Gold And Silver – Without Either, You Will Be Greeced

Commodities / Gold and Silver 2015 Jul 18, 2015 - 03:49 PM GMTBy: Michael_Noonan

Step back for a moment and absorb what just transpired in the ongoing Greek tragedy that refuses to go away. Greece, with no possibility of ever repaying its fictitious debts to the EU, and the EU, in all of its greed and avarice, for no wisdom is to be found within that body of elite-pushing bureaucrats, it determined that the best and ONLY solution for debt-laden Greece was to LOAN MORE “MONEY.”

Step back for a moment and absorb what just transpired in the ongoing Greek tragedy that refuses to go away. Greece, with no possibility of ever repaying its fictitious debts to the EU, and the EU, in all of its greed and avarice, for no wisdom is to be found within that body of elite-pushing bureaucrats, it determined that the best and ONLY solution for debt-laden Greece was to LOAN MORE “MONEY.”

Need anything more be said about what is going on in European politics?

In the real world, if you cannot repay your debt[s], your car is repossessed, your house undergoes foreclosure, you cannot get credit, your credit cards get canceled, your debt-

burdened ass is hauled into court, often times, your family falls apart, etc, etc, etc. Not

so for Greece. She gets offered even more debt from her creditors. Only in politics.

We covered this ground before: Greece was loaned nothing of value. Nothing. Just fictitious digitalized numbers created at the whims [actually the purposeful direction of the elite’s bankers] of the IMF/EU, [off by one letter, the “E” should have been an “F” to more accurately describe what happens to the populations of member countries]. [See 17th paragraph from article Elite NWO Checkmate.] Now the bankers want to be repaid in tangibles, like the country of Greece itself, the Greek banks, and whatever else can be siphoned from the economically broken backs of the innocent Greek people.

Where will the billions of new loaned money to Greece go? Not to the people, not to rebuilding Greece. It will be recycled back to the creditors to keep the facade of bank solvency alive. This is a joke that is not laughable.

Lend nothing, take back everything not nailed down. It has been the Rothschild formula for centuries.

Pay attention. We have said this before: the elites and their bankers take no prisoners. They could care less about people. All the elites care about is taking total control of the currencies of every country in order to bring that country to its financial knees and totally beholding to the dictates of the moneychangers.

The obvious, unstated and perhaps unnoticed point is the the Euro currency is a total fiat totally controlled by the bankers. Hello, Europe?! The sole purpose of the EU is to enslave all Europeans. Is everyone oblivious to the obvious?

All politicians are lying whores, with apologies to whores for making the connection.

Tsipras just sold out the Greek people to a deal worse than the one initially presented months ago, and more importantly, against the referendum held to vote no for the EU’s [mostly elite sell-out Merkel and Germany] austerity program.

Greek banks closed, [the elite’s way of forcing people into financially hopeless situations to get what they want]. People who stupidly still kept their money in the elite’s banking system were denied access to what they thought was theirs. Two lessons: people who keep money in any bank anywhere in the world are now considered creditors, not depositors, and you can, and will be denied access to what you “believe” to be your funds at the dictates of the bankers. Secondly, anything people keep in the form of paper, or worse,

digitalized entries on their accounts, are discovering the true “value” of paper. [None.]

Those who had gold and silver were able to use their own form of wealth to acquire whatever they needed, assuming items were available, and more is available when gold or silver is the basis for the transaction, although alcohol, coffee, cigarettes, even sex facilitate trade exchanges.

If you have no gold or silver, you will be “Greeced,” “Cyprused,” financially screwed for not taking responsibility for your own economic future. Those who already own either or both gold and silver know this, [but still complain about the paper price continuing to decline.]

Precious metals have always been a store of value and always will be. One of the main reasons for FDR’s Executive Order for US “persons” to turn in their gold was to strip people from being independent of the government. Those who had gold and silver did not need to be reliant upon the government for their economic needs. Take away their most reliable form of wealth, substitute it for fiat paper, and now people had to rely upon the government to survive. To paraphrase Chuck Colson, Nixon’s aide, “When you have them by the financial balls, their hearts and minds will follow.”

