Markets Panic as Feds Bluff Called on US Interest Rates

Interest-Rates / US Interest Rates Jun 26, 2008 - 03:22 PM GMTBy: Jim_Willie_CB

For the last couple weeks, my attention has been given to the amusement and desperation behind propaganda, bluffs, and the utter desperation of the US Federal Reserve in the orchestrated rumors of a new position wherein they would soon or eventually raise the official interest rate in order to combat the horrendous price inflation brought about by the falling crippled US Dollar. What utter nonsense! To hear that the investment community actually accepted and embraced this notion was laughable on its face, and served as continued evidence that the loose collection of investors, speculators, and observers simply cannot wake up reality despite the events that began last August 2007 when the mortgage debacle ripped the banking system wide open with gaping wounds. The US Fed needs to arrest the falling US Dollar., no doubt. But it cannot.

For the last couple weeks, my attention has been given to the amusement and desperation behind propaganda, bluffs, and the utter desperation of the US Federal Reserve in the orchestrated rumors of a new position wherein they would soon or eventually raise the official interest rate in order to combat the horrendous price inflation brought about by the falling crippled US Dollar. What utter nonsense! To hear that the investment community actually accepted and embraced this notion was laughable on its face, and served as continued evidence that the loose collection of investors, speculators, and observers simply cannot wake up reality despite the events that began last August 2007 when the mortgage debacle ripped the banking system wide open with gaping wounds. The US Fed needs to arrest the falling US Dollar., no doubt. But it cannot.

The US Fed needs to stem the price inflation, no doubt. But it cannot. This parasite central banker organization has its own track record of inflation boom & bust, complete with profound destruction. The US Fed does not control the shallow and ineffective US Govt policies on ethanol, trade sanctions, geopolitical isolation, crackdown on oil speculators, and delay for actual mortgage bailout programs. The US Govt collectively is responsible for the chronic budget deficits and huge US Treasury Bond sales every year. The US Military is the largest single non-govt user of gasoline, diesel, and jet fuel in the world, yet nobody seems to point a finger at endless war as another reason why the crude oil price is high.

The US Federal Reserve oversees the sequences of credit explosions, fails in its rational regulation, orders hidden subsidies to Wall Street banks, justifies the colossal inflation permitted, and under-writes the last bubble bust with more liquidity. It fails to comprehend that the sequence has gutted the national economy. The ongoing drama must be watched closely.

The US Fed on Wednesday was laid bare in its legless weakness and incapacity. They revealed they are in a corner, trapped, stuck in an unresolvable dilemma. Its propaganda was stripped. Its bluffs were called and they blinked. Its desperation is vividly and tragically clear. Enough on these guys, these charlatans, these improperly revered destructive parasites on the body economic!

STARK MARKET RESPONSE TO THE USFED

The effect on four key markets was pronounced and loud since Wednesday, when the US Fed sheepishly blinked in profound weakness. Its bluff is over now. The euro currency jumped up sharply in a reversal, now at 157.30 or so. The 2-year US Treasury Bill yield fell down sharply in a reversal, now at 2.70% or so. The gold & silver prices jumped up sharply in reversals, now at 913 and 17.3 or so. Anyone who cannot see in basic terms what happened in response is not awake, plainly put! On June 25, everything changed and reality entered the room again!

The stage is set for the next two to four months for a broader banking system deterioration, most likely the bankrupt collapse of a few big banks, and a good chance of lost control of portions of the credit derivative complex. A big broad powerful liquidation sequence is coming soon for the biggest of bloated money center and investment banks. They have tried in vain to sell most of their overpriced mortgage bonds and related financial securities. They cannot find truly stupid parties anymore to buy them. Past rescues are all showing big losses for participants. The bonds lack true price discovery. In many cases no market exists for them, such as with the Collateralized Debt Obligations that leverage mortgage bond in reckless fashion.

In an increasing number of cases, many of the mortgage securities cannot be properly associated with ‘perfected titles' to the actual properties. The big banks might soon choose to dump the bonds on the market in a race to be first, BEFORE class actions are taken by the public to block the foreclosure process. They can and are blocking their own foreclosure, dispossession, and eviction, as they properly and legally demand for the banks or financial agencies to produce perfected property title . In many cases, the banks cannot. In its haste during the Go-Go years of 2003 through 2006, the Wall Street bond dealers, purveyors of fraud, conmen to the pension funds and insurance firms, did not bother to file the documents and connect the asset backed bonds with the properties that backed up the securities. They were concerned about fast bond sales and ripe fees earned. Now they are vulnerable to class action and civil disobedience, which will possibly accelerate disorder and chaos. Enough on these guys, these untouchable conmen felons, these destructive parasites on the body economic!

