Bitcoin Price Up on Probable Greek Deal

Currencies / Bitcoin Jul 11, 2015 - 12:52 PM GMTBy: Mike_McAra

In short: no speculative positions.

In short: no speculative positions.

Greece seems to have given in to its creditors’ demands for more austerity as the Greek government sent out a revised reform proposal yesterday which included substantial concessions on its part. Is this the end of the Greek drama? Most likely not.

Greeks now demand more bailout funds than was discussed previously, probably in order to walk away from the table with at least some “positive” outcome. Positive for the popularity of the government party, that is. This might not be a problem for the creditors. The real bone of contention is the possible debt write-off, reduction, restructuring, relief. Whatever you call it. This is what will ultimately be needed for the Greek economy to start going again as there is widespread consensus that the country will not be able to pay off its debts, no matter how hard the austerity measures.

The real problem is that the most powerful creditors, the Germans, oppose any debt haircut. The German voters are very much in favor of more fiscal discipline, making it hard for the German government to openly consider any debt restructuring, which ultimately seems like the only way to go. The next German elections will be held in 2017, which might be an indication that any debt forgiveness could be postponed until the elections are over. The question is whether Greece could tolerate yet another two years without restructuring. The sooner the restructuring takes place, the better for the Greek economy, given that important labor market reforms are actually carried out. Right now it seems the question of what will prevail, the German government’s wish to delay debt cuts or the possible pressure from other European countries to make necessary concessions.

The most likely outcome seems some form of debt relief, redressed in other terms. Think “interest reduction,” “horizon extension” and so on. The point is, it might be the case that the Greeks will be allowed to pay less without a formal haircut. This is kicking the can down the road yet again. It might be the case that we will have to wait until 2017 to see any sort of more serious action. Of course, nothing of this is certain.

How much the whole situation has to do with Bitcoin is a matter of pure speculation. If one were to believe that Bitcoin’s performance is linked to the situation in Greece, then yesterday’s proposal “should” diminish the uncertainty and exert downward pressure on Bitcoin as the deal between Greece and its creditors seems closer now than it was a couple of days ago. Yet Bitcoin failed to move down significantly yesterday and it has actually gone up significantly today, contrary to what one might have expected. This only shows that the “Greece drives Bitcoin” hype might be just that, hype. Or, at least the link is a lot less clear than is reported in the press.

For now, let’s focus on the charts.

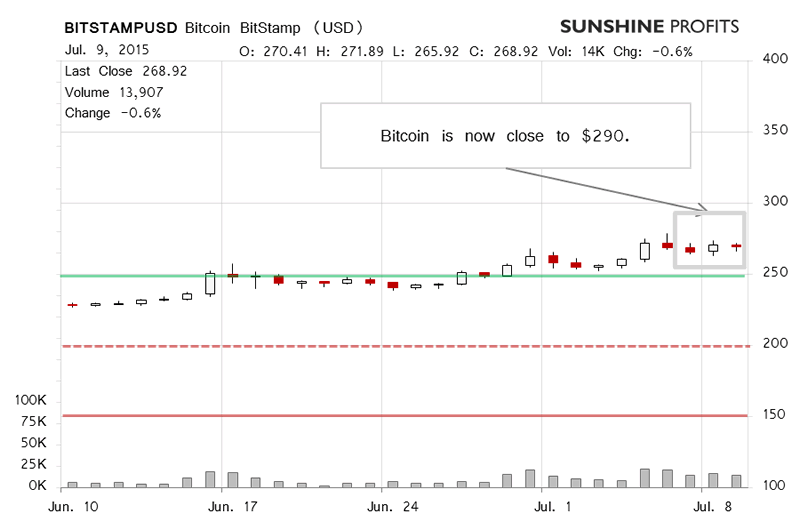

Yesterday, Bitcoin went down a bit on Bitstamp. The volume was roughly at the level we had seen in the previous days – relatively significant. The most important factor to consider is that we haven’t really seen any significant depreciation since the Greek proposal came to light. This might mean that the link between Greece and Bitcoin is not as significant, if there is on at all.

