What Microsoft’s Dismal Earnings Report Really Tells You

Companies / Microsoft Aug 02, 2015 - 05:06 PM GMTBy: ...

MoneyMorning.com

Keith Fitz-Gerald writes: The markets are quiet right now, even the typically volatile technology sector. But as the saying goes, past is prologue. Recent events surrounding Microsoft Inc. (NYSE:MSFT) presage big investment opportunities to come.

Keith Fitz-Gerald writes: The markets are quiet right now, even the typically volatile technology sector. But as the saying goes, past is prologue. Recent events surrounding Microsoft Inc. (NYSE:MSFT) presage big investment opportunities to come.

Microsoft’s latest earnings report landed with a resounding thud last week, catching millions of investors by surprise and prompting yet another round of debate about where to invest your “tech” dollars.

The bulls argue this is par for the course given that Microsoft is retrenching while the bears maintain the company has a long way yet to fall.

Thing is…both camps are wrong.

Today we’re going to talk about why and, in keeping with what we do around here, talk about where you can put your money instead. Then, I’m going to share a simple Total Wealth Tactic you can use to maximize your returns.

With a $4 trillion market on the line, it’s information and perspective you won’t want to miss.

Here’s How To Get the Most Bang For Your Tech Bucks

Microsoft’s latest earnings report rocked headlines when it hit. Not only did the company report a year over year revenue slump of 4%, but it simultaneously posted a $3.2 billion loss – the worst ever – thanks to a write down related to last year’s Nokia acquisition and a 68% slowdown in Windows revenue.

As usual, the tech community immediately split into two camps that are sharply divided by the bullish and bearish implications.

Microsoft bulls like UBS analyst Brent Thill argue that the slump is logical under the circumstances. They believe that the company needs to take a breather as it absorbs Nokia and simultaneously pivots to address market share in new sectors. To make their case, they point to MSFT’s commercial software business, which has grown by a robust 26% from the beginning of 2014 to the end of the most recent quarter.

Microsoft bears point to stagnant demand in almost every other Microsoft business segment and, most notably, cratering Windows revenue.

Here’s the thing…both camps have a myopic view.

By focusing on individual business segments, they are effectively blinding themselves to the bigger picture not to mention the profits that come with it.

Microsoft bulls and bears are splitting hairs. Effectively they’re arguing over spilt milk when, in reality, their entire industry may be disappearing at a rate faster than Microsoft’s growing.

As we have discussed many times, the far more profitable approach is to begin with our 6 Unstoppable Trends then find a company making must-have products that it sells into the one or more of them.

The Microsoft situation reminds of Dell.

That company exploded onto the computer scene in 1984 and ultimately derailed Compaq, HP and IBM. Analysts were convinced that it would dominate the computer business when sales topped $28.4 billion in 2002. Instead, Dell continued to grow into an industry that entered a downward spiral.

Just as PC’s took away the need for mainframe computing, physical connectivity a la Microsoft is giving way to wireless connectivity. Ultimately it will move to embedded connectivity and computational capacity that resides in everything from your refrigerator to your flooring.

What Microsoft’s earnings really tell me is that the markets are moving on. The fact that analysts are fighting over what they see in the rearview mirror is a dead giveaway that you need to be looking over the horizon.

Most immediately that means the “cloud.”

Chances are you’ve heard the term, given that it’s one of the most commonly cited technology buzzwords of our day.

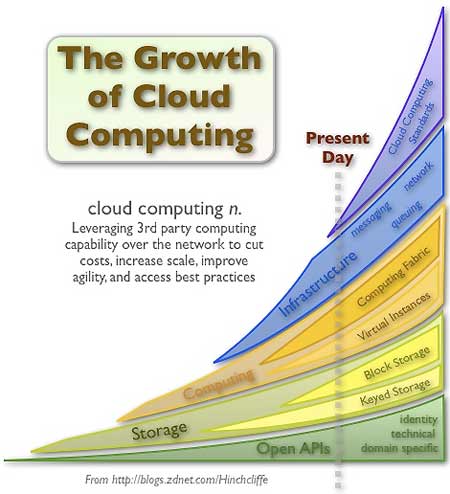

If not, here’s a two second primer. Cloud computing is the increasingly widespread practice of using a network of remote servers hosted on the Internet to store, manage and process data, rather than a local server, personal computer or even a handheld device.

There are any number of benefits to cloud computing ranging from more efficient computing itself to lower infrastructure costs, faster innovation and more profitable operations. The business case is well understood.

But what most people are missing is the sheer scale involved and the speed at which cloud computing is growing. And that, by implication, means they’re missing out on the huge opportunities that go with it, too.

Cloud computing amounted to a mere $16 billion market in 2014. Three years from now it’ll be a $286 billion market and a key component of the $4 trillion information technology market Gartner sees growing by 1,687% over that time frame.

With that kind of potential, do you really care if Windows fails or Microsoft overpays for another company like Nokia?

I don’t.

Not when the future quite literally looks like this.

Everything to the right is tomorrow’s opportunity and, by implication, where you want to invest your money if you’re interested in maximizing profits.

The best way to get started is to use the Total Wealth Tactic of Counterbalance.

This means you are going to establish a core first then move on to ancillary positions that effectively “balance” both the risk and reward.

Right now that means Google (NasdaqGS:GOOG), Apple (NasdaqGS:AAPL) and Amazon.com (NasdaqGS:AMZN).

They’re big, they’re well funded and they’re absolutely at the top of their game. Every one of them has 3-5 key cloud technologies inside that are not yet reflected by current market prices. More importantly, though, it will be very hard to lose money over time with your core positions if you’ve chosen them correctly.

Use new investments to balance those positions with smaller, more speculative companies. Again, your priorities are all to the right of the line and in each of the segments you see in the chart above. I’ll have a few suggestions in the months ahead.

Oh, and if you’re one of millions of investors holding Microsoft?

I’d think twice about the opportunity cost associated with holding on to the past when you’ve got the potential to grow your money a whole lot faster by tapping into the future.

Until next time,

Keith Fitz-Gerald

Source :http://totalwealthresearch.com/2015/07/what-microsofts-dismal-earnings-report-really-tells-you/

Money Morning/The Money Map Report

©2015 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.