The official Federal Open Market Committee statement said, “Although downside risks to growth remain, they appear to have diminished somewhat, and the upside risks to inflation and inflation expectations have increased.” Their statement actually stated that the US Economy was continuing to grow, although slowly. One must wonder what statistics they are reading. Perhaps these clueless guys believe the $165 billion in handouts to US households will sustain the economy. In my view such handouts are very similar to Third World Nations delivering handouts of rice and beans to the impoverished citizens. The next ugly resemblance will be dead cars used as lawn ornaments.

Four specific reactions occurred after the US Fed took no action, did not raise the official Fed Funds rate, mentioned ongoing housing weakness, and basically tipped its hand that it cannot conceivably raise rates as long as the housing market, financial markets, and US Economy remain so weak. They actually cited weakness, but understated the actual weakness. The economic stagflation underway is powerful, and like nothing seen in seven decades. Even Greenspan expects a recession to last for a much longer time in a break from past patterns. Let's proceed with four key markets, as reality entered the room. The next phase is almost ready. The spring deception is now completed, a closed chapter. The next bank bond gigantic losses are soon to come. The next sell off retest of the US Dollar. critical support is coming soon. The next gold & silver run up toward the critical resistance levels of 1030 and 21.50 is coming next. Prepare for fireworks running from July 4th all the way into the autumn in steady fashion, with some assured climaxes in two to four months.

THE EURO JUMPS IN REVERSAL

Even the Euro CB is guilty of phony messages disseminated. It was bluster! They perhaps should raise their official interest rate, but they will not. They too must contend with rising price inflation, but they too are stymied by housing declines, economic slowdowns, and banking crises also. In the past few weeks, they have been displaying a position of bravado, as the Germans defiantly claim they might hike their official interest rate soon, further straining the US Dollar., as they work to manage and protect the economy across the European Union. If they really cared about inflation, they would halt the 12% annual euro money growth. It is all talk, gamesmanship, in a grand struggle to wrest banking leadership from the reckless corrupt Americans who continue out of control. On Wednesday in Europe , the Euro CB head Jean Claude Trichet was on the defensive.

He found himself dismissing the notion that the ECB would install three separate rate hikes before December. He tried to make the case that the ECB would perhaps order just one rate hike. They will not hike at all. They will be forced to deal with a growing conflict within the European Monetary Union, covered in the Hat Trick Letter in recent monthly reports. The southern nations are crippled by housing declines, mortgage disasters, and associated economic harsh slowdowns. They need lower interest rates, but the Germans who run the Euro CB refuse to budge. A potential breakdown of the EMU and euro looms.

The euro currency had been weakened in the last few weeks by accepted beliefs in the propaganda, that the US Fed would next cut its official short-term interest rate. That would have narrowed the differential between the 4.0% official Euro Central Bank rate and the 2.0% official US Fed rate. As stated in my article last week, neither central bank will be hiking interest rates in the foreseeable future, not with economic weakness, housing vulnerability, and bank crisis continuing to wreak havoc. The euro had been down to slightly flat on Wednesday in trading. When the news broke on the US Fed statement to do nothing, and to paint the picture of helplessness on defense of the US Dollar. as engrained policy, the euro jumped up. It is now 150 basis points higher. The Goldman Sachs statement pushed the euro higher still, highlighting the US bank weakness. The contrived US Dollar. bounce is officially done, cooked, stick a fork in it. A more complete analysis will appear in the July Hat Trick Letter in a couple weeks. For now, just view the tremendous single day movement in the euro. The opposite occurred in the US Dollar. DX index, weighted by over 50% in the euro.

