Gold Cycle Running Out of Steam

Commodities / Gold and Silver 2015 Oct 01, 2015 - 03:06 PM GMTBy: Bob_Loukas

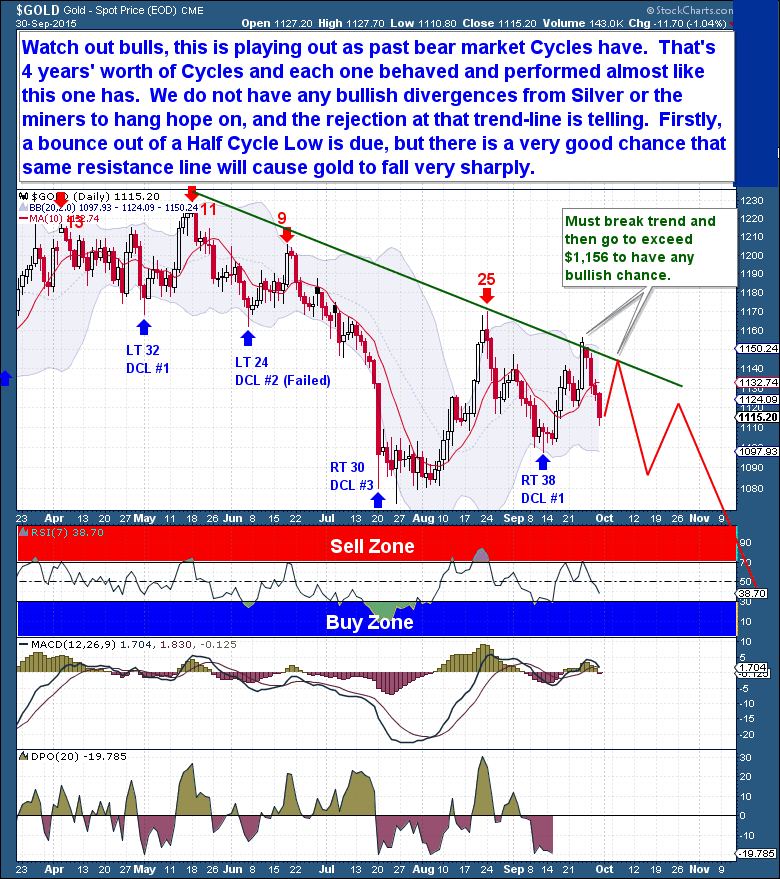

I predicted that gold would rally last week up to the $1,155 area, and was also equally unsurprised when it was rejected the first time by that declining (see green trend-line on chart) resistance line. Those are standard or obvious Cycle pivot points, but how it continued lower yesterday to fall well below the 10 day moving average was not a “typical” development if you’re a supporter of the bull case in gold.

I predicted that gold would rally last week up to the $1,155 area, and was also equally unsurprised when it was rejected the first time by that declining (see green trend-line on chart) resistance line. Those are standard or obvious Cycle pivot points, but how it continued lower yesterday to fall well below the 10 day moving average was not a “typical” development if you’re a supporter of the bull case in gold.

This is after-all supposed to be the most bullish period for gold, the heart of the 2nd Daily Cycle is where most of the solid gains are made during an uptrend. We wanted to see only a brief, possibly just an intra-day break below the 10dma, followed by a rally to smash through that trend-line. There is obviously still some time left for gold to rally, but the point is that it has taken up far too much of the 2nd Daily Cycle while remaining well below recent Cycle highs. During a series of bullish Cycles, new highs are made quickly and sustained relentlessly, they certainly do not languish like this.

So as I covered this past weekend (premium report) and warned then, I’m telling the bulls again to watch out. This is playing out just as past bear market Cycles have. That’s four years’ worth of Cycles and each one behaved and performed almost like this one has so far. And sadly we do not see any bullish divergences from Silver or the precious metal miners to hang some hope on. As I have consistently maintained, during any bear market we must assume surprises will move to the downside and that the trend will push the asset lower.

Remember though, Cycles depict the natural ebb & flow process of an asset. And in the very short term, a bounce out of a Half Cycle Low is now due and expected. Another test in the coming days of that resistance line is likely, but there is a very good chance that same resistance area will cause gold to fall sharply towards the next Daily Cycle Low. If the bulls are serious and want to significantly change this outlook, then they need to smash through the resistance area and make new Cycle highs above $1,156. Until that point, please be mindful of the dominant trend, it is much more powerful than us all combined.

Don’t miss our annual Membership Sale, 50% off your first Quarterly Membership, ends Saturday October 3rd!

CLICK HERE FOR DETAILS

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, $USD, US Bond’s, and Natural Gas Cycles. Along with these reports, members enjoy access to two different portfolios and trade alerts. Both portfolios trade on varying time-frames (from days, weeks, to months), there is a portfolio to suit all member preferences.

You’re just 1 minute away from profitable trades! please visit http://thefinancialtap.com/landing/try#

By Bob Loukas

© 2015 Copyright Bob Loukas - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.