Asia's Whirling Dervish of Devaluations Has Encircled China's Exports

Currencies / Currency War Aug 19, 2015 - 05:10 PM GMTBy: Keith_Hilden

Much digital ink has been spilled to the catalyst of China's sudden thrice devaluation of the CNY, a move trumpeted to be a unilateral action by China. It makes for good headlines, but this simply is not the case: China has been responding to stealthy and not-so-stealthy devaluation of its Asian neighbors, and is responding to these actions to maintain competitiveness of its exports. Hence a whirling dervish of devaluations has started in unlikely small countries such as Malaysia and Thailand, as well as larger economies like Japan, and China has only recently taken its place in the spiraling revelry that is set to ensue. And this has effectively economically encircled China's exports-- and the balance sheets of Chinese companies show it.

Much digital ink has been spilled to the catalyst of China's sudden thrice devaluation of the CNY, a move trumpeted to be a unilateral action by China. It makes for good headlines, but this simply is not the case: China has been responding to stealthy and not-so-stealthy devaluation of its Asian neighbors, and is responding to these actions to maintain competitiveness of its exports. Hence a whirling dervish of devaluations has started in unlikely small countries such as Malaysia and Thailand, as well as larger economies like Japan, and China has only recently taken its place in the spiraling revelry that is set to ensue. And this has effectively economically encircled China's exports-- and the balance sheets of Chinese companies show it.

This in turn has been met with a swift devaluation further of ASEAN currencies almost across the board- Mongolia and Cambodia stand out as exceptions to the rule and have pursued a relatively steady monetary policy. China has been reacting to its neighbors and actually has exercised patience and caution in its delay for so long before finally on August 11 deciding to take the renminbi on the next rung downward.

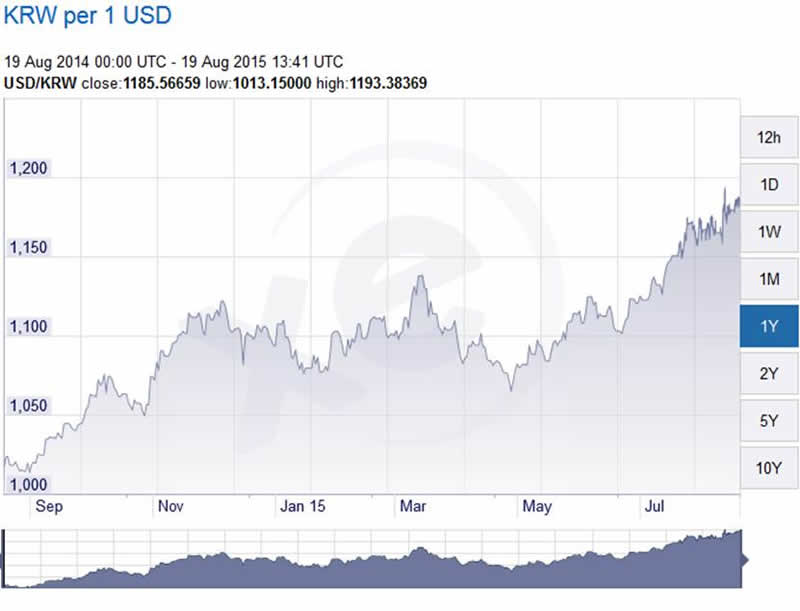

Here are some charts for consideration:

In this XE USD/THB chart, we can clearly see that the majority of Thailand's devaluation, which made the Baht almost a 10% handle cheaper than its level back in May.

We can see the same pattern in this XE USDMYR chart, with the devaluation clearly starting back in May. Note that in both of these times, the USD/CNY rate was essentially stable during this same time period. Notice also the over 30% devaluation of the Malaysia ringgit during this 1 year period. With other nations besides Malaysia in the currency world essentially throwing a liquidation sale on their entire country, how was China not to respond to this? Of course a renminbi devaluation was imminent, as China was only going to tolerate so many stealthy and at times blatant slashing of neighbors' currency values-- this was an inevitable response by the Chinese leadership.

We also saw Korea taking up its place at the devaluation table as well with this XE chart, with the May devaluation call sparking an over 10% devaluation in the Korean won.

