OPEC Divorce And Self-Destruction Thanks To Saudi Crude Oil Strategy?

Commodities / Crude Oil Sep 01, 2015 - 06:44 PM GMTBy: OilPrice_Com

"If you are the world's leading energy economy, you produce energy, that's what you do."

"If you are the world's leading energy economy, you produce energy, that's what you do."

"A government can stay irrational longer than it can stay solvent."

"Even in the short term, you're dead, if you commit suicide."

The first quote modifies a GEICO commercial describing a free-range chicken (If you're a free range chicken, you roam free, that's what you do), the second, the famous John Maynard Keynes quote about markets (The market can stay irrational longer than you can stay solvent), the third, another famous Keynes quote (In the long run, we're all dead).

Together, the three quotes provide a framework for analyzing Saudi options heading into the December 4 OPEC meeting in Vienna and its choices vis-à-vis the OPEC outsiders (all members but Saudi Arabia and its Gulf Arab allies, Kuwait, UAE, Qatar) - reconciliation, separation, or divorce.

If You're a Free Range Oil Producer...

Despite low oil prices, Saudi Arabia is maintaining its investment in its oil industry. Saudi Aramco Chairman Khalid Al-Falih indicated in March that Saudi Aramco would not cut investment. James Crandell, a Cowen & Co. oil analyst cited in this article, who has tracked oil companies' budgets for many years, estimates that Aramco and its Kuwaiti and UAE counterparts will increase their investment in oil exploration and production in 2015 by 4.5 percent to $38.1 billion. (If proportional to output, the Saudi share would be $24.5 billion).

On it's website, the Saudi Arabian General Investment Authority (SAGIA) identifies Saudi Arabia as the world's premier energy economy, describes the outlook for the Saudi energy sector as never having been brighter or more secure and poised for unprecedented growth, diversification, and profitability, and asserts that the high oil revenue environment has spurred a boom in both oil and non-oil development projects.

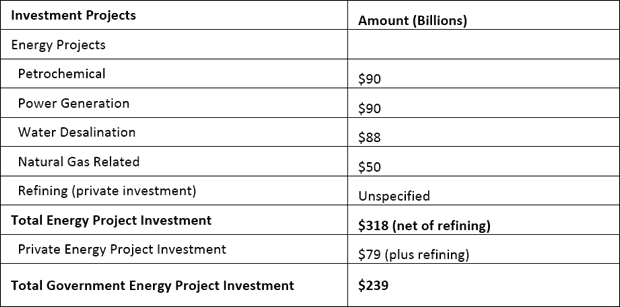

SAGIA is not making idle claims. It lists energy-related projects totaling $318 billion (no timeframe specified), which is, in SAGIA's words, "large-scale capital spending [is] applied to building new capacity and expansion of existing facilities." Of this, the Saudi government will finance $239 billion, while private investors will finance $79 billion, as well as investments in refining (which it does not specify).

If You're a Government...

According to an August 26 Bloomberg article, the Saudi government is seeking ways to "reduce investment in 2016 "...as the drop in oil prices over the last year has put a strain on the nation's finances."

In fact, Saudi government revenue and expenditure data suggest that the Saudis must do far more than "reduce investment" in 2016: the precipitous drop in oil prices -- a consequence of their new policy -- has put Saudi Arabia on an unsustainable financial path.

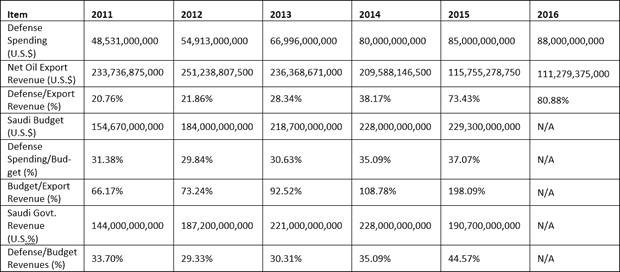

The two tables that follow, which should be viewed as directional rather than precise since some input data is estimated, illustrate the severity of the Saudi financial challenge. The first shows that Saudi defense spending -- a Saudi priority, given its external conflict with Iran and its internal security situation -- has steadily increased as a percentage of Saudi net crude export revenue (export revenue minus Saudi Arabia's estimated $5 production cost), the planned annual Saudi government budget, and the planned annual government revenue (budget/revenue data from the U.S-Saudi Arabian Business Council), and that will reach an estimated ~73.4 percent of net crude export revenues in 2015, as these revenues fall nearly 50 percent from 2014. Were Saudi defense spending to be financed entirely from net oil export revenues in 2015, the spending would consume ~73.4 percent of these revenues.