If there was no significant depreciation yesterday, we have seen strong appreciation today (this is written around 5:30 a.m. ET). On the face of it, this is a strong indication that the outlook is changing to bullish. On the other hand, there is still a lot of uncertainty surrounding the possible Greek deal. Yesterday, we wrote:

The recent appreciation creates the perception that an important breakout might have happened. This might be true but the above considerations make the situation particularly cloudy. If there in fact is a link between the Greek situation and Bitcoin, a last-hour deal during the Sunday summit might be the trigger to erase the most recent gains. If the link is non-existent, then Bitcoin could stay up following the outcome of a possible meeting. This would in turn suggest that more gains are possible. But this is not the case just yet.

Our best bet at the moment is that a summit will be held Sunday and that it either will bring an acceptance of the Greek government of the terms of its creditors or the situation will exacerbate and yet another “last minute” summit will be held next week. It seems that the last possible date for an agreement is June 19 since Greece has to repay a loan to the ECB on July 20 but knowing the flexibility of EU politicians nothing would surprise us here.

If a next summit is called and a deal is reached and if Bitcoin falls after the deal, we might have a shorting opportunity. But that’s a lot of ifs and ands.

This is still the case. The situation has just become more bullish but the situation is still too uncertain, in our opinion, to open speculative positions at this time.

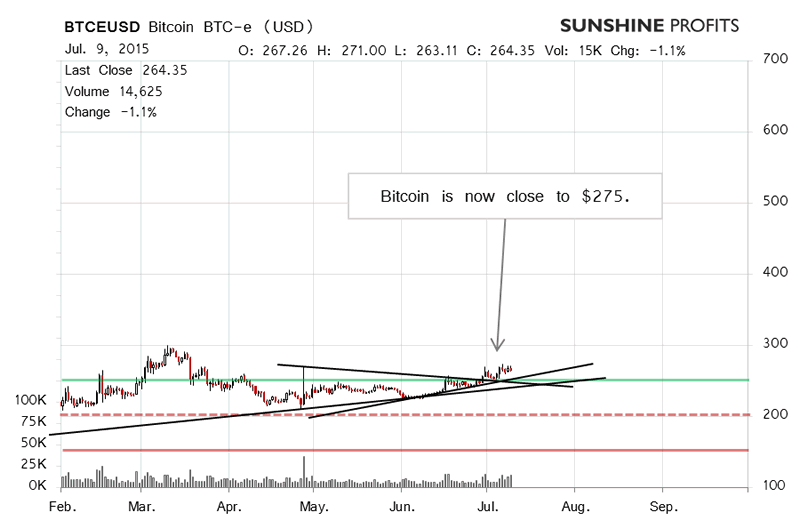

On the long-term BTC-e chart, we haven’t really seen a lot of change. Bitcoin is still above the possible trend lines and the $250 level (green line). What might look like a breakout at first sight, however, is subject to a lot uncertainty in the financial markets in light of a possible Greek deal on Sunday. Our comments from yesterday remain up to date:

(…) Looking only at the chart, one might get the impression that all is bullish and up is the direction in which Bitcoin might move. It might, but the considerations we made (…) suggest that there might be more than meets the eye. Both going long and shorting seem particularly risky at this time. We’re still more inclined toward a short bet as the recent appreciation might have been drive by a perception that there’s a link between Bitcoin and Greece and it might be reversed if a deal is reached. Which is, in our opinion, still the most likely outcome. The situation, however, is too uncertain just now to go short. We have to wait for a confirmation.

Now that it turns out the deal looks a lot more likely, we might see a shorting opportunity next week. This is still not the case.

Summing up, we don’t support any speculative positions at the moment.

Trading position (short-term, our opinion): no positions.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Mike McAra Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.