And this XE chart shows that all of this was taking place as the renminbi appreciated over 20% to the Euro! This only further exacerbated pressure upon China, all the while its Southeast Asian neighbors were putting out a veritable yard sale on their currencies! China was able to eke out a little bit more than 5% after it hit the EURCNY trough back in April, but that was it!

So you clearly see the immobility of the renminbi against such a backdrop to be clearly disadvantaged to the Chinese position, and so the economic balance was restruck with the PBOC's hat trick slash of the renminbi we witnessed.

And this XE chart shows the world's third largest economy seems to be the catalyst that set everything off- Japan. Japan's extremely aggressive Abenomics program set out to drastically slash the Yen in favor of the Japanese keiretsu interlocking family of companies in Japan, so that their export quarterly numbers may be preserved. And the CNY didn't like it one bit- herein lies the smoking gun.

Witness the 60% devaluation of the Japanese yen against the Chinese renminbi and fully understand WHY China has been having such economic difficulties in recent years--- the Euro has surged against the RMB, and its Asian neighbors, with Japan as catalyst, has encircled China's export sector by means of currency devaluations, with Japan ekeing out a 60% competitiveness bonus against Chinese exports!! This was a whirling dervish of massive ramifications that China surely was not going to sit out on! And so they devalued with a PBOC hat trick in recent days-- and these charts show us that we have only seen the beginning.

Further exacerbating this force is the untimely and unfortunate blast incident in Bangkok that has claimed multiple lives-- including those of Chinese tourists. This occurs against a backdrop of Prayuth Chan-Ocha, Thailand's leader, clamoring for an aggressive bid to attract more Chinese tourists to challenge all-time-high tourist arrivals in recent years, amid much squawk in Thailand to further devalue an already discounted baht. The recoil in Chinese tourism to Thailand in wake of the blast will only push a hard-line Prayuth to further enforce the tourism goal mandate and further weaken the baht in turn. And hence the mahjong roundtable of devaluations continue as neighbor countries react to Thailand's devaluation to attract more Chinese tourists- and industry.

That's right, the catalyst towards ever more aggressive monetary policy lies in the mandate to attract more Chinese factories in the new China + 1 manufacturing design plan that is enriching the production of all Southeast Asian countries at this moment. China's devaluation of the RMB comes days before finalization talks cementing the TPP in place, yes, and it certainly is strategically convenient, and serves to take a bit of steam out of the American engine of trade engagement, but this is not the whole story. China knows that regardless of the outside perception of aggressive renminbi devaluation, all it can do is buy time before the inevitability of the shift of production to its Southeast Asian neighbors as the Middle Kingdom undergoes a structural transformation. Chinese firms have been embracing this reality, and hence the surge in Chinese and Taiwanese factories migrating to countries such as Vietnam is the reality on the ground nowadays.

The Japanese and Koreans have seen the writing on the wall already; they know the future of manufacturing lies in Southeast Asian locales and no longer sole domain of the Middle Kingdom. This explains the heavy surge of FDI into such countries as Vietnam as giants like Lotte and Samsung reposition themselves to be at the center of a TPP production member-state, while simultaneously being in close proximity to China to be able to serve the region there as well. Vietnam has been slashing taxes for the Koreans and Japanese that choose to produce here, in some cases even offering tax-free incentives in a win-win tradeoff to bring a higher level of livelihood to the Vietnamese people.

Essentially for frontier nations in this region, we are seeing hallmarks of 1998-2002 China-like conditions at the very beginning of the ascent of China's regional economic breathtaking rise. And conditions are being aggressively set by Vietnamese and other regional government authorities to ensure that the developmental baton is passed to these countries as they take on an increasingly complex array of manufacturing operations, even to the point of almost completely autonomous factories controlled by robots producing such output as green agriculture and other products. Chinese firms see the writing on the wall and at the very least have an increasing realization that their production will have to be diversified outside of China's borders, especially to tap into the increasing web of condition-based trade agreements that require over a certain percentages of production to be originated or processed in that country. We are finally seeing the benefits of globalization being more widely distributed to frontier and emerging market nations, rather than production being largely centered in just 1 or a handful of countries. And this is a boon for frontier markets and the equities that reside within them.

