German-US Bond Yield Spread Breaks Out

Interest-Rates / International Bond Market Aug 13, 2015 - 06:48 PM GMTBy: Ashraf_Laidi

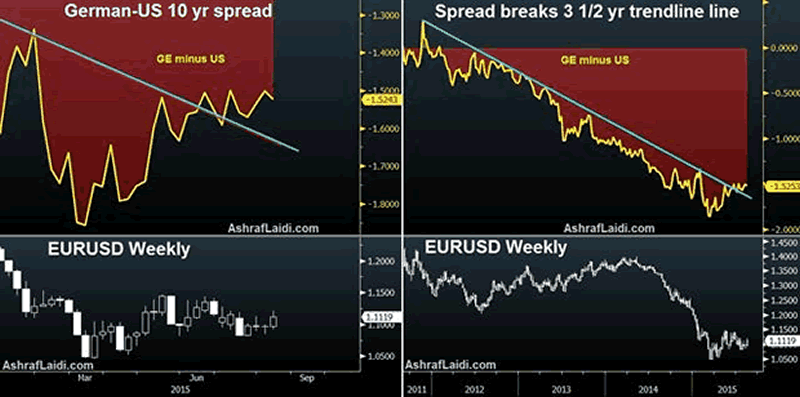

Bond yields fell across the board since mid-June, but the more meaningful fact for currency traders remains yield differentials. For EURUSD watchers, the rate of decline in 10-year bund has been slower than its US counterpart, which led to a stabilisation in the German-US spread (not US-German) to the extent of breaking above an important 3 ½ year trendline.

Today's release of US July retail sales rose by a robust 0.6%, with the bulk of the sales occurring in autos and online, while sales in department stores and of electronics were negative.

The dissipation of Greece risks and near deal with creditors has cemented stabilisation of the single currency, while the probability of a September Fed hike hovers between 40% and 50%. The disinflationary consequences of further CNY weakness could still occur as long as the CNY does not reverse its recent declines.

A deeper CNY devaluation may not be in the cards, but it is somewhat too late to avoid disinflation risks from China when the post-devaluation action suggests the currency will remain neutral-to-weak following an established 50% decline in oil prices over the past 13 months, including a 30% decline since May.

EURUSD today ended a 5-day winning streak, which was the longest since April. The last time the pair had risen 7 days in a row was in December 2013. We stick with our view that the peak of the US dollar bull market (measured in USDX) is already behind us.

Our EURUSD long opened six days before the Aug 7 release of the US jobs report at 1.1020 remains in the green, and is halfway its final target. A fresh update is due today, alongside the other five existing Premium trades.

For more frequent FX & Commodity calls & analysis, follow me on Twitter Twitter.com/alaidi

By Ashraf Laidi

AshrafLaidi.com

Ashraf Laidi CEO of Intermarket Strategy and is the author of "Currency Trading and Intermarket Analysis: How to Profit from the Shifting Currents in Global Markets" Wiley Trading.

This publication is intended to be used for information purposes only and does not constitute investment advice.

Copyright © 2015 Ashraf Laidi

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.