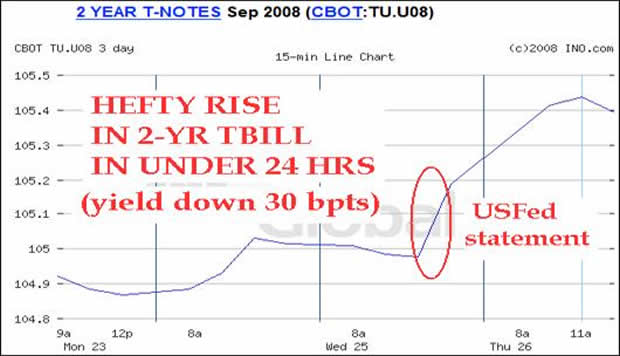

THE SHORT-TERM USTREASURYS JUMP

In the last few weeks, the 2-year US Treasury Bill yield has climbed rather suddenly. The bond traders accepted the notion of an eventual US Fed rate tightening, in response to painful price inflation. They overlooked the weakness in housing, economic slowdown, and worsening bank balance sheets, all of which render impossible any official rate cut. Sure, the Germans and Americans are at odds and in conflict. Each has talked tough on price inflation, stealing from each other the mantle of leadership. But despite the rhetoric and bravado, the facts remain. The two economies of Europe and the Untied States cannot possibly tolerate a rate tightening episode. To order higher rates would push both economies over the edge into a downward spiral. To accept the notion of rate hikes is an exercise in embarrassing naivete at best, and reckless stupidity at worst. In the ensuing minutes following the US Fed public announcement, the short end of the USTreasurys rallied. The US TBill yields are showing more clearly the economic slowdown and ongoing endless recession. The gap between the 2-year TBill yield and the Fed Funds 2.0% target has been reduced. They realized the jig was up.

The US Fed blinked as the gold longs and dollar shorts called their bluff successfully. Below is the bond principal chart in minute ticks. The 2-year TBill yield had been flirting above the 3.0% level. After the announcement, it fell sharply toward 2.8% and stands at 2.7% now. The short-term USTreasurys are screaming recession again. Consistent with such loud cries is the associated painful notion that the US Fed will almost certainly LOWER the official Fed Funds rate reluctantly. Give them a few months. With the next official rate cuts, all US Fed leadership, all US Fed credibility, and all US Dollar. integrity will be thrown out the window.

GOLD JUMPS IN REVERSAL

The gold price has been doing repeated tests of the critical support. At least three or four such successful tests have been completed. The uptrend in the gold price remains clearly evident, very firm in its support, as it prepares for the next summer and autumn fireworks. The silly notion of a US Dollar. rebound led by US Fed vigilance to price inflation is now cast aside like last month's Sunday newspaper. Recycle both the newspaper and the failed propaganda that has become like a rancid sugarcoating upon the financial markets, endlessly repeated deceptions heaped upon the public. The housing weakness will spur continued inflationary responses to deal with it.

Any mortgage rescue platform program will be extraordinarily packed with inflation medicine. Gold will respond. The US Economic weakness will spur continued inflationary responses to deal with it. Any further US Fed stimulus and rescue packages will be extraordinarily packed with inflation medicine. Gold will respond. The bank crisis and upcoming bank failures will spur The US Economic weakness will spur continued inflationary responses to deal with it. Panic will soon enter the financial markets and banking world. Gold will respond. Not a single bank run by depositors has occurred, at least not yet. There will be many. The reversal on Wednesday, continuing into Thursday, was plain as day. For believers in real money, and advocates of sound money, the gold response was reassuring and soothing, not to mention promising.

Some credibility had been accepted within the Fed Funds futures market in the last few weeks, that a rate hike or series of rate hikes would come before the end of the year. This is patently nonsense. The financial markets in the Untied States have swallowed the notion of bank system recovery, mortgage market stability, and immunity of the US Economy from the housing decline. All three notions are absurd on their face, with much worse distress and losses to come in the near future.

The US Treasury Bonds on the short end are finally reflecting the US Economic recession that is growing worse by the month. The news on housing was terrible this week, as the Case Shiller housing price index over 20 cities fell 2.0% in April, registering a hefty 15.3% decline in the last full year. Also, the consumer confidence index by the Conference Board fell hard to 50.4 in June from 58.0 in May. The June reading is the lowest in its history.

The next bank failure will put the final nail in the Rate Hike Coffin, dispelling any doubt. The inevitability of a General Motors bankruptcy has begun to take root. Perhaps Ford Motors will go bust also. Car sales, SUV sales, and truck sales are down badly. The entire car industry supply chain is suffering. Claims of growth in the US Economy by US Fed Chairman Bernanke defy reality.

