Bond Bubble - The Fed is Now Officially in VERY Serious Trouble

Interest-Rates / US Bonds Jun 18, 2015 - 05:44 PM GMTBy: Graham_Summers

The market action of the last 24 hours can be summated as thus:

The market action of the last 24 hours can be summated as thus:

The Fed didn’t raise rates, so the US Dollar fell and all risk rallied hard.

The fact the Fed didn’t raise rates is not important. Interest rates have not been at zero for six years. And the last real period of tightening ended in 2006, nearly a full decade ago.

In the simplest of terms, for the Fed not to be raising rates is not interesting. What IS interesting is WHY the Fed is not raising rates.

Of course there are many reasons why: the economy is not strong enough to handle it, the Fed missed its chance to raise rates in 2011-2012, etc.

However, there is only one REAL reason why rates remain so low:

Actually it’s $555 trillion reason: and they are derivatives based on interest rates.

That is not a typo. $555 trillion… as in an amount greater than 700% of global GDP.

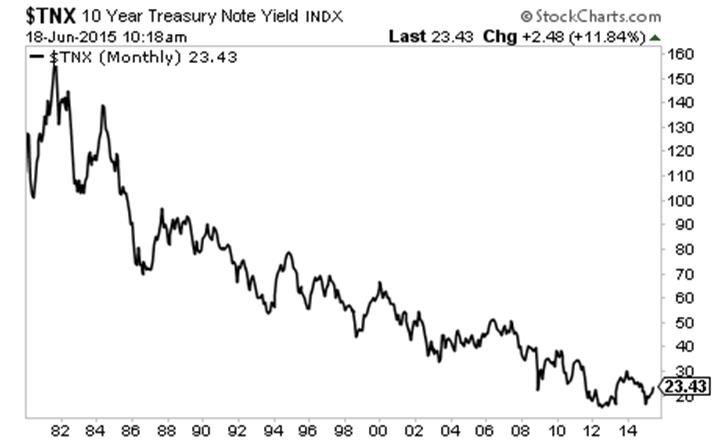

The world tracks "risk" based on the yield of the 10-Yr US Treasury. This yield has generally been falling non-stop since 1983. So we've had well over 30 years of money getting cheaper.

It is not coincidence that as money got cheaper, Wall Street went nuts with leverage. And given that rates have generally been trending down for over 30 years, betting on cheap money became one of the easiest trades in the world.

And that is how you get to where we are today: with a global bond bubble with over $555 trillion in derivatives trading based on it.

This is the REAL issue with interest rates, NOT the economy. The Fed cannot and will not raise rates any significant amount without risking a Crisis that would make 2008 look like a picnic (the CDO market which caused 2008 was a mere $50-60 trillion in size by comparison).

This is why Ben Bernanke told a group of hedge fund managers behind closed doors “rates will not normalize in my lifetime.” Rates CANNOT normalize because this would instantly implode the financial system.

However, the Fed has backed itself into a corner. Globally the bond markets are already starting to plunge pushing rates higher. Spain, and Italy’s bond yields have already taken out their downtrends (meaning bonds are falling and yields are rising). Japan is fast approaching the critical point at which it does the same.

And even the US is about to have its bonds test resistance (a break above the trendline means it’s GAME OVER for the Fed).

In short: 2008 was a warm up. The REAL Crisis concerns the bond bubble which is exponentially larger in scope.

If you've yet to take action to prepare for this, we offer a FREE investment report called the Financial Crisis "Round Two" Survival Guide that outlines simple, easy to follow strategies you can use to not only protect your portfolio from it, but actually produce profits.

We made 1,000 copies available for FREE the general public.

As we write this, there are less than 50 left.

To pick up yours, swing by….

http://www.phoenixcapitalmarketing.com/roundtwo.html

Best Regards

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2015 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.