That was the plan all along, starting from when the Federal Reserve Act of 1913 was enforced on the country by the foreign banking elites. First, gain control of the issuance of a nation’s currency, [again, the classic Rothschild formula] then the rest falls into place: control of the government, control of business sectors, and the media. The public hears only what the elites want them to hear and [falsely] believe.

We have mentioned Agenda 21 several times and always exhorted people to take some time and research what this insidious UN-sponsored agenda is all about. In a nut shell, Agenda 21 is the UN takeover of all local governments in order to corral the masses in whichever direction the UN decides. One of those directions is to ultimately prevent people from owning their own land, water rights, etc…total enslavement.

Here is a small example. In 1998, the Montana Fish Wildlife and Parks approached local county commissioners to persuade them with a proposal to cooperate in driving rural residents out of the Montana countryside into cities. Why? People in rural areas were pretty self-reliant, as a matter of necessity. These people have no need for government support and would highly resent and oppose any government interference. If the government could get people more centrally located, people can be more easily controlled.

The point, beyond the obvious deceit? This is an Agenda 21 scheme, and we are talking about 1998, in a seemingly innocuous location, sparsely populated Montana. Note that the same agenda is being plied throughout the United States. It is a bit like the 1956 movie Invasion of the Body Snatchers. One thing is certain, the elites are taking total control of you and your life right under your unobserving noses.

Read the brief but informative article by Joshua Krause, Agenda 21 Under A New Name,

from which the above comes.

We have also covered how Obama has sold out America and Americans, at the behest of the elites, lately through TPP, TTIP, and TISA, in our widely read article, Obama, Western World’s Worst Enemy for Freedom. This, folks, is how the elites work and why all politicians are pathetic as a puppet ruse for the NWO.

As an aside, for more about the US decline under the directed hands of the president, you may find this interesting to read, Freedom or the Slaughterhouse, American Police State

from A to Z.

The larger point to be made is for those who are myopically focused on the current price for gold and silver, all of the news-related stories about how much gold China owns, how

many coins are being bought in record quantities, etc, etc, stories everyone has heard for the past three years, that focus is grossly misplaced.

First Cyprus, now Greece, and it will not stop there. The entire corrupt Western banking system is bankrupt, a fact few people are willing to accept. The entire Western banking system is corrupt. PMs people have a greater appreciation for that repeated statement, but most people simply cannot comprehend the weight of that situation.

The price for gold and silver is being artificially and purposefully suppressed by central bankers. The Western world is falling apart at the fiat financial seams, and those in control will resort to whatever means necessary to remain in control, evidenced by the unending proxy wars and Middle East disruptions started by the US. A Third World War cannot be taken out of the equation as the bankers are scrambling for their greedy lives, stealing as much wealth from people as possible.

That is where everyone’s primary concern would be well-served to know and continually be aware of what is going on, because when this banker-created financial disaster comes to it sordid end, and it cannot be avoided, owning and physically holding/controlling gold and silver will be one of the best means of surviving financially.

How and when things unfold, no one knows. All one can do is to be informed and prepared, and of the two, being prepared is more important than being informed.

