Crude Oil, Silver, Gold and Real Money

Commodities / Gold and Silver 2015 Sep 08, 2015 - 02:01 PM GMTBy: DeviantInvestor

I’m not convinced!

I’m not convinced!

- Supposedly crude oil prices will stay low for a long time and perhaps drop into the $20’s. The Internet is filled with reasons explaining why crude oil prices will drop. A few are:

- Saudi Arabia is a swing producer and will provide what the world needs, regardless of price, because Saudi Arabia needs the revenue and employment for its people.

- Iranian oil will soon hit the market and provide even more supply.

- The global economic slow-down will reduce demand and prices for crude oil.

- US shale oil production will remain high because those producers desperately need the revenue for debt service. They will pump all they can and maintain supply.

- US foreign policy wants low oil prices to damage the economies of Russia and Iran. Supposedly there was a deal made with the Saudi government.

- Renewable energy will reduce demand for crude oil.

- US dollar strength will push oil prices lower.

- And many more.

I’M NOT CONVINCED.

- Lower oil prices may be helpful at the gasoline pump but they are deflationary, and central banks absolutely do NOT want deflation. Central banks may not be able to drive oil prices higher directly, but they certainly can drive the value of currencies lower. They have for over 100 years, so don’t expect them to reverse policy now.

- The world needs energy, lots of energy and more every day. Crude oil is an important supplier of the energy required to run modern transportation and economies.

- These low prices will not last, in my opinion. They never have. Further, low prices will bankrupt a number of oil companies, shale companies, and reduce supply. As they say, “the cure for low prices is low prices.”

- At every market bottom one will hear a dozen reasons why prices will go even lower and cannot go higher. Those reasons are often wrong.

- At every market top one will hear a dozen reasons why prices will continue even higher and, except for tiny corrections, cannot go lower. Markets always correct, sometimes harshly.

WHAT ABOUT RELEVANT RATIOS?

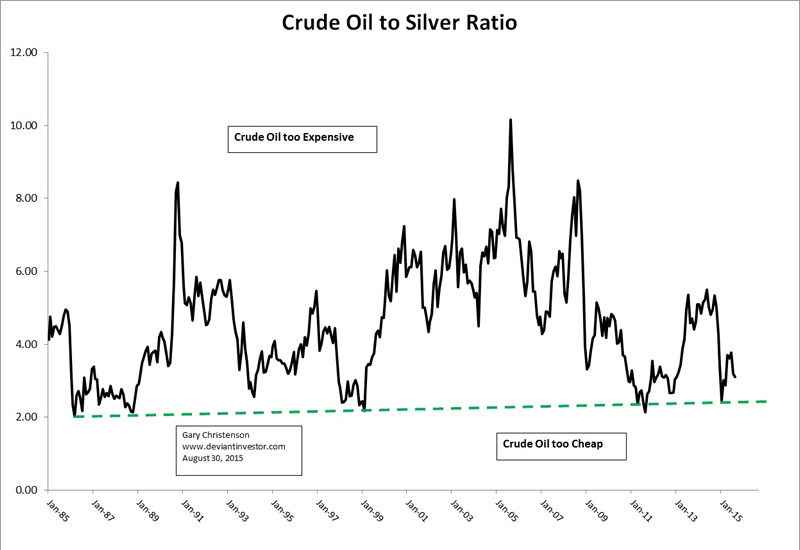

Examine the following Crude Oil to Silver ratio (crude oil priced in real silver) for the past 30 years. Yes, the ratio can drop further, but based on 30 years, it is currently quite low. The most likely next move is a higher ratio.

