QE Fails In Japan: Inflation Nonexistent, Consumer Spending Drops, More Ease Coming

Interest-Rates / Quantitative Easing Aug 01, 2015 - 08:38 AM GMTBy: John_Rubino

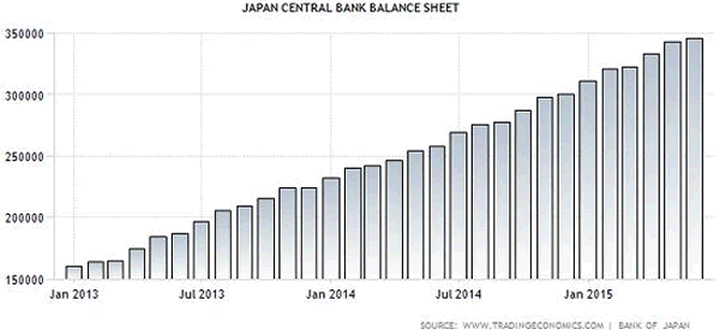

After nearly three decades of stagnation, Japan in 2013 went all-in, ordering its central bank, the Bank of Japan, to buy pretty much every bond on the market with newly-created yen. The BoJ's balance sheet -- a rough proxy for the amount of money it has created and dumped into the economy -- soared at a rate that dwarfs, in relation to GDP, the US Fed's QE programs.

After nearly three decades of stagnation, Japan in 2013 went all-in, ordering its central bank, the Bank of Japan, to buy pretty much every bond on the market with newly-created yen. The BoJ's balance sheet -- a rough proxy for the amount of money it has created and dumped into the economy -- soared at a rate that dwarfs, in relation to GDP, the US Fed's QE programs.

But it's not working:

Japan's Consumer Prices Rise Fractionally While Spending Drops

(Bloomberg) - Consumer price gains in Japan remained little more than zero in June while household spending dropped, challenging the central bank's effort to spur inflation.Consumer prices excluding fresh food rose 0.1 percent from a year earlier, fractionally better than economists estimated. The same measure for Tokyo showed a 0.1 percent decline.

JPMorgan Chase & Co. and Barclays Plc are among economists estimating a second-quarter contraction that could sap momentum in inflation that BOJ chairman Kuroda predicts will pick up later this year.

"I can't see when the BOJ will be able reach the 2 percent inflation target at all," Yasunari Ueno, chief market economist at Mizuho Securities Co., said before today's data. "It appears to be a matter of time before the BOJ adds monetary stimulus."

Oil has tumbled more than 50 percent from last year's high, squelching early progress that the BOJ made with unprecedented monetary stimulus in reflating the economy. Consumer prices excluding food and energy increased just 0.6 percent in June from a year earlier.

Household spending, which dropped in 14 of the past 15 months, fell 2 percent in June from a year earlier. Retail sales data released earlier in the week showed a 0.8 percent drop from May while industrial production provided a bright spot, rebounding more than expected.

There isn't enough momentum in Japan's economy to drive up inflation, said Yoshiki Shinke, an economist at Dai-ichi Life Research. He sees a contraction as deep as 2.5 percent last quarter, driven by weaker exports and consumer spending.

Most economists see the BOJ failing to reach its goal in its timeframe, with 22 of 35 in a Bloomberg survey this month forecasting that the bank will eventually bolster stimulus.

Japan is bit of a special case because its population is aging faster than any other. The country's stores now sell more adult diapers than baby diapers while its seniors commit more crimes (mostly shoplifting for necessities) than its teenagers. In that kind of environment it's not clear that any amount of money creation will produce healthy growth.

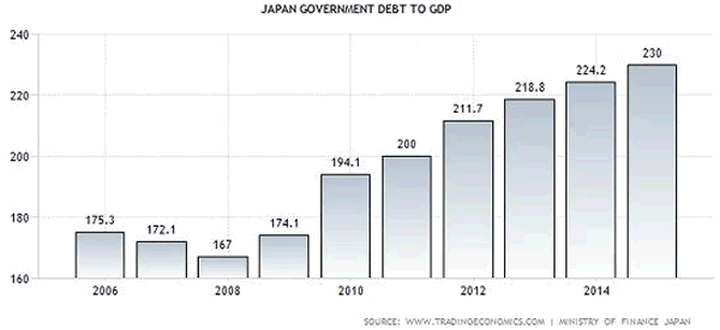

But giving up isn't an option because debt continues to soar. The following chart is a slow-motion train wreck:

So, as the above article notes, "It appears to be a matter of time before the BOJ adds monetary stimulus."

Which means that Japan will be the first nation to test the modern limits of debt monetization. Specifically, what does a central bank do when it has bought all the bonds in its economy and the politicians demand even more? Does it become the country's largest landlord by buying up office buildings and apartment complexes? Or the largest hedge fund by vacuuming up blue chip equities or small caps or derivatives?

Whatever the specifics, at a certain point (arguably already achieved by most of today's major central banks) it damages the price signaling mechanism that defines free markets beyond repair.

By John Rubino

Copyright 2015 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.