Gold Rose 2.2%, Silver Surged 5.4% After Poor Jobs Number On Friday

Commodities / Gold and Silver 2015 Oct 05, 2015 - 01:38 PM GMTBy: GoldCore

– BIS warns “unrealistic and dangerous to expect that monetary policy can cure all the global economy’s ills”

– BIS warns “unrealistic and dangerous to expect that monetary policy can cure all the global economy’s ills”

– Bank of International Settlements warns that recent turmoil is not caused by isolated incidents

– Debt levels are now so extreme they threaten the financial system

– Ultra low rates have led to mal-investment and bigger boom/bust cycles

– Emerging markets vulnerable to deeper crises

– ECB easy money may juice markets for a while but reckoning is coming

– BIS acknowledge that central banks rig markets

– Gold and silver protect against crises in financial system

BIS via Business Insider

In a stark warning, the Bank for International Settlements (BIS), the central bank of central banks, has said in its quarterly report that the turmoil that has shaken global stock markets in recent weeks showed how developed and emerging markets were exposed to the unwinding of financial vulnerabilities built up since the 2008 crisis.

The sell-offs rocking equity markets reflect the “release of pressure” accumulated along “major fault lines”, the BIS said, as it warned that investors should not expect central banks to be able to ride to the rescue and solve such deep-rooted problems.

The BIS thus dispelled the misleading narrative that the growing instability in global markets can be brought under control by the Federal Reserve and other masters of monetary policy.

According to the head of its Monetary and Economic department, Claudio Borio “It is unrealistic and dangerous to expect that monetary policy can cure all the global economy’s ills.”

In the report the BIS – known as the central bank of central banks – warned that recent turmoil in markets were not caused by isolated incidents but rather “the release of pressure that has gradually accumulated over the years along major fault lines”.

The Bank was one of the few large entities to warn in advance of the crash in 2008 [see “Gold Up as the $500 Trillion Derivatives Time Bomb Keeps Ticking“]. The report warned that debt levels are now so extreme that they threaten the entire financial system.

Public and private debt in the developed world has risen 36% since the crisis and is now 265% of GDP. It adds that the post-crisis problems have been dealt with with the same ineffectual policies that caused the crisis – prolonged ultra low interest rates and easy monetary policy.

In this period of ultra low rates – and rates have not risen in almost a decade – rich countries have become bloated on debt rather than paying down and clearing the imbalances in the system. The West may consequently be entering a period of stagnation similar to the trap that has afflicted Japan since the 1990’s.

Borio warned that investor reliance on every pronouncement by the Fed were hampering its desire to return to a normal rate environment.

“This is . . . a world in which interest rates have been extraordinarily low for exceptionally long and in which financial markets have worryingly come to depend on central banks’ every word and deed, in turn complicating the needed policy normalisation,” – Claudio Borio

The low rate environment has led to an array of wasteful “investment” such as ghost cities in China and pumping up share prices with stock buybacks in the U.S. where the underlying business is not performing.

The BIS warns that the already battered emerging markets are particularly vulnerable to crisis. While debt to GDP ratios are mild compared to those of the developed economies at 167% they have increased by 50% since 2007 which usually precipitates a major crisis.

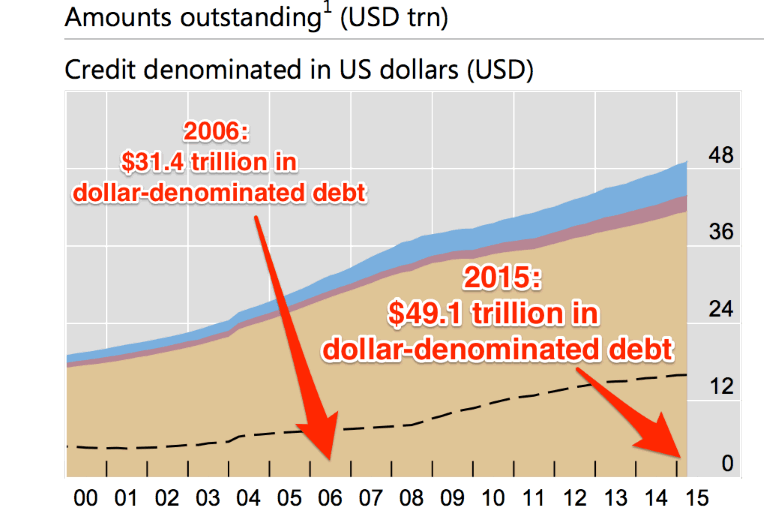

Emerging markets are further exposed because of the large amount of dollar denominated debt they have taken on – over $3 trillion for non-financial corporations. If and when the Fed begin to raise rates it will affect liquidity in emerging markets and may also cause capital flight into the perceived stronger dollar.

“Dollar borrowing . . . [spills] over into the rest of the economy in the form of easier credit conditions,” said Hyun Song Shin, who advises the BIS. “When the dollar borrowing is reversed, these easier domestic financial conditions will be reversed.”

Incidentally, in covering the story, the FT matter-of-factly stated that “markets have been systematically rigged by central bankers” – a charge for which we and others have been ridiculed for making in the past.

Unlike the many US dollar denominated paper instruments that have been created in an unprecedented fashion in recent years and continue to be – gold is finite.

Gold bears the confidence of millions of people throughout the world and especially people – both poor and rich – in Asia. People in the the non-western world value gold’s intrinsic value far above the promises of politicians and bankers and far above the unbacked and increasingly debased paper and electronic currency of today.

DAILY PRICES

Today’s Gold Prices: USD 1134.35, EUR 1006.43 and GBP 746.28 per ounce.

Friday’s Gold Prices: USD 1106.30, EUR 990.86 and GBP 730.21 per ounce.

(LBMA AM)

Gold in USD – 1 Week

After the poor jobs report on Friday, gold rose and silver surged. Gold was up 2.2% or $23 and closed at $1,137.30 while silver surged over 5% or 68 cents to $15.24. Gold was 0.8% lower last week while silver rose 1.1%.

Gold bullion is slightly lower in European trading after posting their biggest one-day jump since January after the worse than expected jobs report on Friday. Gold has consolidated on Friday’s price gains and is trading near $1,136 following a 2.2% rise on Friday.

Silver surged 5.4% on Friday, its sharpest rise since December, 2014. It rose to its highest in two weeks of $15.35 early on Monday and also appears to consolidating on the sharp gains seen on Friday.

Palladium hit a 3-1/2-month high of $706 on Monday, while platinum is trading at $910 after hitting a near-seven-year low in the previous session.

Download Essential Guide To Storing Gold Offshore

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.