Commodity Markets Breakdown Of 2015 Is Now A Fact

Commodities / Gold and Silver 2015 Jul 26, 2015 - 06:58 PM GMTBy: GoldSilverWorlds

We wrote on July 5th that markets are increasingly looking scary. Now, only 3 weeks later, the situation seems to be escalating.

We wrote on July 5th that markets are increasingly looking scary. Now, only 3 weeks later, the situation seems to be escalating.

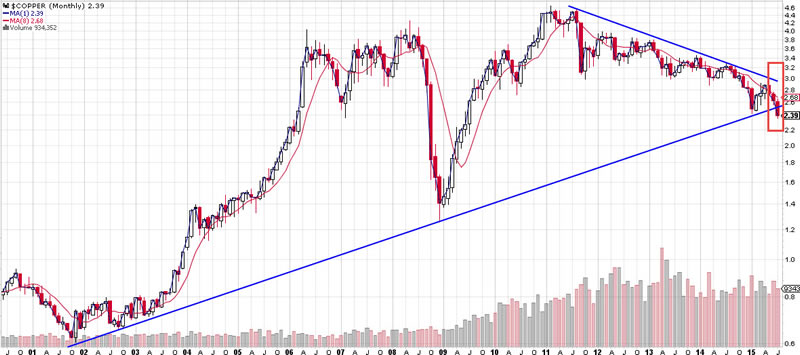

Let’s get it straight: this is a serious deflationary bust in the making. The most worrisome fact is Dr. Copper’s technical breakdown, as seen on the first chart.

Source: StockCharts.com

The price of copper, being a leading indicator for the health of the global economy, has broken through a multi-decade trend channel. This is really bad news for the global economy, and for markets in particular. This setup carries a message you simply cannot ignore if you are a serious investor.

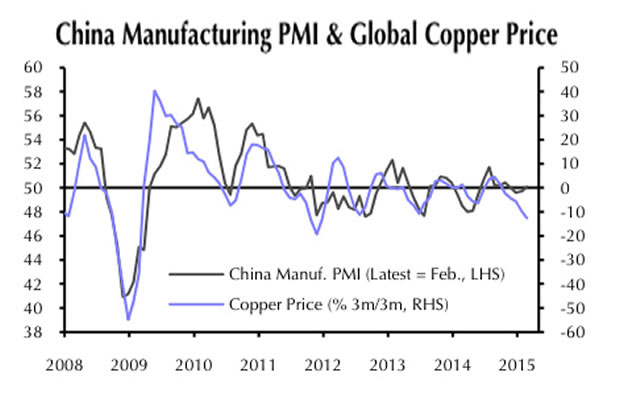

Part of the problem resides in China. As the next chart shows, the correlation between the price of copper and the Chinese Manufacturing Purchasing Managers Index (PMI) has been very high. In particular, the copper price has a track record of anticipating the direction of the PMI index. The latest PMI reading earlier this week came in at 48.2 this week, still below the critical 50 level. It indicates that purchasing managers believe economic contraction is prevailing at this point.

Source: Capital Economics

It is not only copper, but almost all commodities are tumbling right now. So here must be more going on than contraction in China.

The price of gold, apart from the fact that last Sunday’s crash was more than suspicious (given the low number of sellers, high number of contracts, in a overseas thin trading market), has broken through key support as well. What is more worrisome, however, is the trend of the gold miners. Traditionally, the miners are a leading indicator within the precious metals complex.

Calculations of our analyst team at SecularInvestor.com show that prices of various gold mining stocks are factoring in a scenario of $600 gold in the not too distant future.

Scary movie? It will probably become worse, as from a technical point of view there is still quite some downside in the leading commodities (copper, gold, crude oil).

The key question of course is what central bankers will do with this deflationary cabal. If anything, they cannot ignore the fact the economy is doing exactly the opposite to what they are aiming for, i.e. a 2% inflation rate.

China’s central bank has become quite aggressive in their monetary easing. Also, they have plenty of room to set interest rates lower, as a tactic to stimulate inflation. In the U.S., however, the trend is towards higher rates, at least that is the message of Mr. Bernanke and Mrs. Yellen in their forward guidance since two years. On the other hand, both the U.S. and Europe have not much room left to bring interest rates down.

Is Mrs. Yellen caught between the proverbial rock and a hard place?

Potentially yes, but it could be that this deflationary scenario is exactly what she wants. Or what to think of the scenario in which she created this situation. As we explained in our latest article, we believe it is fair to think that Mrs. Yellen has created this scenario on purpose. The thinking behind this is that her relentless endeavor to raise interest rates will undoubtedly make things worse; so at a certain pint, she has to intervene and come out as the big hero who ‘saved the world’ (similar to what Mr. Bernanke did in 2009). Fact or conspiracy? We will never know for sure, but one should not exclude this scenario.

Trying to determine what is going to happen in the markets in the coming weeks and months is a fool’s game as there is always the possibility of intervention of central banks. But as long as they don’t intervene, it seems an easy call that commodities will continue their downtrend, and that they will take emerging markets and most key stock markets of the world with them. We are seeing the first cracks even in the U.S. stock market now, undoubtedly the strongest worldwide in the last 3 years.

Ironically, in such an environment U.S. Treasuries seem to do well as they attracted quite some inflows of money last week, according to an article on Zerohedge based on data of Bank Of America. However, would Mrs. Yellen decide to raise interest rates, then bonds would see a strong outflow, according to our view.

So here is the trilion dollar question: where is your money safe going forward? We have to say that these are rough markets, and the challenge to be successful is becoming bigger with the day. Meantime, having sufficient cash and remaining at the sideline seems to be a good strategy.

As far as commodities and precious metals are concerned, we will release a special edition of the next Commodity Report and the Gold & Silver Report. In it, we will focus on the debt position of the companies we are featuring. Given the long anticipated interest rate increase, some of the companies will be hit very hard.

So if this commodities and precious metals crash is setting up for a buying opportunity, it will only be for a very select number of companies.

Secular Investor offers a fresh look at investing. We analyze long lasting cycles, coupled with a collection of strategic investments and concrete tips for different types of assets. The methods and strategies are transformed into the Gold & Silver Report and the Commodity Report.

Follow us on Facebook ;@SecularInvestor [NEW] and Twitter ;@SecularInvest

Source - http://goldsilverworlds.com/

© 2015 Copyright goldsilverworlds - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.