Higher U.S. Interest Rates? Not Next Month, Not Even Next Year, In Three Charts

Interest-Rates / US Interest Rates Sep 19, 2015 - 12:34 PM GMTBy: John_Rubino

Not only did the Fed vote to keep interest rates stable yesterday, it did so overwhelmingly -- with just as many members apparently favoring lower rates as higher. Now all the people who bought the "rate normalization" promise/threat are backtracking. From today's Bloomberg:

Not only did the Fed vote to keep interest rates stable yesterday, it did so overwhelmingly -- with just as many members apparently favoring lower rates as higher. Now all the people who bought the "rate normalization" promise/threat are backtracking. From today's Bloomberg:

Expecting a Fed Rate Increase by Halloween? Maybe Reconsider

Federal Reserve Chair Janet Yellen wants you to know that a rate increase is possible at the policy-setting committee's Oct. 27-28 gathering. Don't hold your breath.

"Every meeting is a live meeting where the committee can make a decision to move to change our target for the federal funds rate," Yellen said at her press conference Thursday in Washington. "That certainly includes October."

Economists and investors don't view an October move as likely. The chart below shows market expectations for an increase before December have shifted down dramatically. The Septemberists pushed their calls to December or 2016, not October, after the Fed announcement that rates would stay near zero.

Here are three key reasons not to expect the first interest rate increase since 2006 next month.

Global Clouds Take Time to Clear

Yellen highlighted global economic uncertainty during her post-meeting press conference, referencing heightened concerns about China and other emerging market economies that have led to volatility in financial markets.

"While we still expect that the downward pressure on inflation from these factors will fade over time, recent global economic and financial developments are likely to put further downward pressure on inflation in the near term," she said in her opening statement.

Those external risks aren't likely to clear up in the course of the next six weeks.

"The outlook is pretty much unchanged, it really came down to uncertainty, and it's uncertainty about the extent of the slowdown in China and how that might skew risks to our outlook in the U.S.," said Aneta Markowska, chief U.S. economist at Societe Generale in New York. "I worry that they might not get that clarity that they want by the October meeting."

Not a "Hawkish Hold"

Today's Fed watchers are reminiscent of the Cold War Kremlinologists who used to read meaning into who stood where on podiums and which modifiers were used in Pravda press releases. In each case the organization in question is both opaque and -- the crucial point -- operating with patently absurd worldviews and underlying assumptions. You can't make sense of the senseless.

Specifically, given the trends now in place, the idea that the world will be more stable and/or faster-growing a month or two hence is somewhere between highly unlikely and completely delusional. To take just three of many possible situations that are far more likely to deteriorate than improve:

Brazil, which is hugely important for the stability of already-unstable Latin America, is in such a mess (interest rates spiking, bond rating cut to junk, corruption scandal that reaches all the way to the top) that it's responding to a gathering recession with austerity. That is, higher taxes and lower spending. Its currency, the real, is down by 40% versus the dollar in the past year and still falling.

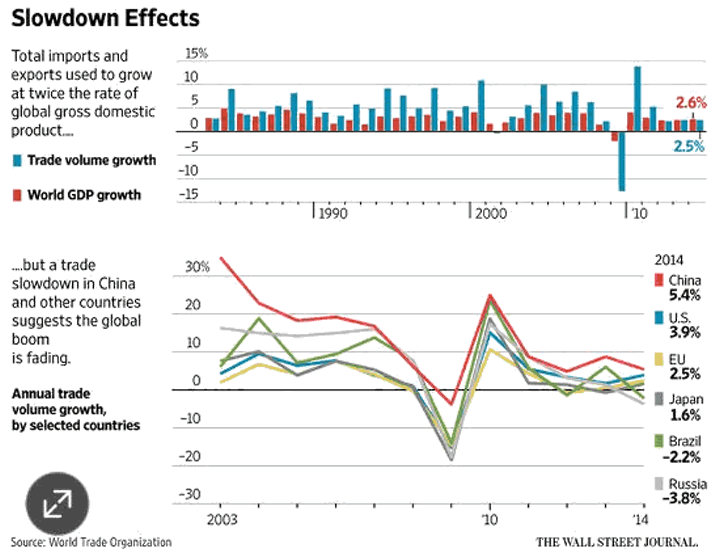

Global trade is flat-lining. Turns out that a big part of the past couple of decades' rising global wealth came from trade -- which in turn came largely from the combination of China's willingness to borrow trillions of dollars to buy up the world's raw materials and US consumers' willingness to max out credit cards to buy Chinese junk. Now both parties have hit a wall and trade growth has entered a long-term decline which will not reverse in the next couple of months.

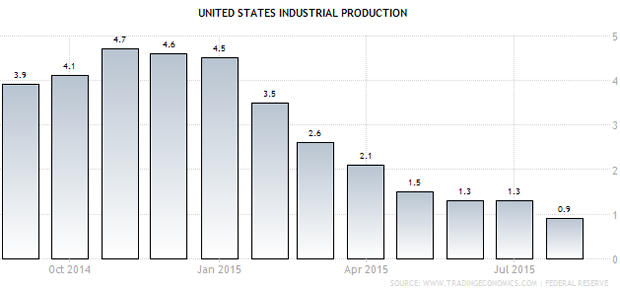

Growth in US industrial production -- that is, factories paying workers decent wages to make real things -- is rapidly falling towards zero. This is related to both the decline in global trade and the overleveraged state of US consumers, neither of which is going to improve in the near term.

Add it all up and 2016 will likely see the ascendance of the current Fed minority that favors lower rates and more aggressive currency creation. Next-generation monetary policy, here we come.

By John Rubino

Copyright 2015 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.