Empire Fed, Retail Sales, Industrial Production All Miss

Economics / US Economy Sep 15, 2015 - 05:31 PM GMTBy: Ashraf_Laidi

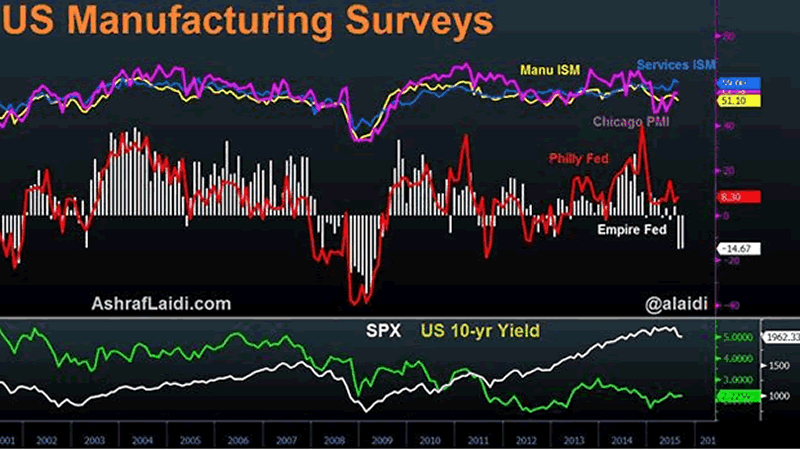

A trifecta of misses in today's US economic releases may not be a game-changer in Thursday's Fed decision because the game is already "unchanged". The September Empire Fed survey posted another double digit decline to remain at 6-year lows, August retail sales rose 0.3% to miss expectations for the sixth consecutive month and industrial production fell 0.4% in August to post seven declines over the past eight months--the worst pattern since 2008-9.

On the bright side, core retail sales (excluding autos, gas and building materials), rose along upward revisions to the prior two months. In the Fed's Empire survey, the employment component turned negative to 6.2 from 1.8, as did the average workweek plunging 10.3 from -1.8. US industrial production was battered by the usual strong US dollar story and weak exports. Manufacturing dropped 0.5%, mining fell 0.6% and utilities were up 0.6%.

Bearish Argument

The bearish side may argue against the robust retail sales by indicating the report was too early to take into consideration the slump in equities, materializing in the 2nd half of the month. The argument becomes especially potent following Friday's release of the preliminary report of the September University of Michigan Sentiment Survey, showing the biggest one-month plunge since late 2012. Thus, the release of US September retail sales, due in mid-October (2 weeks before the FOMC) could potentially disappoint.Bullish Argument

A more optimistic interpretation of the figures could point to the fact that the gloomy surveys in the chart above focus on manufacturing, which has been pummelled by the disinflationary challenges of a strengthening US dollar and the eroding global supply change. Not only manufacturing accounts for shrinking part of the overall US economy, but also inflation is more positive in the services sector.This leaves us with tomorrow's release of US August CPI for and Thursday's September Philly Fed survey as the remaining last figures prior to the Fed decision. Fed watchers are already hedging themselves in their prediction for the big event, indicating a hawkish statement/forecasts accompanying an unchanged announcement on rates, while others predict a dovish statement/forecasts to accompany a rate hike. While we lean towards expecting no change this week, markets have already made up their mind in pursuing further downside for the month.

For more frequent FX & Commodity calls & analysis, follow me on Twitter Twitter.com/alaidi

By Ashraf Laidi

AshrafLaidi.com

Ashraf Laidi CEO of Intermarket Strategy and is the author of "Currency Trading and Intermarket Analysis: How to Profit from the Shifting Currents in Global Markets" Wiley Trading.

This publication is intended to be used for information purposes only and does not constitute investment advice.

Copyright © 2015 Ashraf Laidi

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.