Charts next…

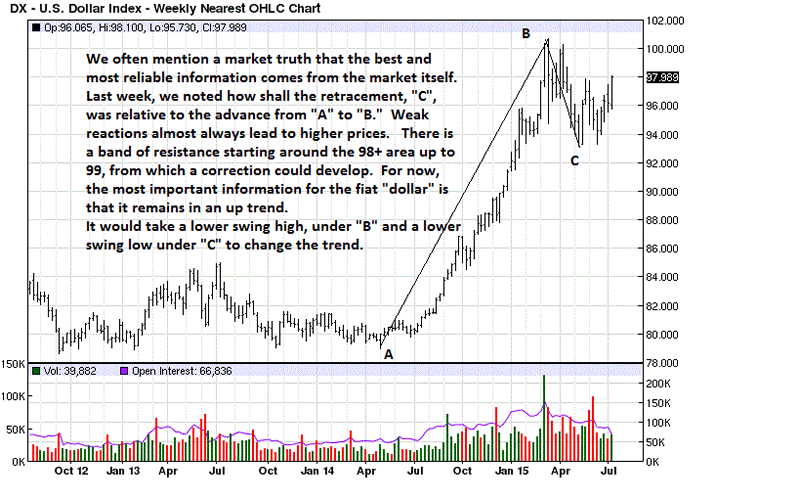

For as long as the corporate federal government can keep its unwanted “dollar” moving higher, it is an apt barometer for the opposite direction of gold and silver. Chart comments pretty much cover the salient features.

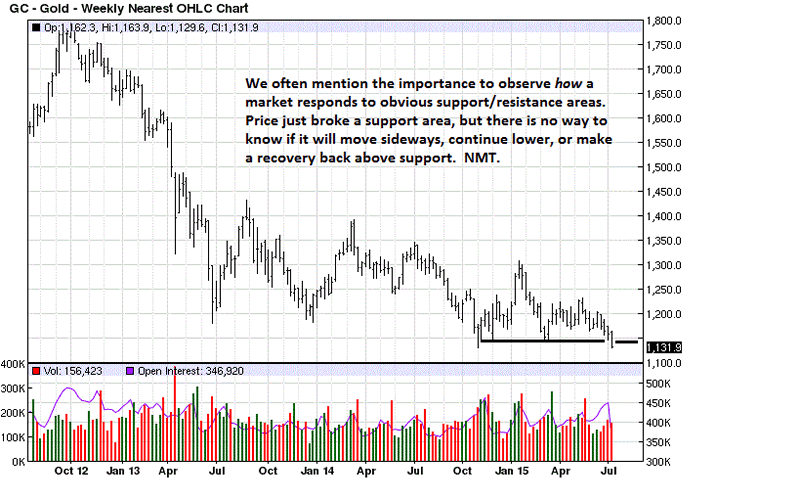

NMT = Needs More Time. Gold continues its decline in a snail-like fashion, despite the obvious intended assaults to drive price lower. Those efforts continue to succeed, but it appears with decreasing effect.

Last week, we commented there was little reason why gold could not go lower, and it did. The same still applies until there is some sign of ending activity.

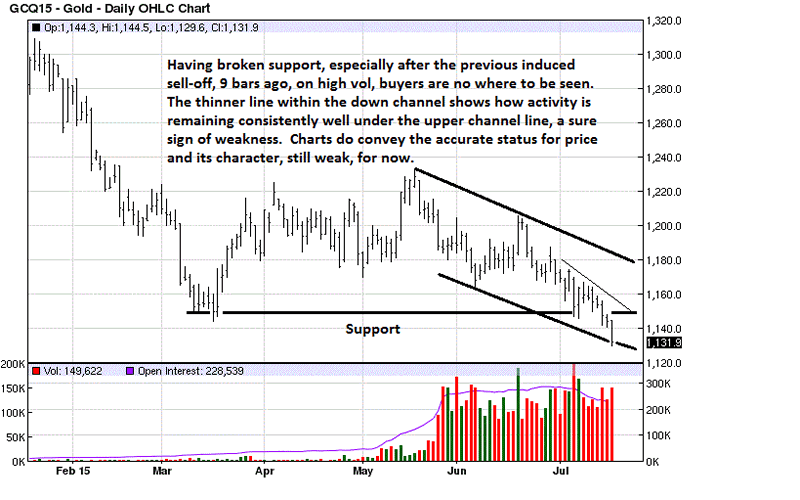

In addition to the chart comments, Friday’s close touched the lower channel line, and that puts gold in an oversold condition. We hasten to add, oversold very often becomes more oversold, so it should not be taken as a potential trade from the long side. You will see how silver reached an oversold condition. While gold is clearly in a similar position, it does not mean it will react in a similar manner, a mistake too many make in reading charts.

Every situation is unique, regardless of any past similar formations.