Above: A lady I ran across in Ho Chi Minh City, Vietnam, donning the traditional Vietnamese non la hat, while gabbing away on a smartphone.

Market capitalization of equity markets in comparison to the total output of each country is extremely low in frontier markets-- these markets are thus essentially structurally undercapitalized. And as their markets reach normalized equitization levels, there is naturally a rise in the value of the equity markets in these countries. Our view is that targeting the countries very likely to see a rise in manufacturing due to the China + 1 manufacturing strategy, and thus a rise in the broader economy, are solid long term equity plays. With these countries, you are essentially betting upon the outcome that the livelihoods of the peoples of these countries will increase-- that you will see more people like the lady above, garbed in traditional dress who nevertheless demands the latest in technology. This all results in the long run in a more robust consumerism, we find this a solid bet to make in our view of the outlook of Southeast Asian economy trajectories for years to come.

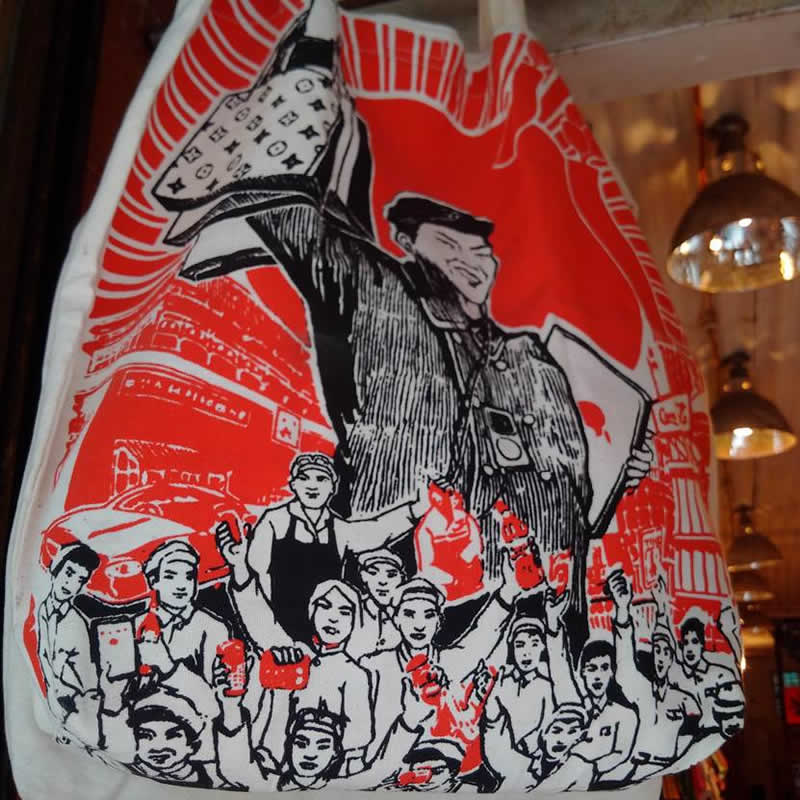

Or, as pictures-- or a shopping bag I found along Saigon's streets-- says 1,000 words, witness the evolution of Southeast Asian countries undergoing reform-- and embracing THIS. This is your Southeast Asian equity portfolio in 5 years time.

Keith Hilden is the founder of Squawkonomics. He holds a degree in Economic Crime Investigation and has CFE training, and is fluent in Mandarin. He also researches Asia Pacific markets and Cyber Security for geopolitical consultancy Wikistrat.

By Keith Hilden

Keith Hilden holds a degree in Economic Crime Investigation and has CFE training. He is an Asia Pacific markets and Cyber Security Researcher for geopolitical consultancy Wikistrat, and researches frontier markets in developing countries and digital currencies on Squawkonomics.

Squawkonomics is focused on delivering multi-dimensional media and business intelligence products on emerging and frontier markets, to assist companies with their market entry strategy and market research needs. Employing a team of capable analysts, Squawkonomics provides first-hand business insights from the best sources and synthesizes them into perspectives that understand markets like never before. Currently based out of Taipei, Taiwan, and with operations in Thailand, China and Canada, Squawkonomics offers an unparalleled glimpse into a whole new economy. Contact us on Twitter, Facebook, or info@squawkonomics.com.

© 2014 Copyright Squawkonomics - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.