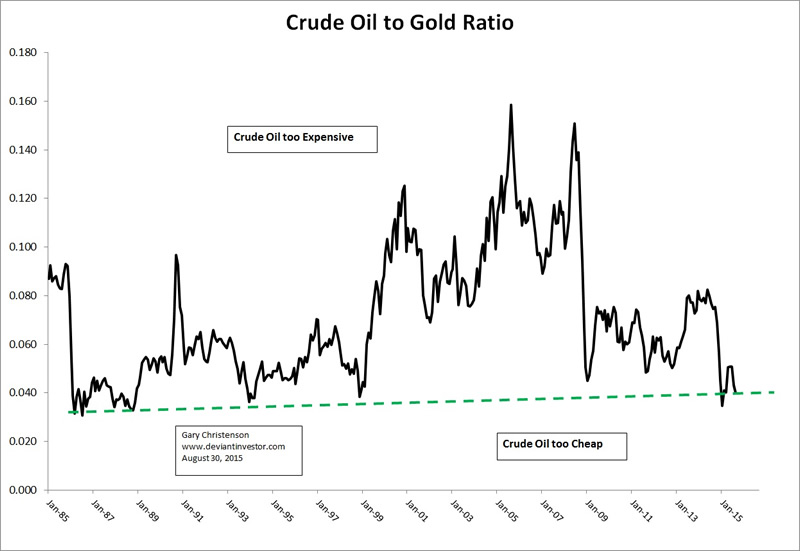

Examine the following Crude Oil to Gold ratio (crude oil priced in real gold) for the past 30 years. Yes, the ratio can drop further, but based on 30 years, it is currently quite low. The most likely next move is a higher ratio.

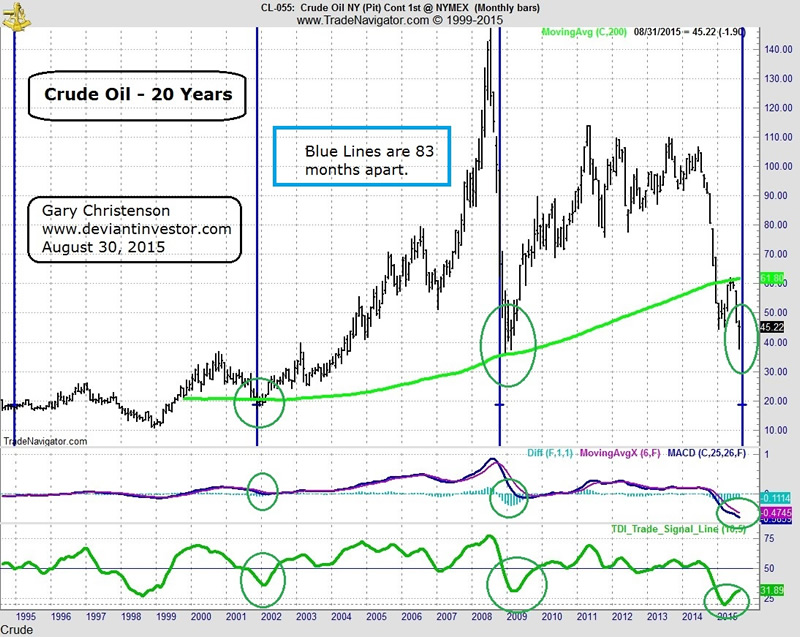

Examine the following 20 year chart of crude oil prices. Note the blue vertical lines that occur every 83 months – about every 7 years. The last two important lows were late 2001 and late 2008. A similar low appears to be occurring now, about August or September 2015.

There is no guarantee that a 7 year cycle will mark a bottom in the crude oil market now or soon. But don’t ignore the possibility.

Other reasons to expect a bottom in crude oil:

- The ratios to silver and gold (above) indicate that crude oil, when priced in real money such as gold and silver, are near 30 year lows.

- The technical indicators (green ovals) suggest that monthly crude oil prices are oversold and ready to turn up.

- The world is pushing toward more war. Higher crude oil prices and war go together.

- Central banks want inflation. They are likely to get it, and more than they want. Crude oil prices will rise as currencies devalue.

CONCLUSION: I’m not convinced that crude oil prices will drop much from here or remain low for many more months. Regardless of the “reasons” listed at the beginning of this article, I think higher crude oil prices are much more likely than lower prices in six months or less.

Gary Christenson

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2015 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.