 1 Week

Gold in Singapore for immediate delivery was marginally lower at $1,185.6 an ounce towards the end of the day, while bullion in Switzerland fell a dollar.

Gold inched down this morning but stayed in lock down in a very narrow range. The yellow metal looks well supported at these levels with safe haven bids increasing due to the unresolved Greek debt crises as the time runs out before the deadline at the end of the month.

Some investors wait for more guidance from the U.S. Federal Reserve during its meeting that begins today. Fed Chair Jane Yellen’s comments and wording of the Fed policy statement tomorrow will be closely watched.

U.S. economic data is still weak. Yesterday’s data from industrial production was poor underlining concerns about the U.S. economy.

The Bank of China has joined the ICE Benchmark Administration (IBA) gold price benchmarking process. This increases the number of participants to eight including – JPMorgan Chase Bank, Scotiabank, HSBC, Société Générale, UBS, Barclays and Goldman Sachs in the LBMA Gold Price, which formally replaced the London Gold Fix this spring.

In late morning European trading gold is down 0.16 percent at $1,184.87 an ounce. Silver is off 0.38 percent at $16.01 an ounce and platinum is also down 0.15 percent at $1,086.56 an ounce.

This update can be found on the GoldCore blog here.

Stephen Flood

Chief Executive Officer

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.