UK Jobs, BoE, Sterling and Yield Spreads

Interest-Rates / UK Interest Rates Jun 18, 2015 - 07:11 AM GMTBy: Ashraf_Laidi

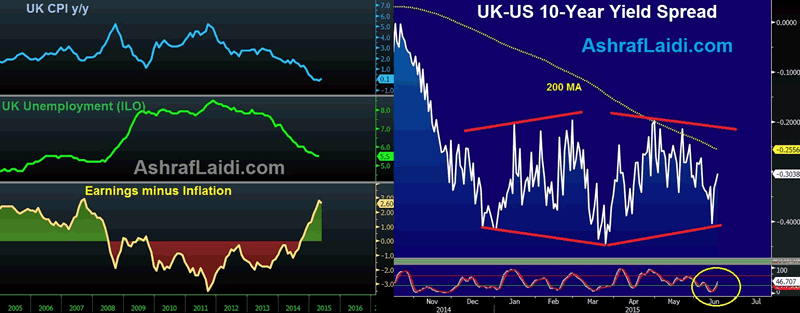

Today's UK jobs figures powered the pound across the board as average weekly earnings growth (excluding bonuses) shot up to a six-year high of 2.7% in the three months to April y/y, exceeding market expectations for a 2.1% rise. Substracting the 0.1% level of inflation, real earnings come in at 2.6%, also the highest since 2009. If wage gains persist on their upward trend, then wage cost inflation would follow, forcing the gilt market to price more aggressive expectations for a BoE rate hike.

With regards to the release of the Bank of England's BoE minutes, the usual hawks continued (likely to be Weale & MacCaferty) continued to deem their vote to hold rates unchanged as "finely balanced", which raises the probability of seeing 1-2 dissenting voters (in favour of a rate hike) by end of this summer. Private economists are calling for rates to be lifted by Q1 2016, while Short sterling contracts are pricing a full chance of a 25-bp rate hike June 2016 versus August 2016 prior to this morning's release of the jobs and BoE minutes.

On the yields spread front, UK-US 10-yr spreads have bottomed out from a key support, now eyeing the 200-DMA, a break of would will pave the way for the top of the diamond formation.

Finally, our long GBPUSD entry at 1.5360 on June 8th, hit the final target of 1.5670. A new Premium Insight trade will be added this afternoon to the existing 3 long trades.

For more frequent FX & Commodity calls & analysis, follow me on Twitter Twitter.com/alaidi

By Ashraf Laidi

AshrafLaidi.com

Ashraf Laidi CEO of Intermarket Strategy and is the author of "Currency Trading and Intermarket Analysis: How to Profit from the Shifting Currents in Global Markets" Wiley Trading.

This publication is intended to be used for information purposes only and does not constitute investment advice.

Copyright © 2015 Ashraf Laidi

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.