Given they depend largely on imported defense equipment, services, and expertise, and crude revenues reportedly comprise 90 percent of Saudi budget revenue, it is clear that net crude export revenue is critical to financing the Saudi military.

The defense spending for 2011, 2012, and 2013 draws on the Stockholm International Peace Research Institute (SIPRI) Military Expenditure Database Constant U.S. dollar spreadsheet. In a CNN article quoting SIPRI for 2014, the author's guesses for 2015 (6.25 percent increase) and 2016 (3.5 percent increase), based on Saudi Arabia's conflict with Iran.

Net export revenue is based on average annual OPEC Basket prices for 2011, 2012, 2013, and 2014 of $107.46, $109.45, $105.87, and $96.29 respectively, with an estimated $51.81 for 2015 (based on actual average monthly prices through August of 53.97 and $50 from August through December), and $50 (undoubtedly too high or too low) for 2016. Annual export volume is based on the IEA's monthly Oil Market Report's Table 2 (Summary of Global Oil Demand) and Table 3 (World Oil Production). Export revenues are net of $5/barrel production cost.

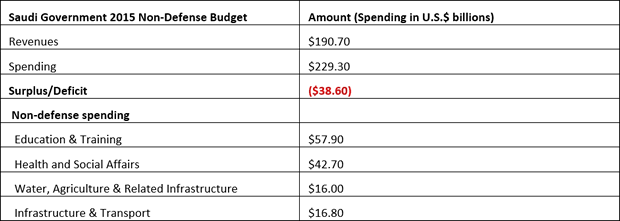

However, defense spending isn't the only claim on net crude export revenues, the Saudi budget, and budget revenues. The U.S.-Saudi Arabian Business Council provided the following data on the Saudi government's 2015 budget. It puts totalnon-defense spending at $163 billion, which is 71.43 percent of the 2015 budget and 85.89 percent of 2015 budget revenues:

Adding estimated defense spending ($85 billion) and the U.S.-Saudi Arabian Business Council's data on non-defense spending ($163 billion) yields Saudi government spending that totals $248 billion, or 204.5 percent of estimated net crude export revenues (versus 118.3 percent of 2014 net export revenues).

Much Higher Volume and/or Much Higher Prices

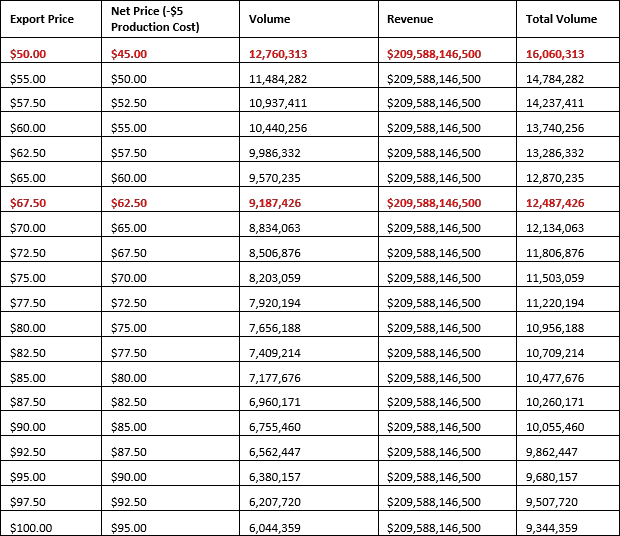

The net export revenues Saudi crude exports generated in 2014 are, simply put, impossible to attain given Saudi policy. The following table shows how much crude the Saudis would have to export in 2015 at various OPEC Basket price points to match the revenue their crude exports generated in 2014 (based on 2015's 6.31 mmbl/day average exports (IEA data) at the 2014 average OPEC Basket price of $96.29 per barrel (minus $5 production cost).

Their exports would have to reach ~12.7 mmbl/day in 2015 -- ~6.4 mmbl/day more than 1H 2015 average daily exports -- at a $50/barrel export price ($45 net of production cost) to generate the same revenue 2014 crude exports generated.

