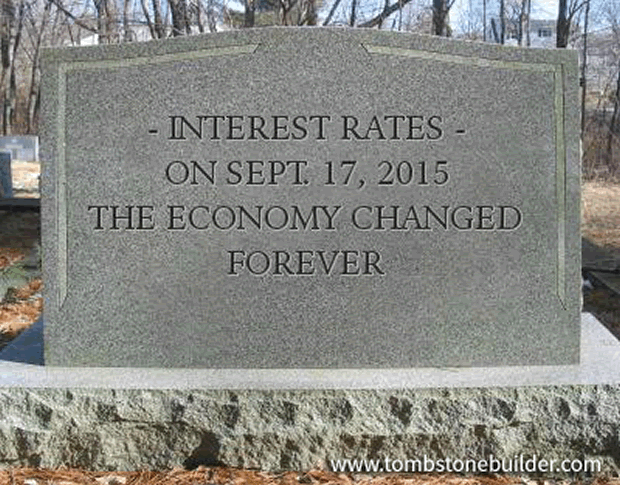

R.I.P. Interest Rates

Interest-Rates / US Interest Rates Sep 20, 2015 - 01:22 PM GMTBy: Investment_U

Andrew Snyder writes: I went to the doctor Friday morning. What a problem we have.

Andrew Snyder writes: I went to the doctor Friday morning. What a problem we have.

“How’s the pain? Do you want some pills for that?” he asked.

“No thanks, doc. Let’s just figure out what’s causing it.”

“How about stress? We can treat that, too.”

“No, doc. Unless you give those pills to somebody else, pills won’t fix my stress.”

I don’t blame the doctor. He’s doing his job. Most of his patients likely walk away with a stack of prescriptions and are happy with it... lots of different ways to hide what’s really going on.

Long-term solutions like eating right, exercising more and drinking less aren’t what we want to hear. We want a pill.

It’s a dangerous idea. But it’s certainly not something that’s constrained to the medical community. Oh no, laziness is a pandemic.

In fact, it’s how we got to the death of interest rates. Instead of fixing the problem, we took a pill.

On Thursday, Janet Yellen gave the American economy another whopping dose of free money... and permanently rewrote the rules of economics.

For most American investors, Yellen’s decision was devastating. Not for the short-term effects - the markets barely moved on the news.

It’s the long term that has us worried. It’s now quite likely we will never see a return to normalcy in our lifetimes.

Thanks to the death of interest rates... gone are the days of “safe income.” Gone are the days of selling our “risky” stocks as we age. Gone are the days of traditional investing.

Take, for instance, a conversation I had at dinner on Thursday night. “We just bought an annuity,” my freshly retired friend said. “We’ll get $400 a month for the next 20 years.”

“Hmm,” I replied. “What did it cost you?”

“About $40,000. But we’ll get paid a total of $89,000.”

My first thought... wow, a 4% annual return; you got ripped off. But then I was reminded that these aren’t the rules of investing we grew up with. These days, a guaranteed 4% return isn’t something to sneeze at.

That has us worried. From here on out, we need to get creative about where we make our money.

On Friday, the Club’s Chief Investment Strategist Alex Green told readers about the virtues of investing in bonds at a time like this. He summarized the situation well.

“When the Federal Reserve took short-term rates to zero in the fall of 2008, no one was predicting that rates would still be that low seven years later.

“Yet they are. And rates could stay low a lot longer, especially since the futures markets are indicating that inflation will remain negligible for the next 10 years.

“Sounds unlikely? Think again. Add up slow economic growth, stagnant wages, a strong dollar, global outsourcing, cheap raw materials and plunging energy prices and see what you get.”

I think we know what we get... the need for more pills.

That, too, has us worried.

We wonder how long banks and insurance companies - nay, the entire financial system - can survive after the death of interest rates. How can an annuity provider offer 4% for 20 years when it needs to go way out on the risk spectrum just to earn 4%? How can a pension fund earn the 8% it needs without risking the ability to pay its pensioners today?

To be sure, Wall Street will use all sorts of derivatives to keep the system on life support, but eventually spreads will wither and the Street will be forced to pull the plug.

Yellen and her troops at the Fed know dirt-cheap money won’t fix what ails us. It only masks it... cheap money is a pill. It makes us feel better so we stop griping about the pain.

It’s now clear we’re addicted. There’s no way to quit the pain pills without forcing us into an all-out crisis.

That’s what has us worried.

R.I.P. interest rates.

Good investing,

Andrew

Copyright © 1999 - 2015 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.