GOLDMAN SACHS PAINTS THE PICTURE

Some clear indications are coming to light. The Wall Street firms are both banding together and at odds with each other. First a preface. The Bear Stearns kill job engineered by JP Morgan has numerous stories behind the public face story told. Some of my views have been shared. Here is more. Bear Stearns did not participate in the Long Term Capital Mgmt emergency bailout rescue in 1998. They were punished ten years later. Furthermore, when the US Fed opened the Bear Stearns books in March, they found a giant position that was short the US Dollar. They found a giant position that was betting on a higher gold price. So Bear Stearns was killed, with the liquidation of their gold position responsible for a huge gold price drop, aided by the cover of their US $ position. See the mid-March gold price and US$ action.

The Wall Street firms took notice of the message. If they bet against the US $ and bet in favor of gold, they would not have any further access to the US Fed discount window or lending facilities. So now the Wall Street firms might be helping each other to stand up. If one fails, they all might fail and go bust. That is why the Lehman Brothers story and the Merrill Lynch story are so important. They are being propped up. Enter Citigroup. My guess is that a huge amount of mortgage bonds are to be sold soon by Citigroup, and maybe another big bank, in the initial stage of a bond liquidation scheme and exercise. Citigroup is busted, and will portray their bankruptcy as a restructuring procedure, complete with liquidation. We will have to wait to see what remains.

Goldman Sachs on Thursday downgraded Citigroup with a short stock recommendation. Why would they do that? They put Citi on their ‘Americas Conviction Sell' list, which just has to evoke laughter for its name. They expect another gigantic bond loss to be admitted by Citi, more cash to be raised as they sell capital and undermine stock equity value, and even more dividend cuts. Up to May, the total amount of cash they raised by selling off capital to foreign entities was a robust $42 billion, thus undermining US control of the biggest US bank. One can only speculate. Perhaps GSax finally has a big short position in place against Citi, and wants the public to climb aboard the selling parade. Perhaps GSax has inside word of the big Citigroup bond liquidation fire sale upcoming. People need to remember that GSax is not a charitable organization.

They make money by legitimate trades, but also by lying, cheating, and sometimes stealing, all legally. Just to prove that GSax remains a corrupt information source, they downgraded the entire brokerage sector from ‘Attractive' to ‘Neutral' in laughable style. The US brokerage industry is fast approaching extinction. Check their bond and stock issuance lately. Their ugly position matches the US banks, which on average are insolvent. Sanford Bernstein analyst Brad Hintz forecasted a $3.5 billion Q2 write down for Merrill Lynch, matched by Bank of America analyst Michael Hecht.

The Goldman Sachs analyst Richard Ramsden said just a week ago that the US banks must produce $65 billion more capital to cope with the destruction to their balance sheets before the peak of the crisis sometime in 2009. So have we seen the worst yet? No way! Once again, they are not raising capital. They are raising cash. They are selling capital in the form of stock equity and long-term debt. As they do so, control of the banks goes into foreign hands more so.

STRANGE TIDBITS

Yet another excellent quote came from Art Cashin of UBS, from the New York Stock Exchange floor. Two weeks ago he responded to the crude oil mania when he said, “Goldilocks is thinking about a career change. She is considering a new job renting out and operating a drill rig.” Today he said simply, “The Fed cuts before it raises,” which surprised the anchors on the financial advertisement public address system known as CNBC. Even Ron Insana, yesterday afternoon said, “The Fed offered nothing for everyone.” The smart guys out there have figured out the helpless and desperate situation that the US Fed finds itself. It cannot raise rates, since that would harm the stock market, further cripple the mortgage and housing markets, and worsen the rapidly advancing US Economic recession. Sure, it needs to raise rates in order to defend the US Dollar., but the US $ is not defensible. It has been totally ruined by three decades of mismanagement, corruption, pork projects, sacred war budgets, socialist programs like Medicare, and reckless creation of bubbles in serial fashion.

Yet another shadowy story came to light (for those who know how to flash the spotlight), certainly not mentioned by the intrepid lapdog US financial press networks. Lehman Brothers and the London Stock Exchange announced plans to set up a pan-European trading platform steeped in darkness (click here ). The joint venture is called Baikal, named after the world's deepest fresh water lake in western Siberia within Russia . It is known as the ‘Blue Eye of Siberia' in exotic terms. It is famous for holding a volume of water larger than all the North American Great Lakes combined. At 1637 meters (5371 feet), Lake Baikal is the deepest lake in the world, and the largest freshwater lake in the world by volume, holding approximately 20% of the total surface fresh water on earth.