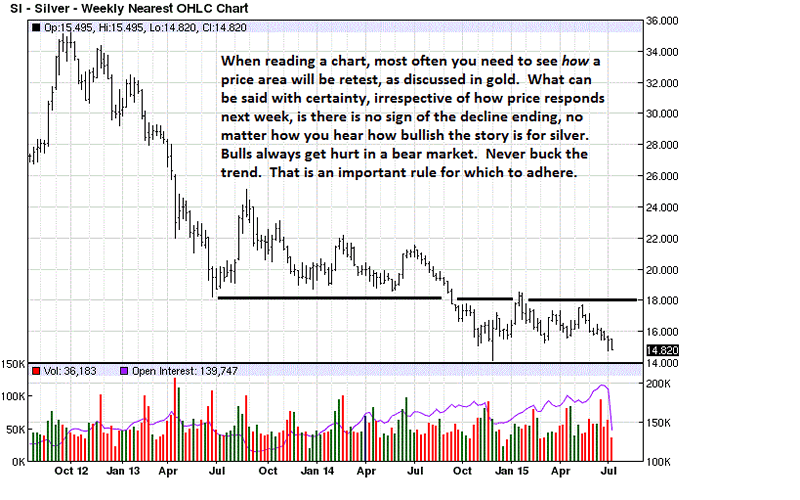

Just as we cautioned to obverse how gold reacts to its just breaking an obvious support area, the same holds here. Both silver and gold can move sideways, continue lower, or rally in response to broken support. The absolute lowest probability is a rally back over support that can hold.

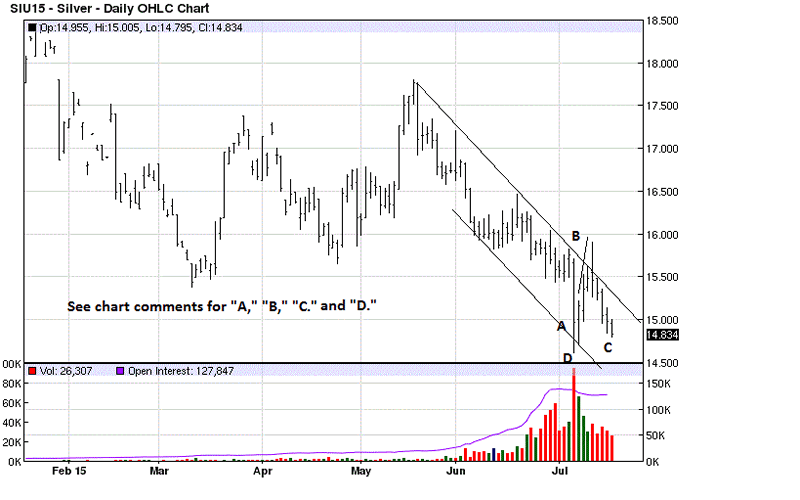

“A” is a wide range down bar on sharply higher volume. Last week, we mentioned how the daily chart was not very encouraging for a sustained rally. That conclusion was made from simply reading developing market activity conveying a message. Note how it took four TDs to retrace the one-day decline, “A.” The ease of movement is to the downside, and recovery rallies are more labored. Plus, the small range of the rally into the previous Friday, 5 bars ago, the 4 day “B” rally, was an obvious indication that buying was weak, otherwise the range would have extended higher.

At “C,” we see a slowing of the decline as it retests the low area at “D.” Friday’s small range is the opposite of the small range rally bar, just described. Plus, Friday’s range mostly overlapped the previous bar, showing less ease of downward movement. Despite these potential caveats, the most important factor is the prevailing trend, down.

You can also see when “D” developed, it reached an oversold condition similar to what was described on the daily gold chart. An obvious reason why gold may not hold as silver did is seen in how silver is holding in the middle of the down channel, where gold was easily under the middle of its down channel, making gold relatively weaker in character, given the two similarities.

The trend for both metals remains down, and from the last two lines to Ode On A Grecian Urn:

“Beauty is Truth, truth beauty,—–that is all

ye know on earth, and all ye need to know.”

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2015 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.