Greece Crisis Shows Importance of Gold as Europeans Buy Coins and Bars

Commodities / Gold and Silver 2015 Jun 30, 2015 - 01:44 PM GMTBy: GoldCore

- Demand for physical gold from Europeans surges

- Demand for physical gold from Europeans surges

- Greek ATMs limit withdrawals to €60 per day

- Greeks panic buy food, fuel and medicine

- European elites threaten Greece with expulsion

- Gold not subject to capital controls or “bail-ins”

Demand for gold coins and bars from European investors has increased significantly in the past month as the Greek crisis enters a new phase.

As reported in our statement – to which Bloomberg referred in their piece – we saw a significant increase in demand from the U.K. and Ireland yesterday where sales of coins and bars were three times the average of the previous three Mondays.

The Royal Mint said that Greek demand for coins in June was double the average for the last five months and the U.S mint saw the highest sales of bullion coins since January.

Bloomberg report that many buyers want to store their gold outside of the Eurozone, citing Switzerland as an example. We advise our clients to do the same and many have opted for storage in Singapore also.

As the crisis in Greece accelerates the value of owning gold will become more apparent to everyday people.

What is happening in Greece today may well await the citizenry of other developed economies tomorrow – as recently warned by well placed observers in notable institutions such as HSBC, Goldman Sachs and Fidelity.

Greek banks remain closed and ATM withdrawals have been limited to €60 per day. There has been panic buying of various essentials such as food, fuel and medicines across Greece, as reported by the New York Times.

This is in anticipation of chaos and disruptions of supply chains should the country be forced out of the euro and onto a much depreciated drachma.

European elites have threatened Greece with expulsion from the euro currency should Sunday’s referendum – on using austerity as a tool to deal with Greece’s unpayable debt – return a “no” vote.

Greece has fought back with Finance Minister Yanis Varoufakis telling the Telegraph,

“We are taking advice and will certainly consider an injunction at the European Court of Justice. The EU treaties make no provision for euro exit and we refuse to accept it. Our membership is not negotiable.”

What happens next in Greece is unsure. What is assured is the insurance gold will provide going forward. Physical gold, held outside the banking system, is not subject to capital controls.

With the ECB reneging on its responsibility as lender of last resort – not the first time it has used its power to political ends in Greece – Greek banks may soon be forced to “bail-in” deposits – i.e. confiscate the cash of their customers.

American Silver Eagle 1 0z Coin

Those holding cash “under the mattress” and physical gold and silver coins will be provided a degree of security in such an environment.

Precious metals can be used directly in exchange for goods or are readily converted to cash for the same purpose while retaining their store of value until required.

Should the Greek crisis morph into a full-scale euro-crisis – if, for example, Credit Default Swaps were triggered which provoke a derivatives crunch – gold and silver would still enable you to secure life’s necessities if the value of one’s cash savings should collapse.

The euro, like all paper and digital currencies, is backed by nothing more than the faith in the institution that issues it. Faith in central banks is rapidly evaporating.

Physical gold, on the other hand, is a time-tested and academically proven store of value or safe haven in times of crisis. It will likely be recognised as such by the wider public in the coming months and years.

Must Read Guide: 7 Key Gold Must Haves

MARKET UPDATE

Today’s AM LBMA Gold Price was USD 1,175.00, EUR 1,053.01 and GBP 747.08 per ounce.

Yesterday’s AM LBMA Gold Price was USD 1,176.50, EUR 1,060.82 and GBP 749.10 per ounce.

Gold climbed $5.10 or 0.43 percent yesterday to $1.179.20 an ounce. Silver slipped $0.08 or 0.51 percent to $15.72 an ounce.

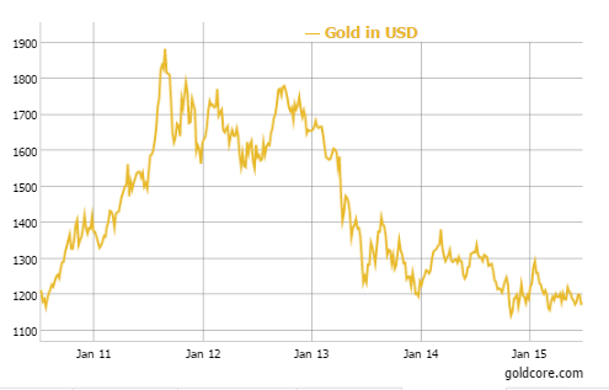

Gold in U.S. Dollars – 5 Year

Gold in Singapore for immediate delivery ticked lower by 0.3 percent to $1,176.35 an ounce near the end of the day. Gold is on track for a 1 percent decline this month.

Even with Greece just hours from defaulting on its 1.6 billion euro loan from the IMF, safe haven bids for gold are weak. The U.S. dollar gained 0.4 percent against other currencies, while U.S. and Asian stock markets rose.

Greek Prime Minister Alexis Tsipras is calling for a bailout referendum on July 5. The Greek drama is not finished.

In late morning European trading gold is fell 0.20 percent at $1,176.62 an ounce. Silver fell 0.10 percent at $15.71 an ounce and platinum rose 0.19 percent at $1,079.00 an ounce.

This update can be found on the GoldCore blog here.

Stephen Flood

Chief Executive Officer

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.