This implies total domestic production at ~16 mmbl/day, 3.5 mmbl/day than capacity), given domestic consumption at 3,330,000 barrels/day (IEA). Were production total IEA estimated capacity, 12.5 mmbl/day, exports could reach ~9.2 mmbl/day -- 2.9 mmbl/day more than it currently exports. $67.50/ barrel would be needed to generate the same revenue as in 2014. (In current market conditions, increasing exports by 2.9 mmbl/day would drive global prices below the August 26 OPEC basket price of $40.51).

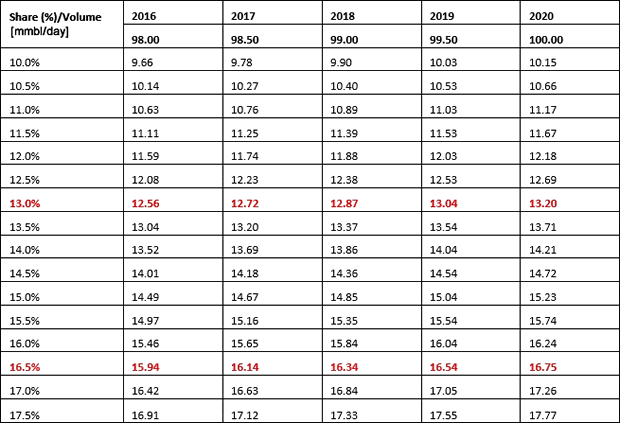

Since 2011, the Saudi share of global output has ranged from 10.2 percent (2011) to a maximum of 10.5 (2012), and averaged 10.4 percent in the 1H 2015. Producing at current maximum output (~12.5 mmbl/day) equates to a 13 percent global share. The following table shows the Saudi output required to maintain a 13 percent share of global output through 2020, assuming 2016 output at 98 mmbl/day and net increases of 500 mbls/day annually through 2020. (At 16 mmbl/day, the Saudi share would be 16.5 percent).

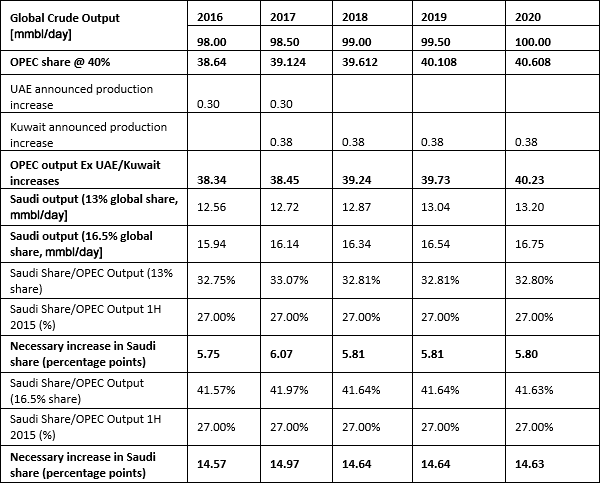

Reaching both 12.5 mmbl/day and ~16 mmbl/day output levels would require a forceful offensive against other OPEC members -- in other words, the OPEC outsiders. Since 2011, OPEC's share of global crude output has ranged from ~39 percent-to-41 percent. The following table shows that the increase in Saudi share of OPEC output that a 13 percent and 16.5 percent global share would require through 2020, assuming the Saudi increase in output came exclusively from OPEC, and taking into account the production increases the Saudi's Kuwaiti and UAE allies have announced (the distribution of the increases by year is arbitrary).

If You're A Free Range Oil Producer, Do You Produce Even More Even If It's Irrational?

A recent article on Oilprice.com lays out a strong case for Saudi maintaining its current offensive against other oil producers.

This article shows that the Saudis cannot achieve, or even come close to, their estimated 2014 net export revenue if they prolong their current strategy. They can't achieve the output necessary at a $50/barrel OPEC basket price (16.5 mmbl/day), and they are unlikely to achieve the $67.50 OPEC basket price they need at their 12.5 mmbl/day maximum production capacity, since the additional 2.4 mmbl/day output (and exports) over 1H 2015 average output would drive prices further down.

This doesn't mean the Saudis won't stay the course despite its peril to their own situation. To repeat the two modified Keynes quotes at the beginning of this article:

"A government can stay irrational longer than it can stay solvent."

"Even in the short term, you're dead, if you commit suicide."

By Dalan McEndree for Oilprice.com

© 2015 Copyright OilPrice.com - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

OilPrice.com Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.