Californian Housing Market in Meltdown, Liar Loan Writedowns Have Barely Begun

Housing-Market / US Housing Jun 28, 2008 - 03:59 PM GMTBy: Mike_Shedlock

My

friend "TC" monitors C.A.R. data, DQNews data, and Case-Shiller Data. Case-Shiller data was out a few days ago and you can read about it in Case Shiller Futures Suggest 2010 Housing Bottom .

My

friend "TC" monitors C.A.R. data, DQNews data, and Case-Shiller Data. Case-Shiller data was out a few days ago and you can read about it in Case Shiller Futures Suggest 2010 Housing Bottom .

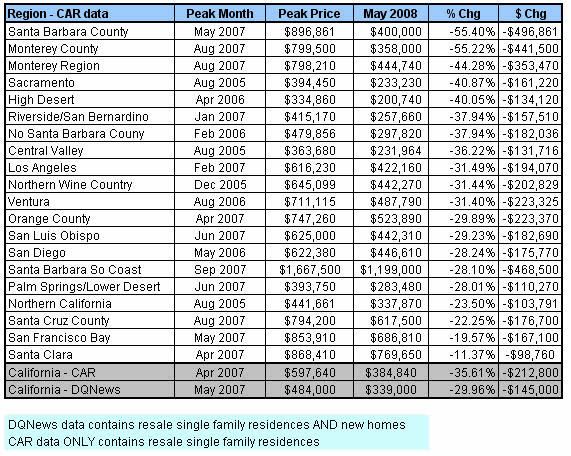

What follows is an analysis of data from the California Association of Realtors from "TC" who tracks the data month by month and is looking at things from perspective of percent declines from the peak.

"TC" writes: I put together the just released May 2008 CAR data. As you can see the CA median home price is now down more than $200K and every region CAR tracks but one is down at least $100K. Additionally, 3 regions are now nearing a $500K median price decline. The declines in these areas is more than twice as much as the national median price!

Source: C.A.R. reports sales increased 18.1 percent; median home price fell 35.3 percent in May

According to CAR half of the decline is because of "shifts in the types of homes selling" and half due to price depreciation. Their calculation of "shifts in the types of homes selling" however is flawed. This because they base the shift on the % of jumbo loans. The problem with this method is that as prices decline the % of jumbo loans naturally moves lower so one can't automatically assume the "credit crunch" has lead to an equal % of the median price change.

However, CAR is in part correct that the credit crunch is having an effect on CA median home prices. In order to get a more accurate picture of how much I use the Case-Shiller data which using the repeated-sales methodology. This methodology is typically the most accurate representation of home prices (however Case-Shiller only tracks a few CA markets which is why I enjoy the CAR data as well).

Using the Case-Shiller data as a baseline one can see that about 1/4 of the median price decline can be attributed to the credit crunch statewide, with the other 3/4 of the decline being actual home depreciation.

Discussion Of Data Presentation Bias

The percentage declines from the peak is an admittedly biased way of looking at things as it makes each decline as large as possible. However there is an overall number from CAR and DQNews that shows the peak to be in April, May of 2007.

Is there any wonder that late vintage loans are defaulting at such a high rate. Liar loans were still ramping late 2006. Those liar loans found their way into various Alt-A pools. For a recent look at one Alt-A pool and what defaults are doing please take a peek at Is The Inflation Scare Over Yet?

Writeoffs in California have barely begun. However, the market is increasingly aware of what must happen. You can see it in the charts.

Washington Mutual Daily Chart

Washington Mutual (WM) crossed the magic threshold of $5. Many mutual funds have a requirement about market cap and price. Those with a threshold of $5 may have to dump it if it does not quickly recover.

On a purely fundamental basis, more writedowns on account of Alt-A liar loans are coming. More people will be walking away from their homes in California and Florida. Approximately 75-80% of those in liar loans only make the minimum payment. Negative amortization increases every month in those loans. On top of that, home prices are falling rapidly. Add the two together and anyone who put down even as much as 20% is now hugely underwater.

At some point escalation clauses will kick in. Escalation clauses vary by contract, but typically vary between 110% of the loan to 125% of the loan. Those clauses should be kicking in now, in mass, based on price depreciation alone.

Have they in practice? Think again. It would be the kiss of death for either WaMu or Wachovia to start enforcing those clauses, homeowners would immediately default. Instead, both banks pretend they are well capitalized when it is increasing apparent they are likely insolvent.

I fail to see how either of those banks survive. The Fed's policy so far is to have the relatively strong take over the pathetically weak. Examples of this are the shotgun wedding between JPMorgan (JPM) and Bear Stearns (BSC), and Bank of America (BAC) and Countrywide Financial (CFC).

Strong Become Weak

Eventually the strong become weak because of these actions. Bernanke's actions suggest there is no bank strong enough to take over the banks are about to fail. And that is why Bernanke is scrambling around like a mad fool (See Fed Looking To Bend Rules To Aid Banks ), directly soliciting private equity firms to invest in banks.

The situation is so dire that Turf Wars Between Fed, SEC, Congress, Treasury are being openly fought in public.

If those private equity firms were smart they will treat this Fed offering like a Trojan Horse.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.