Where is the Crude Oil Price Heading Next

Commodities / Crude Oil Jun 20, 2015 - 12:12 PM GMTBy: Investment_U

Bob Creed writes: Last month, OPEC held its 167th meeting in Vienna, Austria. The two main takeaways?

- One: The oil cartel will maintain production at 30 million barrels per day (bpd), with unofficial numbers above that.

- Two: Saudi Arabia’s price war against U.S. shale producers will continue.

By resolving to preserve its already high production ceiling, OPEC is keeping prices low and putting the squeeze on all non-OPEC output...

Especially companies working in shale, where costs are significantly higher.

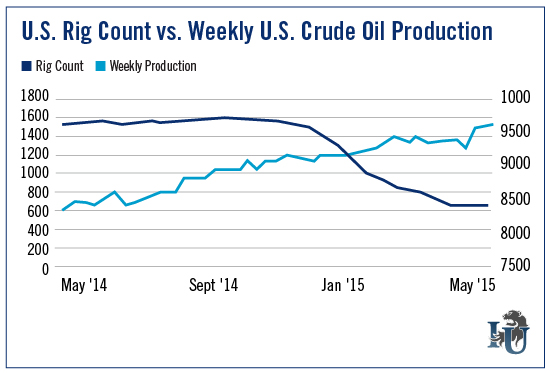

But as this week’s chart shows, OPEC’s actions haven’t managed to slow U.S. production. In fact, last month, total domestic oil production increased to over 9.6 million bpd.

To compare, the May 2014 average was 8.4 million barrels a day. And at that time, it was the highest monthly average since March 1988.

What does this all mean? We can expect lower oil prices in the future. And probably sooner than you think...

You see, prices have held near the $60-a-barrel level thanks to a slight inventory drawback. But this can hold for only so long. Eventually, Saudi Arabia will strike again and increase its output even more.

And any increase in production, in a market that already faces an oversupply, will depress prices further.

iuox.display(71);

After all, it’s this strategy that’s led to the sharp decline in oil prices over the past year... and provided U.S. drivers with the cheapest gasoline in six years.

Spending less at the pump has no doubt put more money in your pocket. But what about your portfolio?

As the Oxford Club’s Emerging Trends Strategist Matthew Carr pointed out on Thursday, there are plenty of opportunities in oil right now. Trouble is, the average investor makes the mistake of looking at only one metric: the rig count.

But, as you can see from the chart, even though counts have steadily decreased over the last few months, production remains on the uptrend.

In Matt’s words: “The declines in the broad energy sector have been capped and have slowed considerably, even as production continues to increase. But in no way does that mean investors have to abandon oil companies. It’s about being more selective.”

Editorial Note: Most investors are blissfully unaware of OPEC’s true motives - and the impact they could have on certain investments. To help you protect yourself, The Oxford Club has produced this urgent presentation. In it, our experts blow the lid off of OPEC’s secret agenda and give you specific ideas to sidestep the fallout. Click here to watch.

Copyright © 1999 - 2015 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.