Crude Oil Energy Markets and Jobs Disintegrating

Commodities / Crude Oil Aug 19, 2015 - 05:15 PM GMTBy: Dan_Norcini

The US Energy Information Administration released their weekly data this morning as usual. The reaction to the data from crude oil was anything but the usual. Most everyone in the industry was looking for a draw in crude oil stockpiles especially after yesterday afternoon’s API data showed a reduction in supplies.

The US Energy Information Administration released their weekly data this morning as usual. The reaction to the data from crude oil was anything but the usual. Most everyone in the industry was looking for a draw in crude oil stockpiles especially after yesterday afternoon’s API data showed a reduction in supplies.

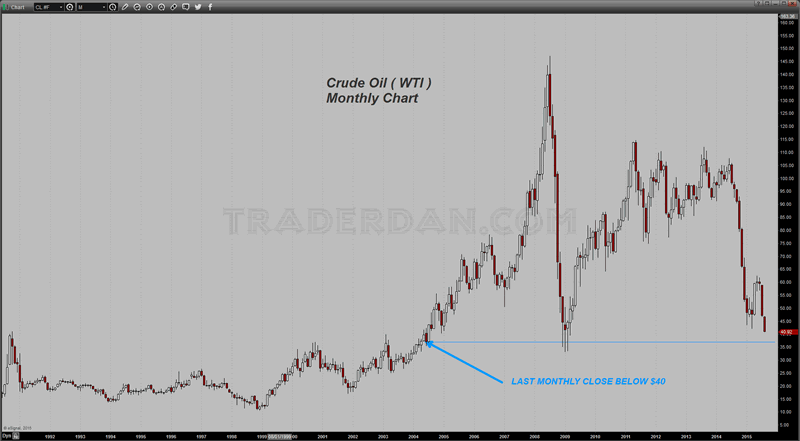

Instead of confirming a drawdown, EIA instead showed an increase of 2.6 million barrels. Whoops! Down went crude oil with a vengeance. Folks, this is getting downright scary to me. Crude oil has been trying to hold above round number and psychological support at the $40 level. Remember, it has not had a MONTHLY CLOSE below that level since JUNE 2004. We are talking more than ELEVEN YEARS ago. Yet here we are once again flirting ever so dangerously with that level and there are still yet 9 trading days remaining in the month of August.

I am of the view that if crude were to close the month of August below $40, it could very well descend to $35. Perhaps that is what is needed to send the US shale oil industry into even more of a contraction mode. But I think of the loss of jobs and how that is going to negatively impact the oil and gas sector moving forward.

That has been one of the few very high paying sectors remaining in an otherwise moribund labor market. Take that away and then what? Also, the ripple effect throughout those small towns associated with the shale rig locations will be enormously devastating.

While we consumers will certainly benefit from reduced energy prices, one does wonder what, if any, segments of the US economy are going to be showing any upward signs of wage pressures as we move ahead. It was not even a year ago when the oil patch could not attract enough skilled workers in spite of paying some very good wages. That is all gone now.

With the man child running the nation killing the coal industry, with oil and natural gas getting obliterated, what’s left for energy related jobs – building windmills that mangle birds to shreds and turn the landscape into something out of a Jules Verne Sci-Fi novel?

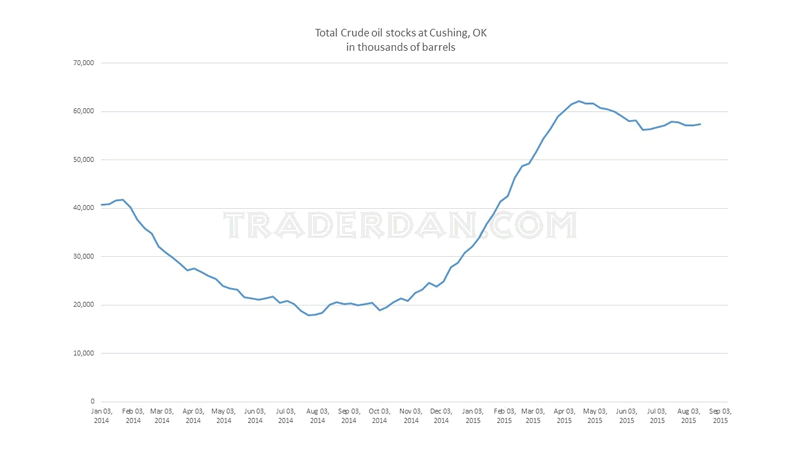

By the way, here is the updated weekly chart of stocks in Cushing. As you can see, they went up this week.

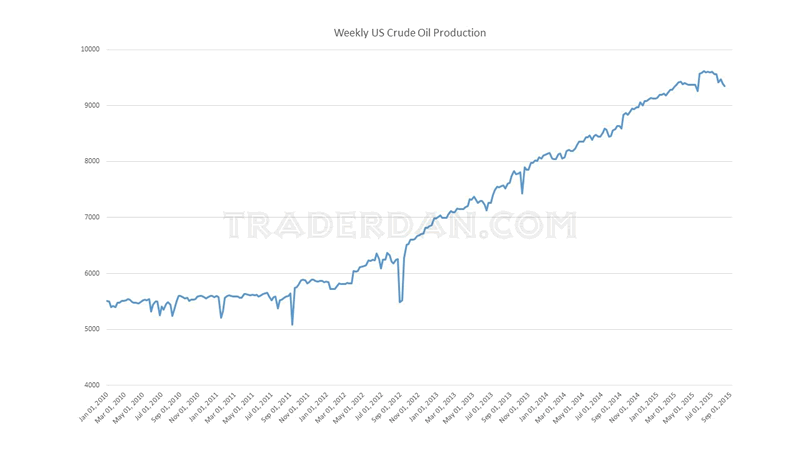

About the only good thing I could see in this report is that daily production actually dropped. That is helpful but right now, the market is focusing on the build in supplies. Also, it is looking at the refinery usage rate. That fell a complete percentage point to 95.1%. While that was not unexpected given the fact that some refineries plan outages this time of year for maintenance, it does not help when supplies build and usage falls. That signals falling demand from refiners which at this time, is exactly the OPPOSITE of what this market needs.

AS of this moment, crude oil has taken out this week’s low and in the process set a fresh, six year low.

Dan Norcini

Dan Norcini is a professional off-the-floor commodities trader bringing more than 25 years experience in the markets to provide a trader's insight and commentary on the day's price action. His editorial contributions and supporting technical analysis charts cover a broad range of tradable entities including the precious metals and foreign exchange markets as well as the broader commodity world including the grain and livestock markets. He is a frequent contributor to both Reuters and Dow Jones as a market analyst for the livestock sector and can be on occasion be found as a source in the Wall Street Journal's commodities section. Trader Dan has also been a regular contributor in the past at Jim Sinclair's JS Mineset and King News World as well as may other Precious Metals oriented websites.

Copyright © 2015 Dan Norcini - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

Dan Norcini Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.