How appropriate! The new Dark Pool Trading Platform will offer access to securities across 14 European countries, featuring computer driven trading schemes. The claim is to address complexity of order execution, but the real intention is to minimize market impact and avoid the scrutiny of public disclosure. Wall Street and London firms, as in investment banks, large money center banks, and hedge funds, are anxious to dump huge positions without attention. Those who claim the US and London financial markets have transparency are dead wrong! Those who claim they have price discovery that seeks equilibrium are dead wrong!

A bizarre story was just told to me by a friend from Philadelphia . On a daily basis, his wife travels the New Jersey Transit Train line as many commuters do, from Philly to New York City . In the last month alone, three suicides have taken place, almost never heard of before. Some men without hope jumped in front of the train. Each time the usual 2-hour trip by train suffered delays, including today. The delay added 2-1/2 hours, making the commute over four hours. The entire NJ Transit line was interrupted, which included the Amtrak Metroliner and Keystone Service. People trying to avoid cars, gasoline, and its nightmare face a different nightmare. Contrast this story to a recent analysis that points to how many US citizens earning under $25k in annual income will be forced to stop driving altogether. In typical overextended US style, over 30% of them have more than one car.

The perceived right of Americans to drive will slowly endure a transition toward the privilege to drive. Japan has made its investment in electric cars and hybrids for well over ten years. The Untied States made its investment in Sport Utility Vehicles piglets, Hummer true hogs, and light trucks. The US has not made any meaningful investment in commuter railways, and especially not high speed railways like Japan , London , and Europe . The US is horrendously mismanaged and corrupt. The 60% share of new vehicle sales that were from SUV and light trucks will be cut in half in the next year. Shocks to the US landscape will be ongoing, regular, and severe. Expect shocks to become routine.

The strange new world is emerging, with more onerous extensions of the Fascist Business Model. My view is that the financial markets will declare the shock filled status as normal very soon. Panic will slowly seep into the environment. This late summer or early autumn, some really nasty bank failures are assured. GOLD WILL REACT VERY STRONGLY, AS WILL SILVER. The next US Dollar. decline is coming soon, right on schedule for those who ignore the propaganda, nonsense, and blatant deception promulgated by Wall Street.

Has anyone noticed that the Dow Jones Industrial index has fallen below critical long-term support, but the S&P500 index is near critical long-term support levels??? Each is falling badly. This occurs while gold rises!!! The criminal prosecution has begun finally. They started with the small fries at Bear Stearns. Look for these little guys to roll over, to turn state's evidence, and to attempt to bring down some executives for criminal fraud felonies. The process is very early here. Bad publicity like CFO or CEO indictments akin to WorldCom, Enron, and Tyco lies in the future. Gold will respond.

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

From subscribers and readers:

“Your unmatched ability to find and unmask a string of significant nuggets, and to wrap them into a meaningful mosaic of the treachery-*****-stupidity which comprise our current financial system, make yours the most informative and valuable of investment letters. You have refined the ‘bits-and-pieces' approach into an awesome intellectual tool.” - (RobertN in Texas )

“I am astonished at the level and depth of your writing. There is, to my knowledge, no one who comes close to your commitment to finding the truth and putting it out there for us. I am hooked. You tower above your competition. Keep it up.” - (DavidP in Florida )

“Your reports scare the hell out of me every month, probably more so over time, since so many of your predictions have turned out to be very accurate. I am afraid you might be right that by the end of 2008, we are in a pretty severe situation, with civil unrest and severe financial stress on Main Street .” - (GeorgeC in Minnesota )

“You are able to consume and regurgitate complicated information into layman's terms. It shows that you understand your subject well. It is very easy to take complicated material and repackage it as complicated material. You, however, have the ability to take the complicated and make it understandable to the common man.” - (RickS in Californiaa)

by Jim Willie CB

Editor of the “HAT TRICK LETTER”

Home: Golden Jackass website

Subscribe: Hat Trick Letter

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy.

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 25 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com . For personal questions about subscriptions, contact him at JimWillieCB@aol.com

Jim Willie CB Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.