U.S. Interest Rate Hikes Keep On Slippin' Into the Future; Treasury Yields Sink Again

Interest-Rates / US Interest Rates Oct 03, 2015 - 11:18 AM GMTBy: Mike_Shedlock

Treasury Yields Drop Again

Treasury Yields Drop Again

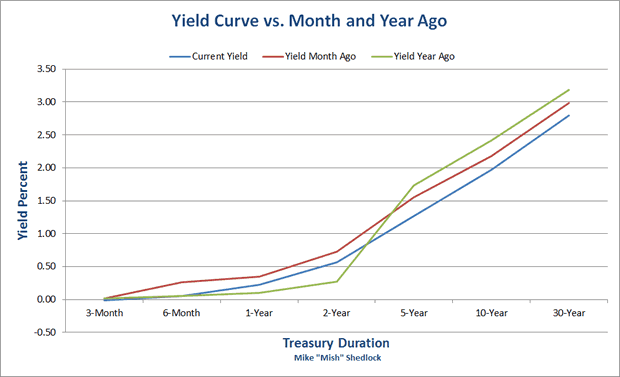

Curve Watcher's Anonymous notes a further plunge in yields today following the disastrous payroll and factory order reports.

Yield on the 30-year long bond fell to 2.80% from 2.85% yesterday. Yield on the 10-year note once again sports a 1-handle at 1.97%, down from 2.03%.

| Duration | Current Yield |

Yield Month Ago |

Yield Year Ago |

Yield vs Month Ago |

Yield vs. Year Ago |

| 3-Month | -0.01 | 0.02 | 0.02 | -0.03 | -0.03 |

| 6-Month | 0.05 | 0.26 | 0.05 | -0.21 | 0.00 |

| 1-Year | 0.22 | 0.35 | 0.10 | -0.13 | 0.12 |

| 2-Year | 0.57 | 0.73 | 0.27 | -0.16 | 0.30 |

| 5-Year | 1.27 | 1.55 | 1.73 | -0.28 | -0.46 |

| 10-Year | 1.97 | 2.18 | 2.42 | -0.21 | -0.45 |

| 30-Year | 2.80 | 2.99 | 3.18 | -0.19 | -0.38 |

Treasury Yields vs. Month and Year Ago

Data plotted from Bloomberg US Treasury Yields.

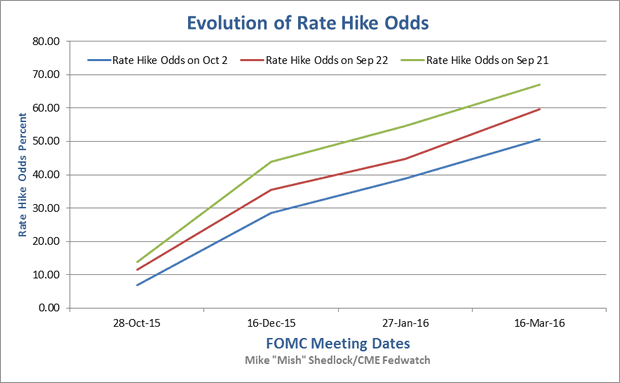

Rate Hike Odds

Curve Watcher's Anonymous also has an eye on rate hike odds. Here is a chart I put together on the evolution of rate hike odds. I captured two previous data points. Today I added October 2.

Data for the above from CME FedWatch.

| FOMC Meeting Date | Rate Hike Odds on Oct 2 |

Rate Hike Odds on Sep 22 |

Rate Hike Odds on Sep 21 |

| 28-Oct-15 | 6.90 | 11.50 | 13.80 |

| 16-Dec-15 | 28.50 | 35.50 | 43.80 |

| 27-Jan-16 | 38.80 | 44.70 | 54.60 |

| 16-Mar-16 | 50.60 | 59.70 | 66.90 |

The above table is a bit simplified because there is a chance of hikes bigger or smaller than a quarter point. However, I believe it is safe to discount multiple hikes until we at least see the first one.

And following today's disastrous data reports, I think it is safe to rule out hikes this year. In honor of that statement and with a tip of the hat to my friend "BC" who suggested the song, I present this musical tribute.

Slippin', Slippin', Slipin' Into the Future

Link if video does not play: Time Keeps On Slipping Into The Future by Steve Miller Band.

Today's Reports

- Payroll Disaster: Establishment Survey +142K Jobs, Employment -236K; Labor Force -350K; 59K Downward Revisions

- Factory Orders Disaster: Factory Orders Hit the Skids, Last Month Revised Lower, Shipments Down 4th Time in 5 Months

I don't believe the Fed will hike into this weakness and nor does the market. Rate hike odds have been pushed all the way out to March of 2016 (and even then just barely above 50%).

In addition, the flattening of the yield curve is outright recessionary.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2015 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.